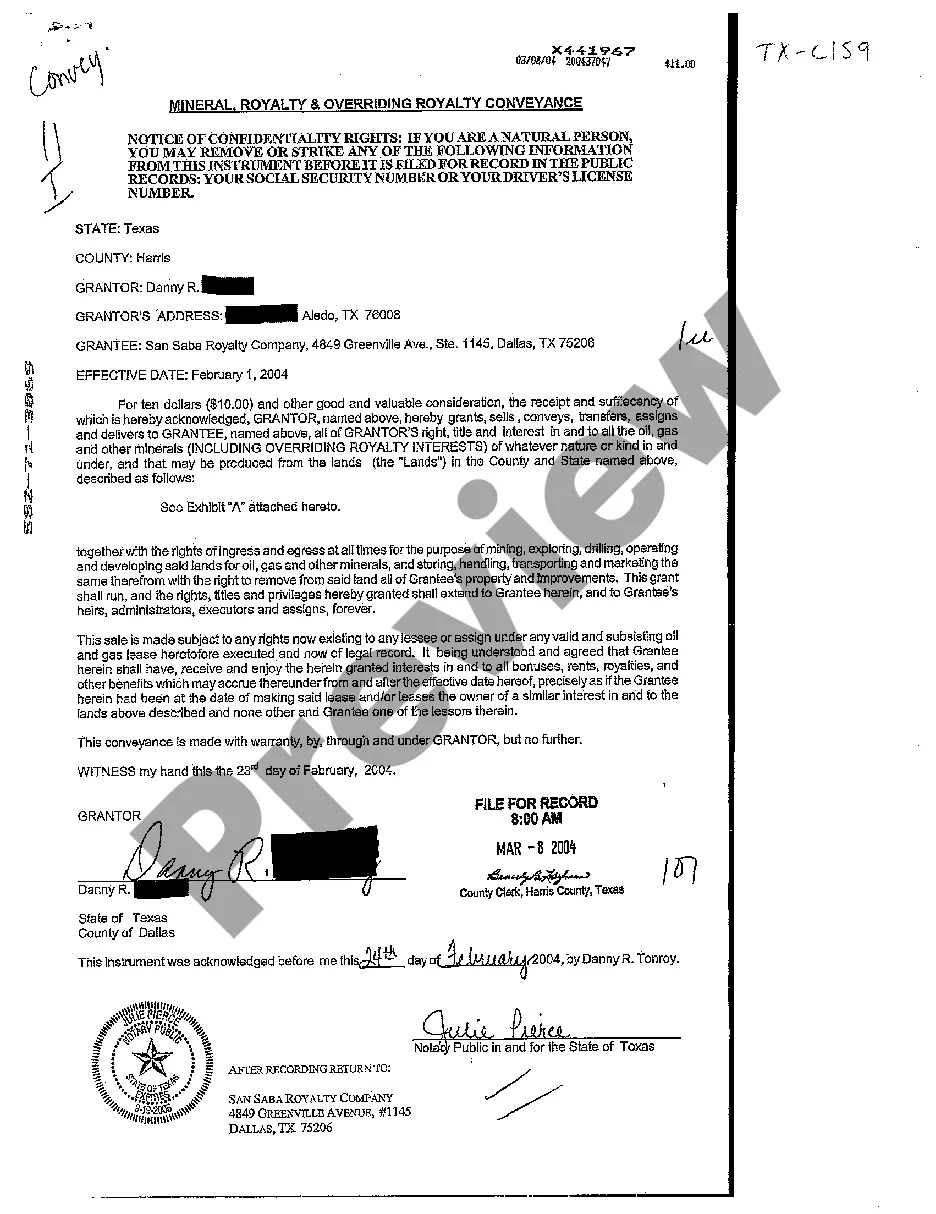

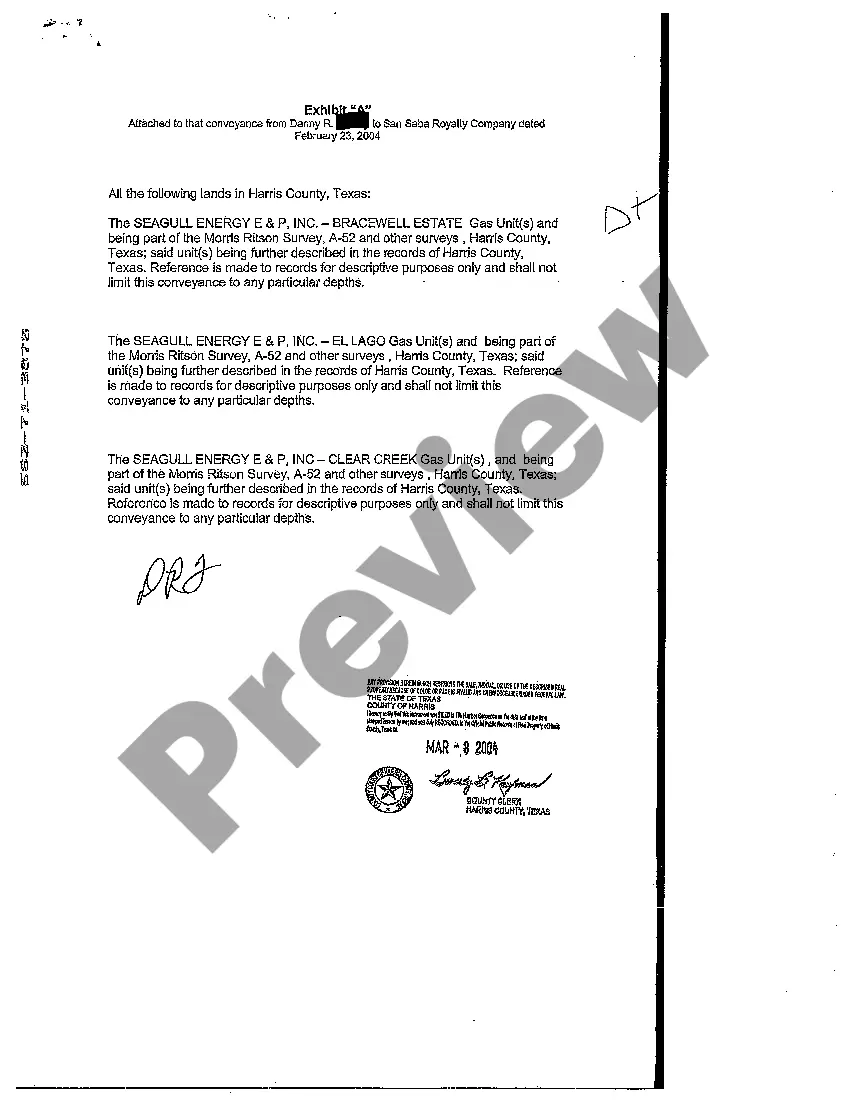

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Beaumont, Texas is renowned for its rich mineral resources, attracting numerous energy companies and investors looking to capitalize on the city's thriving oil and gas industry. To facilitate property transactions in this sector, Beaumont Texas offers various types of Mineral, Royalty, and Overriding Royalty Conveyance Deeds, designed to provide legal and financial clarity to all parties involved. One prominent type of Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Standard Deed. This comprehensive document typically includes a detailed description of the rights and interests being conveyed, ensuring the transfer of both surface and subsurface ownership. In this conveyance, the seller transfers mineral rights, royalties, and any overriding royalties to the buyer, along with an assurance that the property is free from any liens or encumbrances. Another type of Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Partial Conveyance Deed. This deed allows for the transfer of only a portion of the mineral rights, royalties, or overriding royalties of a property. It is commonly used when the seller wants to retain some interest while still selling a significant portion to the buyer. Furthermore, there is also the Overriding Royalty Interest (ORRIS) Deed, which specifically deals with the conveyance of overriding royalties. Unlike mineral rights and royalties, which are based on ownership of minerals, overriding royalties are typically based on the produced value of oil and gas. The ORRIS Deed ensures the legal transfer of these overriding royalty interests from the granter to the grantee. To execute a Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed effectively, certain keywords and phrases should be appropriately incorporated: 1. Mineral rights: These are legally recognized ownership rights to exploit and extract minerals, including oil, gas, and other valuable substances, from the property. 2. Royalty interest: This refers to the ownership interest that entitles the holder to a percentage of the revenue generated from the production and sale of minerals extracted from the property. 