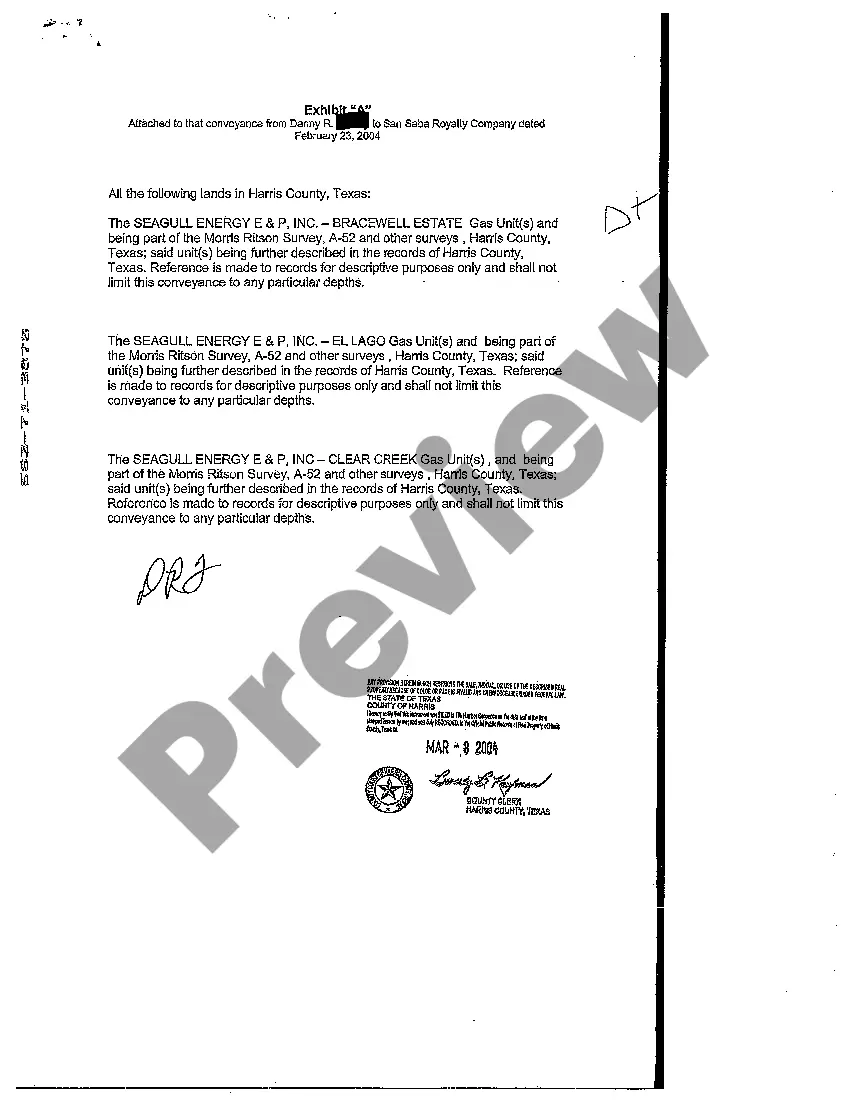

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

The Harris Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is an essential legal document used in the transfer of property rights associated with mineral extraction and royalties within Harris County, Texas. This deed outlines the terms and conditions under which a party conveys their rights to minerals, royalties, or overriding royalties to another individual or entity. In Harris County, Texas, there are different types of conveyance deeds related to mineral, royalty, and overriding royalty interests, including: 1. Mineral Deed: This deed focuses on the transfer of ownership rights to minerals found within a specific property or land. It grants the new owner the right to extract and benefit from the minerals present. 2. Royalty Deed: This specific deed concentrates on transferring the rights to receive royalty payments from the production or extraction of minerals on a property to another party. The new owner becomes entitled to receive periodic royalty payments based on the agreed-upon terms. 3. Overriding Royalty Interest (ORRIS) Deed: An ORRIS deed is used to convey the right to receive a specific percentage or fraction of the gross revenue or production from the extraction of minerals on a property. This interest is separate from the mineral and royalty interests and is typically retained by an individual or entity even after the sale or lease of the mineral rights. In all these types of conveyance deeds, the document will typically include important information such as: Granteror and Grantee Details: The full names, addresses, and contact information of both the party conveying the rights (granter) and the party receiving the rights (grantee) will be stated. — Legal Description of the Property: This section defines the specific location, boundaries, dimensions, and any other essential details that accurately identify the property being conveyed. — Mineral/Royalty/Overriding Royalty Interests: The document will detail the specifics of the conveyed interests, including the type, percentage, fraction, or amount being transferred. It may also include any limitations, encumbrances, or reservations on the conveyed interests. — Consideration: The amount of consideration or compensation to be given for the conveyed interests will usually be included, whether in the form of a lump sum payment, a percentage of future royalties, or any other agreed-upon arrangement. — Execution and Recording: The deed will require the signatures of the granter, often witnessed and notarized. Additionally, it will outline the instructions for recording the document at the appropriate county clerk or land records office to ensure its validity and official recognition. It is crucial that all parties involved understand the terms and implications of the Harris Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed to ensure a smooth transfer of interests and avoid any potential disputes or legal issues in the future. Consulting with a qualified attorney or real estate professional is strongly advised during this process.The Harris Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is an essential legal document used in the transfer of property rights associated with mineral extraction and royalties within Harris County, Texas. This deed outlines the terms and conditions under which a party conveys their rights to minerals, royalties, or overriding royalties to another individual or entity. In Harris County, Texas, there are different types of conveyance deeds related to mineral, royalty, and overriding royalty interests, including: 1. Mineral Deed: This deed focuses on the transfer of ownership rights to minerals found within a specific property or land. It grants the new owner the right to extract and benefit from the minerals present. 2. Royalty Deed: This specific deed concentrates on transferring the rights to receive royalty payments from the production or extraction of minerals on a property to another party. The new owner becomes entitled to receive periodic royalty payments based on the agreed-upon terms. 3. Overriding Royalty Interest (ORRIS) Deed: An ORRIS deed is used to convey the right to receive a specific percentage or fraction of the gross revenue or production from the extraction of minerals on a property. This interest is separate from the mineral and royalty interests and is typically retained by an individual or entity even after the sale or lease of the mineral rights. In all these types of conveyance deeds, the document will typically include important information such as: Granteror and Grantee Details: The full names, addresses, and contact information of both the party conveying the rights (granter) and the party receiving the rights (grantee) will be stated. — Legal Description of the Property: This section defines the specific location, boundaries, dimensions, and any other essential details that accurately identify the property being conveyed. — Mineral/Royalty/Overriding Royalty Interests: The document will detail the specifics of the conveyed interests, including the type, percentage, fraction, or amount being transferred. It may also include any limitations, encumbrances, or reservations on the conveyed interests. — Consideration: The amount of consideration or compensation to be given for the conveyed interests will usually be included, whether in the form of a lump sum payment, a percentage of future royalties, or any other agreed-upon arrangement. — Execution and Recording: The deed will require the signatures of the granter, often witnessed and notarized. Additionally, it will outline the instructions for recording the document at the appropriate county clerk or land records office to ensure its validity and official recognition. It is crucial that all parties involved understand the terms and implications of the Harris Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed to ensure a smooth transfer of interests and avoid any potential disputes or legal issues in the future. Consulting with a qualified attorney or real estate professional is strongly advised during this process.