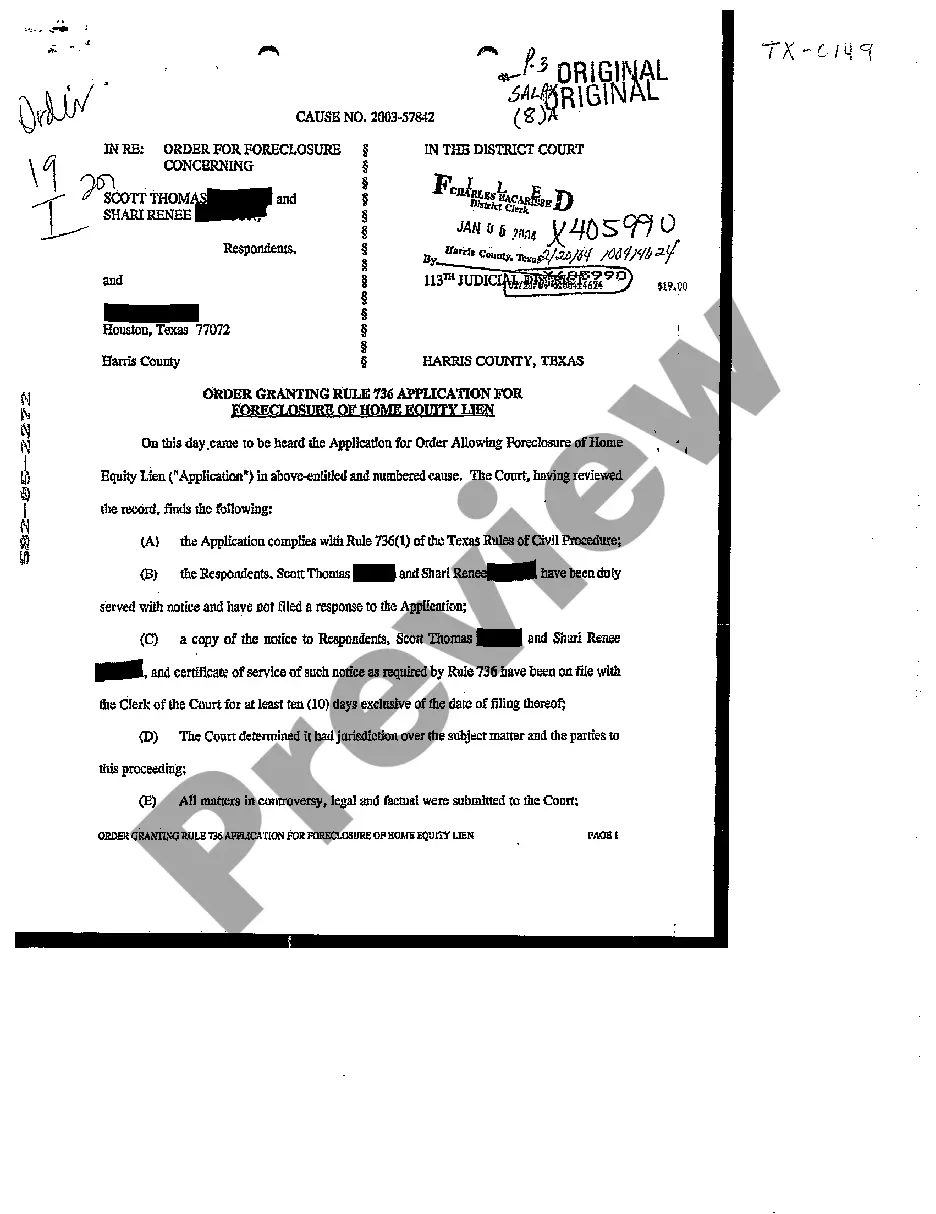

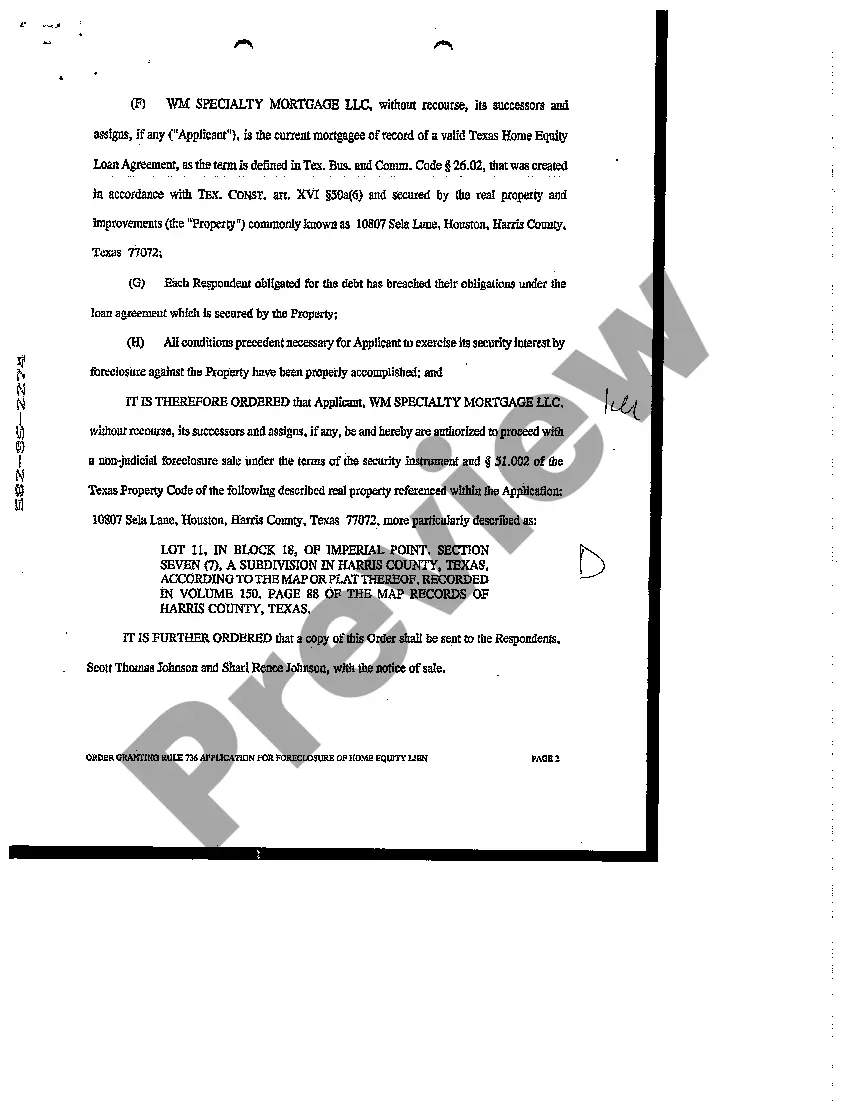

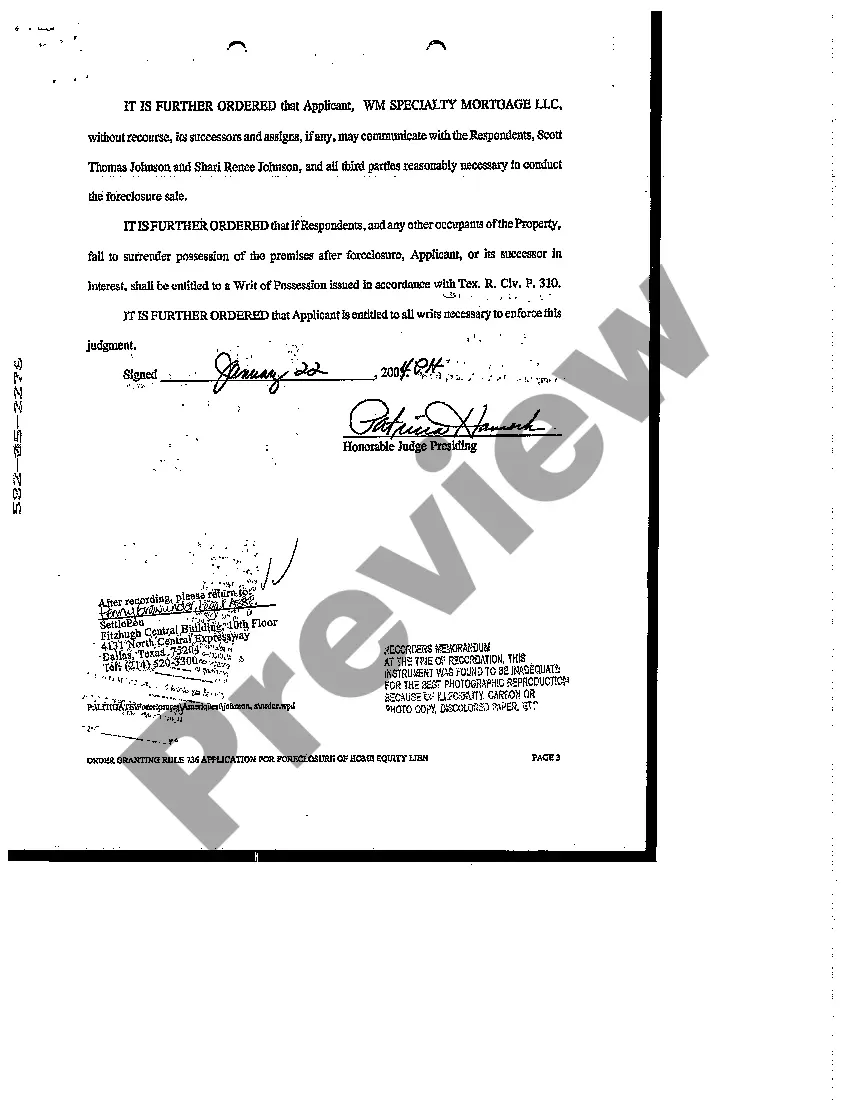

Title: Understanding the Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien Keywords: Waco Texas, Rule 736 Application, Foreclosure, Home Equity Lien Description: The Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process commonly used to initiate foreclosure proceedings on properties with home equity liens in Waco, Texas. It allows lenders or lien holders to request the court's permission to foreclose on a property when the homeowner defaults on their mortgage payments. Here are the two types of Waco Texas Order Granting Rule 736 Applications for Foreclosure of Home Equity Lien: 1. Rule 736 Application for Foreclosure of Home Equity Lien — Regular: This type of application is filed by the lender or lien holder to pursue foreclosure on a property where the owner has defaulted on their mortgage payment obligations. The application is submitted to the court, and if approved, it initiates the process for foreclosure sale. 2. Rule 736 Application for Foreclosure of Home Equity Lien — Expedited: In situations where the lender or lien holder believes the property is at risk of waste or destruction, they may file an expedited application for foreclosure. This type of application is designed to speed up the legal proceedings in order to protect the property's value. The Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is governed by specific rules and regulations set forth in the Texas Property Code. The process begins with the lender or lien holder filing the application with the appropriate court, which includes a detailed explanation of the homeowner's default, the amount owed, and supporting documentation. Upon successful submission, the court will review the application and, if