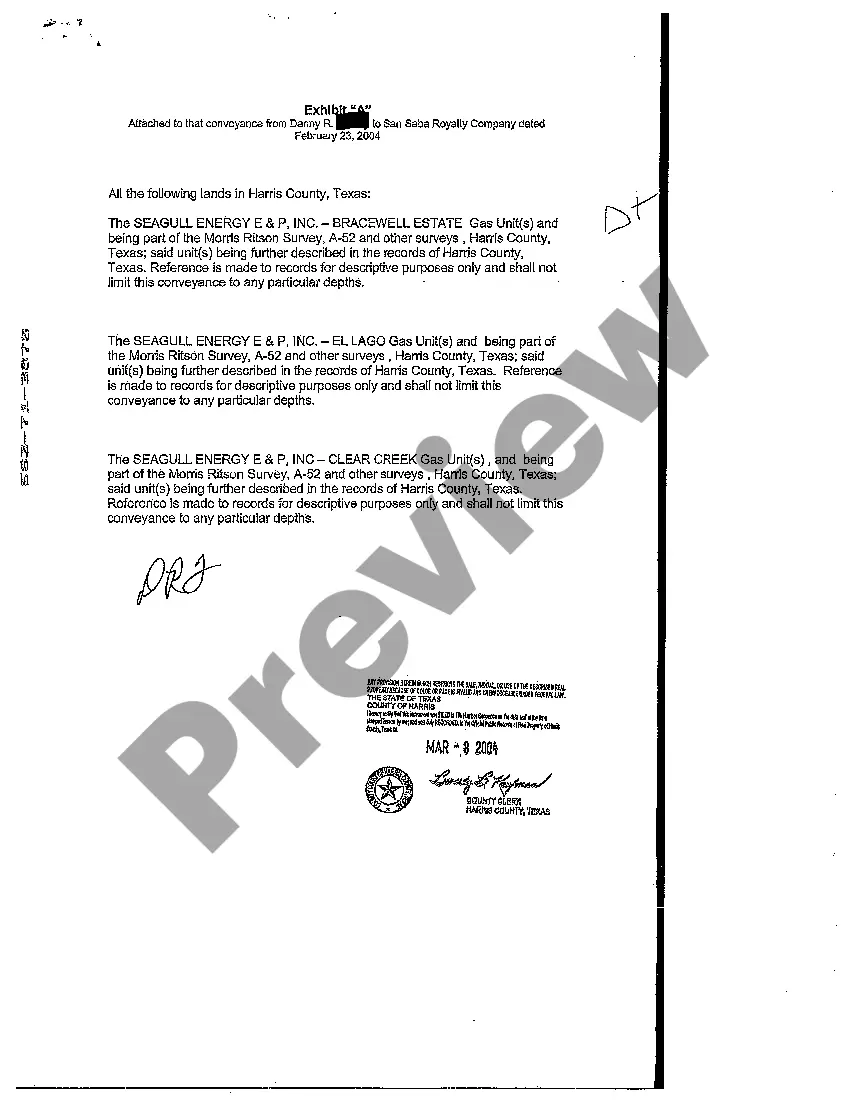

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

An Austin Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers ownership or rights of minerals, royalties, and overriding royalties in the state of Texas, specifically in the city of Austin, from one party to another. This deed pertains to the conveyance of these specific interests in real property. The term "mineral" refers to naturally occurring substances or resources such as oil, gas, coal, and precious metals. "Royalty" signifies the owner's entitlement to a portion of the revenue generated from the extraction and production of these minerals on the property. "Overriding royalty" refers to a share of the proceeds derived from an oil and gas lease, which is separate from the mineral owner's royalty interest. There are different types of Austin Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds that may exist, depending on the specific terms and conditions agreed upon by the parties involved. These variants may include: 1. General Conveyance Deed: This type of conveyance deed transfers the entire ownership or rights of the minerals, royalties, and overriding royalties from the granter (seller) to the grantee (buyer). It effectively hands over all rights and interests to the mineral resources and associated revenue streams. 2. Partial Conveyance Deed: In certain cases, a partial conveyance may occur, where the granter transfers only a specific portion or percentage of their ownership or rights in the minerals, royalties, or overriding royalties. This allows the granter to retain some interest in the property and its associated revenue. 3. Revocable Conveyance Deed: A revocable conveyance deed enables the granter to reserve the right to revoke or cancel the conveyance at a later date. This provides flexibility to the granter in case of changes in circumstances or if they wish to retain control over the property. 4. Irrevocable Conveyance Deed: The opposite of a revocable conveyance deed, an irrevocable conveyance permanently transfers the ownership or rights of the minerals, royalties, and overriding royalties without the ability to revoke or cancel the conveyance in the future. These are just a few examples of the different types of Austin Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds that may be encountered. It is important to consult with legal professionals and conduct thorough due diligence when executing or entering into such agreements to ensure all parties have a clear understanding of the terms and implications of the conveyance.An Austin Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers ownership or rights of minerals, royalties, and overriding royalties in the state of Texas, specifically in the city of Austin, from one party to another. This deed pertains to the conveyance of these specific interests in real property. The term "mineral" refers to naturally occurring substances or resources such as oil, gas, coal, and precious metals. "Royalty" signifies the owner's entitlement to a portion of the revenue generated from the extraction and production of these minerals on the property. "Overriding royalty" refers to a share of the proceeds derived from an oil and gas lease, which is separate from the mineral owner's royalty interest. There are different types of Austin Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds that may exist, depending on the specific terms and conditions agreed upon by the parties involved. These variants may include: 1. General Conveyance Deed: This type of conveyance deed transfers the entire ownership or rights of the minerals, royalties, and overriding royalties from the granter (seller) to the grantee (buyer). It effectively hands over all rights and interests to the mineral resources and associated revenue streams. 2. Partial Conveyance Deed: In certain cases, a partial conveyance may occur, where the granter transfers only a specific portion or percentage of their ownership or rights in the minerals, royalties, or overriding royalties. This allows the granter to retain some interest in the property and its associated revenue. 3. Revocable Conveyance Deed: A revocable conveyance deed enables the granter to reserve the right to revoke or cancel the conveyance at a later date. This provides flexibility to the granter in case of changes in circumstances or if they wish to retain control over the property. 4. Irrevocable Conveyance Deed: The opposite of a revocable conveyance deed, an irrevocable conveyance permanently transfers the ownership or rights of the minerals, royalties, and overriding royalties without the ability to revoke or cancel the conveyance in the future. These are just a few examples of the different types of Austin Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds that may be encountered. It is important to consult with legal professionals and conduct thorough due diligence when executing or entering into such agreements to ensure all parties have a clear understanding of the terms and implications of the conveyance.