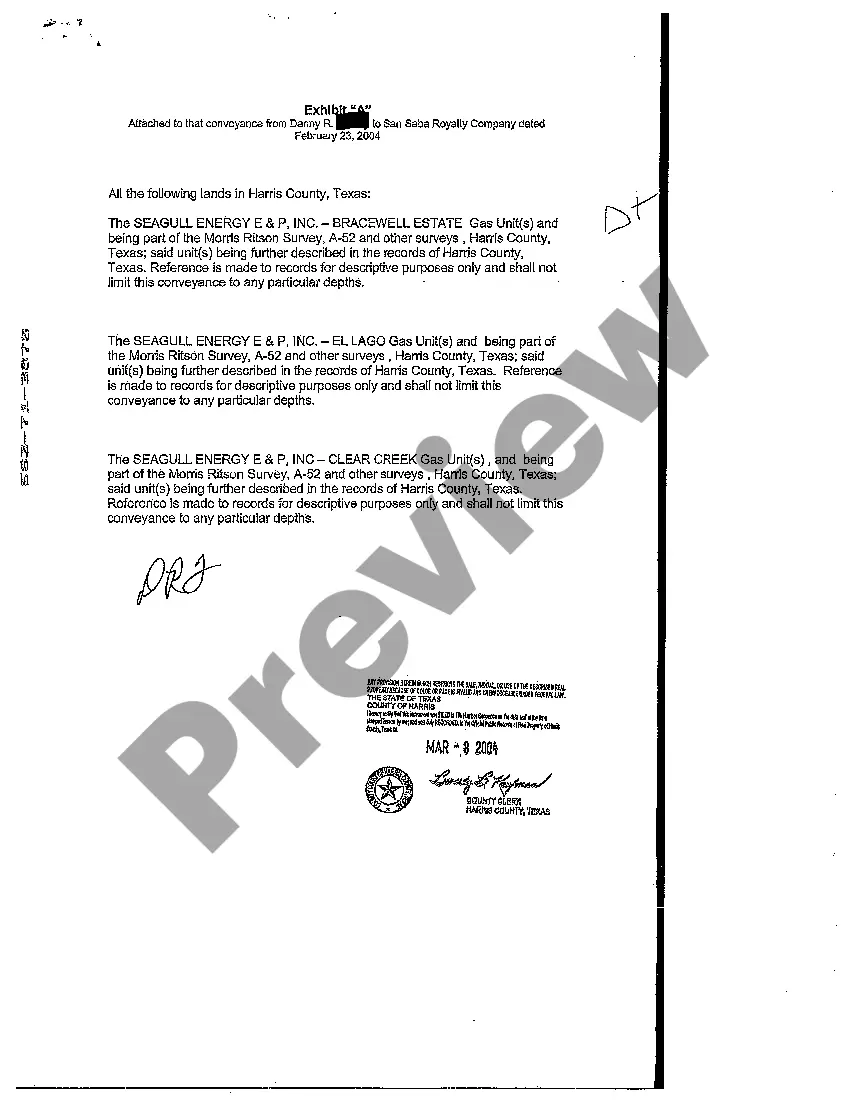

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

The Arlington Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers ownership rights and interests in mineral rights, royalty interests, and overriding royalty interests in Arlington, Texas. This deed allows individuals or entities to convey these rights to another party, providing them with the legal authority and entitlement to the respective mineral resources and associated profits. There are several types of Arlington Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, each serving a different purpose: 1. Mineral Conveyance Deed: This type of deed specifically transfers ownership of the mineral rights in Arlington, Texas. It grants the recipient the right to explore, extract, and profit from any minerals present in the specified property. 2. Royalty Conveyance Deed: This deed transfers the royalty interests associated with the mineral rights. Royalties refer to a certain percentage of the profits derived from the extraction and sale of minerals. By conveying these rights, the granter relinquishes their entitlement to future royalty payments while providing the grantee with the right to receive these payments. 3. Overriding Royalty Conveyance Deed: Similar to a royalty conveyance deed, an overriding royalty conveyance deed transfers overriding royalty interests. Overriding royalties are distinct from regular royalties and are typically reserved for parties involved in the production or exploration of minerals. This conveyance allows the grantee to receive a specific percentage of revenue generated from the mineral property, often above and beyond existing royalty interests. It is essential to include relevant keywords when discussing the Arlington Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed to enhance the content's search engine optimization (SEO). Keywords relevant to this topic include: — Arlington Texas mineral right— - Arlington TX royalty interests — Mineral conveyance deeArlingtonto— - Royalty conveyance in Arlington Texas — Overriding royalty interests Arlington — Arlington TX mineraDeeee— - Conveying mineral rights in Arlington — Arlington Texas royaltconveyancenc— - Overriding royalty conveyance in Arlington TX By incorporating these keywords in the content, it will increase its visibility and accessibility to individuals searching for information about these specific types of conveyance deeds in Arlington, Texas.