3. Overriding royalty interest: Similar to royalty interest, overriding royalty interest grants the holder a percentage of the revenue from the production, but it is distinct as it is not based on mineral ownership. 4. Conveyance deed: This legal document facilitates the transfer of ownership rights, mineral rights, and royalties from the granter to the grantee. 5. Standard conveyance: A comprehensive conveyance deed that accounts for the transfer of mineral rights, royalties, and overriding royalties while ensuring the property's freedom from liens or encumbrances. 6. Partial conveyance: A deed allowing for the transfer of only a portion of mineral rights, royalties, or overriding royalties, often used when the seller wishes to retain some ownership interest. 7. Overriding royalty interest deed: Specifically focuses on the conveyance of overriding royalty interests, detailing the transfer of this distinct form of revenue interest. Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds play a vital role in facilitating smooth property transactions in the region's thriving energy sector. These legal documents ensure clarity and transparency for buyers and sellers, safeguarding their respective interests in the lucrative mineral rights and royalty landscape.Beaumont, Texas is renowned for its rich mineral resources, attracting numerous energy companies and investors looking to capitalize on the city's thriving oil and gas industry. To facilitate property transactions in this sector, Beaumont Texas offers various types of Mineral, Royalty, and Overriding Royalty Conveyance Deeds, designed to provide legal and financial clarity to all parties involved. One prominent type of Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Standard Deed. This comprehensive document typically includes a detailed description of the rights and interests being conveyed, ensuring the transfer of both surface and subsurface ownership. In this conveyance, the seller transfers mineral rights, royalties, and any overriding royalties to the buyer, along with an assurance that the property is free from any liens or encumbrances. Another type of Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Partial Conveyance Deed. This deed allows for the transfer of only a portion of the mineral rights, royalties, or overriding royalties of a property. It is commonly