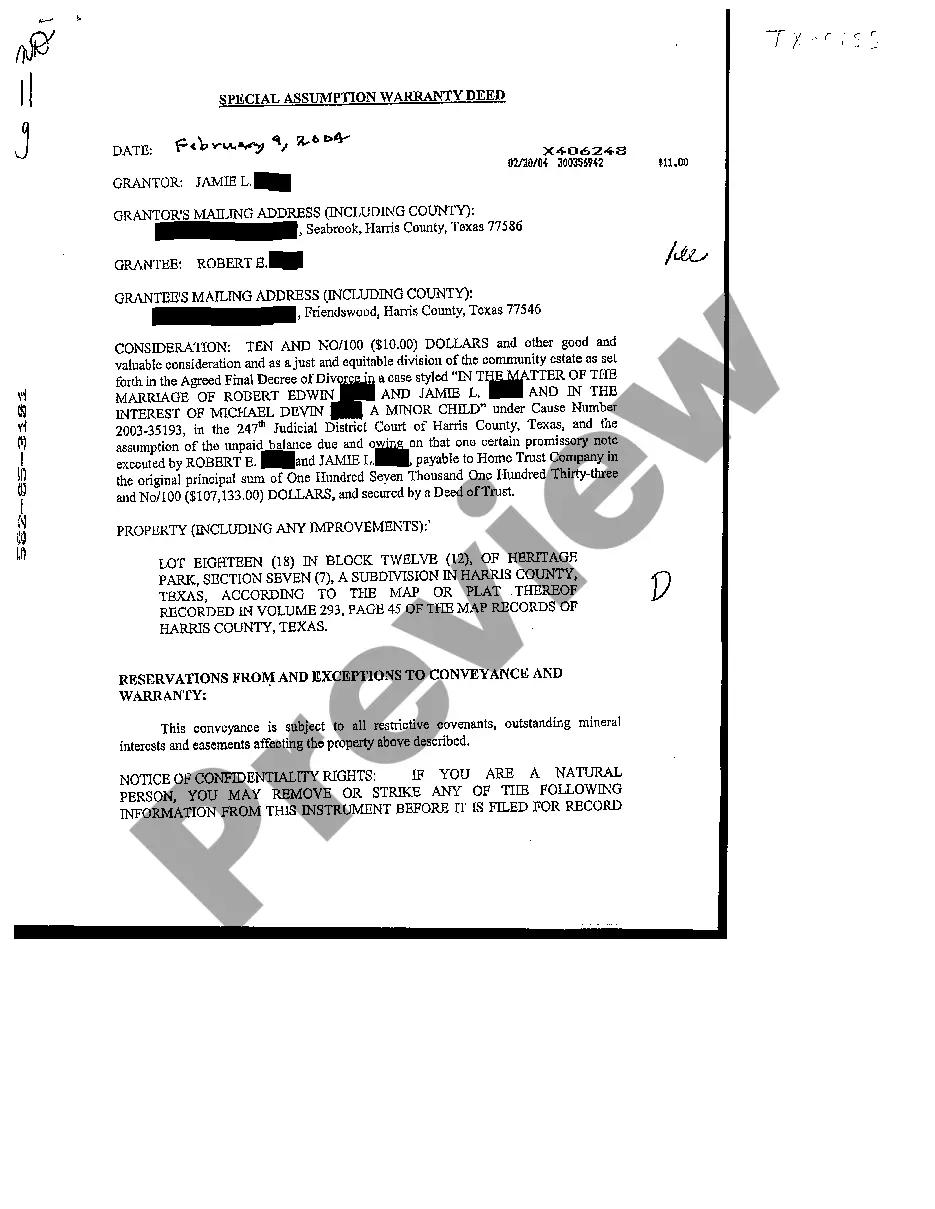

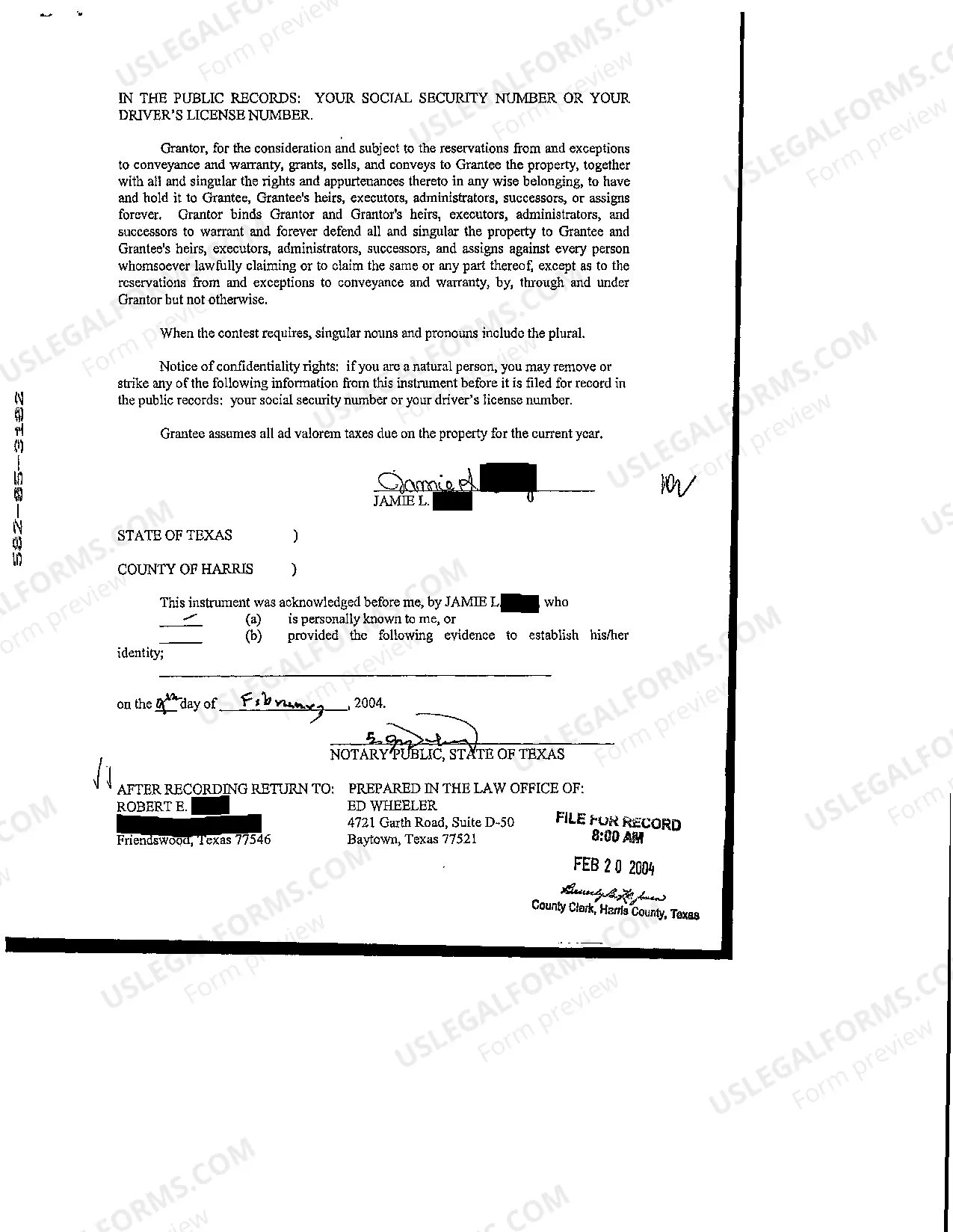

Lewisville Texas Special Assumption Warranty Deed is a legal document that conveys ownership of a property located in Lewisville, Texas, while also providing specific guarantees to the buyer regarding the property's title status. This type of deed ensures that the seller assumes responsibility for any outstanding mortgages, liens, or encumbrances on the property up to a certain date. A Lewisville Texas Special Assumption Warranty Deed typically includes the following key information: the names and addresses of both the buyer (grantee) and the seller (granter), a detailed legal description of the property, the purchase price or consideration paid for the property, and any specific terms and conditions agreed upon between both parties. There are various types of Lewisville Texas Special Assumption Warranty Deeds that may be used depending on the specific circumstances: 1. General Special Assumption Warranty Deed: This type of deed allows the seller to transfer the property to the buyer, guaranteeing that there are no outstanding mortgages or liens other than those explicitly assumed by the buyer. 2. Special Assumption Warranty Deed with Limited Warranty: This deed provides a limited warranty to the buyer, whereby the seller guarantees that he or she has done nothing to jeopardize the title's validity during their ownership, but does not provide any protection against defects arising before their ownership. 3. Special Assumption Warranty Deed with Full Warranty: This deed offers the most comprehensive protection to the buyer, as the seller guarantees that the property is free from any defects in the title, regardless of when they occurred. The seller assumes responsibility for any claims against the title, even if they existed prior to their ownership. When utilizing a Lewisville Texas Special Assumption Warranty Deed, it is crucial to consult with a qualified real estate attorney or title company to ensure that the deed is properly drafted and executed. This provides both the buyer and seller with peace of mind, knowing that the property's title is secure and all necessary obligations have been addressed. It is also recommended obtaining title insurance to protect against any unforeseen title issues that may arise.

Lewisville Texas Special Assumption Warranty Deed

Description

How to fill out Lewisville Texas Special Assumption Warranty Deed?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, usually, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of an attorney. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Lewisville Texas Special Assumption Warranty Deed or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Lewisville Texas Special Assumption Warranty Deed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Lewisville Texas Special Assumption Warranty Deed is proper for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!