approved, issue an order granting the foreclosure. This gives the lender or lien holder the authority to initiate the foreclosure process, including conducting a foreclosure sale to recover the outstanding debt. It's important to note that homeowners facing foreclosure have the right to contest the application by filing a response to the court. This can be done within a specified time frame set by the court, allowing the homeowner an opportunity to present their case and potentially negotiate alternatives to foreclosure, such as loan modifications or repayment plans. In conclusion, the Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal tool used in Waco, Texas, to facilitate the foreclosure process on properties with home equity liens. There are two types of applications: regular and expedited, each serving specific purposes. Homeowners facing foreclosure should seek legal advice to understand their rights and explore potential alternatives.

Title: Understanding the Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien Keywords: Waco Texas, Rule 736 Application, Foreclosure, Home Equity Lien Description: The Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal process commonly used to initiate foreclosure proceedings on properties with home equity liens in Waco, Texas. It allows lenders or lien holders to request the court's permission to foreclose on a property when the homeowner defaults on their mortgage payments. Here are the two types of Waco Texas Order Granting Rule 736 Applications for Foreclosure of Home Equity Lien: 1. Rule 736 Application for Foreclosure of Home Equity Lien — Regular: This type of application is filed by the lender or lien holder to pursue foreclosure on a property where the owner has defaulted on their mortgage payment obligations. The application is submitted to the