used when the seller wants to retain some interest while still selling a significant portion to the buyer. Furthermore, there is also the Overriding Royalty Interest (ORRIS) Deed, which specifically deals with the conveyance of overriding royalties. Unlike mineral rights and royalties, which are based on ownership of minerals, overriding royalties are typically based on the produced value of oil and gas. The ORRIS Deed ensures the legal transfer of these overriding royalty interests from the granter to the grantee. To execute a Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed effectively, certain keywords and phrases should be appropriately incorporated: 1. Mineral rights: These are legally recognized ownership rights to exploit and extract minerals, including oil, gas, and other valuable substances, from the property. 2. Royalty interest: This refers to the ownership interest that entitles the holder to a percentage of the revenue generated from the production and sale of minerals extracted from the property. 3. Overriding royalty interest: Similar to royalty interest, overriding royalty interest grants the holder a percentage of the revenue from the production, but it is distinct as it is not based on mineral ownership. 4. Conveyance deed: This legal document facilitates the transfer of ownership rights, mineral rights, and royalties from the granter to the grantee. 5. Standard conveyance: A comprehensive conveyance deed that accounts for the transfer of mineral rights, royalties, and overriding royalties while ensuring the property's freedom from liens or encumbrances. 6. Partial conveyance: A deed allowing for the transfer of only a portion of mineral rights, royalties, or overriding royalties, often used when the seller wishes to retain some ownership interest. 7. Overriding royalty interest deed: Specifically focuses on the conveyance of overriding royalty interests, detailing the transfer of this distinct form of revenue interest. Beaumont Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds play a vital role in facilitating smooth property transactions in the region's thriving energy sector. These legal documents ensure clarity and transparency for buyers and sellers, safeguarding their respective interests in the lucrative mineral rights and royalty landscape.