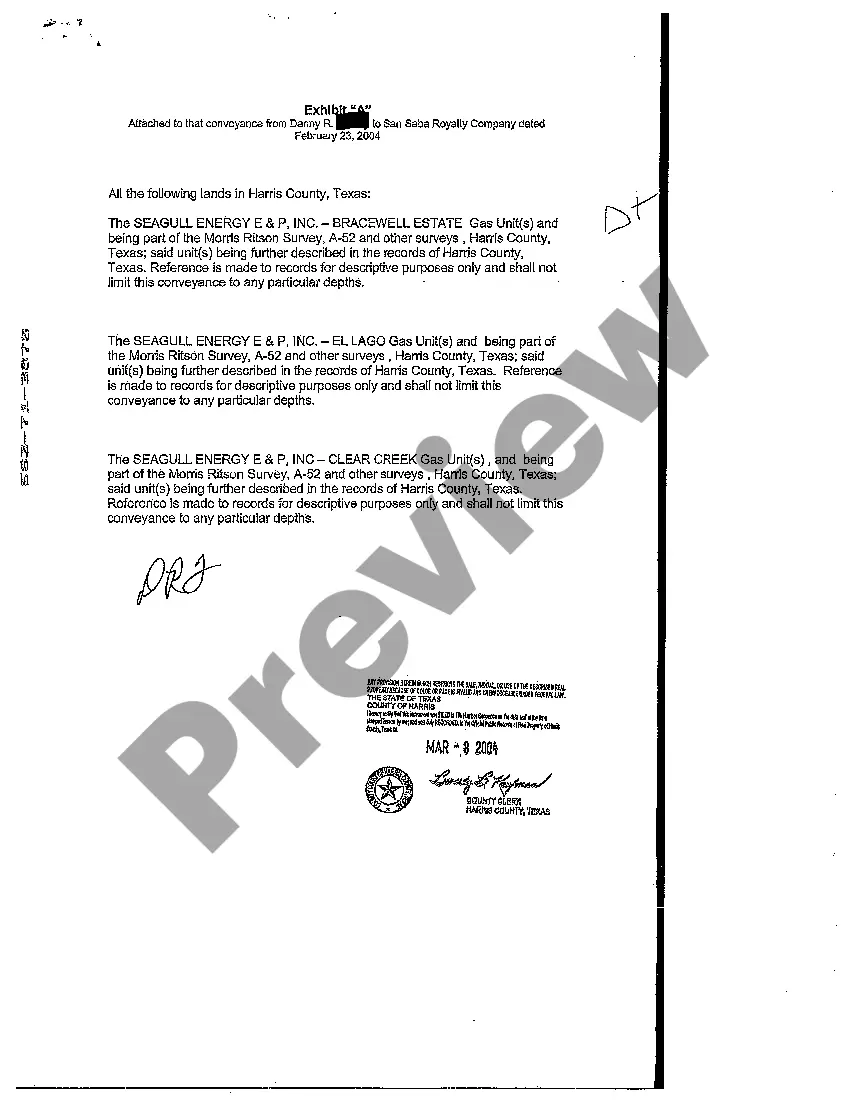

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

A Houston Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed refers to a legal document that transfers ownership or rights associated with mineral interests, royalty interests, and overriding royalty interests in Houston, Texas. This conveyance deed is crucial in the oil and gas industry, as it helps to establish the ownership and transfer of these interests from one party to another. The Houston Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed typically includes important details such as the names of the granter (seller) and grantee (buyer), a description of the property, and a clear statement of the conveyance. It may also contain information regarding any reservations or exceptions made by the granter. There can be different types of Houston Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds based on the specific interests being conveyed. These may include: 1. Mineral Conveyance Deed: This type of deed transfers ownership of the mineral rights associated with a property. Mineral rights grant the owner the legal right to explore, extract, and sell the minerals found beneath the surface of the land, such as oil, gas, coal, and metals. 2. Royalty Conveyance Deed: A royalty conveyance deed transfers the right to receive a share of the revenue generated from the production and sale of minerals. The owner of a royalty interest typically receives a percentage of the total proceeds from the production, known as royalties, without bearing the expenses of exploration and drilling. 3. Overriding Royalty Conveyance Deed: An overriding royalty conveyance deed transfers a non-operating interest in the profits generated from an oil or gas lease. Unlike a royalty interest that is a share of revenue, an overriding royalty is a share of production, typically reserved for those who have a particular relationship with the project, such as a professional advisor or company executive. These conveyance deeds play a crucial role in oil and gas transactions, helping to establish clear ownership and transfer of rights in Houston, Texas. They provide the legal framework for companies and individuals involved in the exploration, production, and development of natural resources, ensuring proper compensation and rights allocation in these industries.