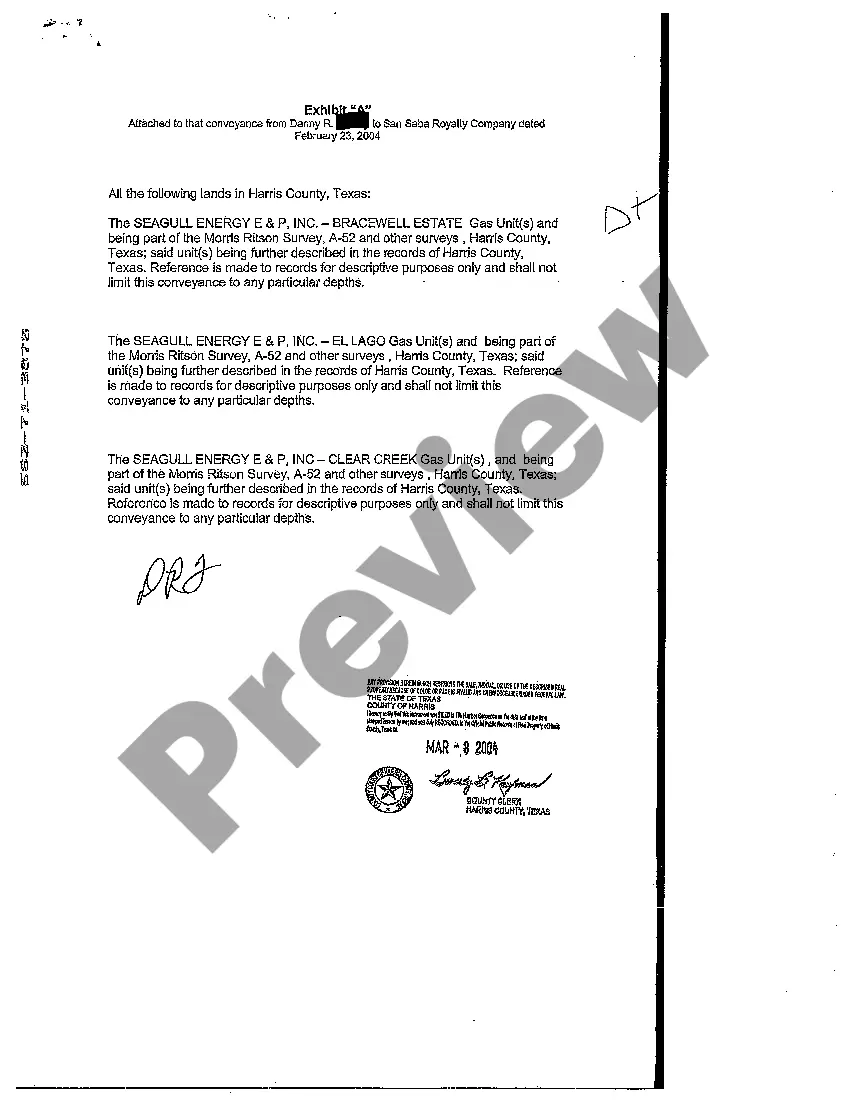

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

College Station, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds are legal documents that pertain to the transfer of mineral rights and royalty interests in College Station, Texas. These deeds play a crucial role in the world of oil and gas exploration and production, enabling the transfer of ownership and benefiting both the granter and grantee. One type of College Station, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Mineral Conveyance Deed. This deed refers to the transfer of ownership of mineral rights, granting the grantee the exclusive rights to extract and profit from any minerals found on the specified property in College Station. Another type is the Royalty Conveyance Deed. These deeds focus on the transfer of royalty interests to the grantee. Royalties are payments made to the mineral rights owner based on the production and sale of minerals extracted from the property. By transferring the royalty interests, a granter can monetize their ownership rights, while the grantee gains the opportunity to receive ongoing royalty payments. Lastly, the Overriding Royalty Conveyance Deed is a specific type of conveyance deed that involves the transfer of overriding royalty interests. Overriding royalties are similar to regular royalties; however, they are usually created when a third party holds an interest in an oil and gas lease or well, allowing them to receive a portion of the revenues generated, regardless of the mineral rights' owner. These deeds facilitate the transfer of these overriding royalty interests from the granter to the grantee. The College Station, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds include various essential elements such as the legal description of the property, specific terms of conveyance, the consideration or payment involved, and any reservations or exceptions made by either party. Additionally, these deeds must adhere to Texas state laws and regulations governing mineral rights and conveyances. In conclusion, College Station, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds are legal instruments that enable the transfer of mineral rights, royalty interests, and overriding royalty interests in College Station, Texas. They serve as vital tools, allowing parties to monetize their ownership rights and benefit from the exploration and production of minerals in the region.