court, and if approved, it initiates the process for foreclosure sale. 2. Rule 736 Application for Foreclosure of Home Equity Lien — Expedited: In situations where the lender or lien holder believes the property is at risk of waste or destruction, they may file an expedited application for foreclosure. This type of application is designed to speed up the legal proceedings in order to protect the property's value. The Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is governed by specific rules and regulations set forth in the Texas Property Code. The process begins with the lender or lien holder filing the application with the appropriate court, which includes a detailed explanation of the homeowner's default, the amount owed, and supporting documentation. Upon successful submission, the court will review the application and, if approved, issue an order granting the foreclosure. This gives the lender or lien holder the authority to initiate the foreclosure process, including conducting a foreclosure sale to recover the outstanding debt. It's important to note that homeowners facing foreclosure have the right to contest the application by filing a response to the court. This can be done within a specified time frame set by the court, allowing the homeowner an opportunity to present their case and potentially negotiate alternatives to foreclosure, such as loan modifications or repayment plans. In conclusion, the Waco Texas Order Granting Rule 736 Application for Foreclosure of Home Equity Lien is a legal tool used in Waco, Texas, to facilitate the foreclosure process on properties with home equity liens. There are two types of applications: regular and expedited, each serving specific purposes. Homeowners facing foreclosure should seek legal advice to understand their rights and explore potential alternatives.