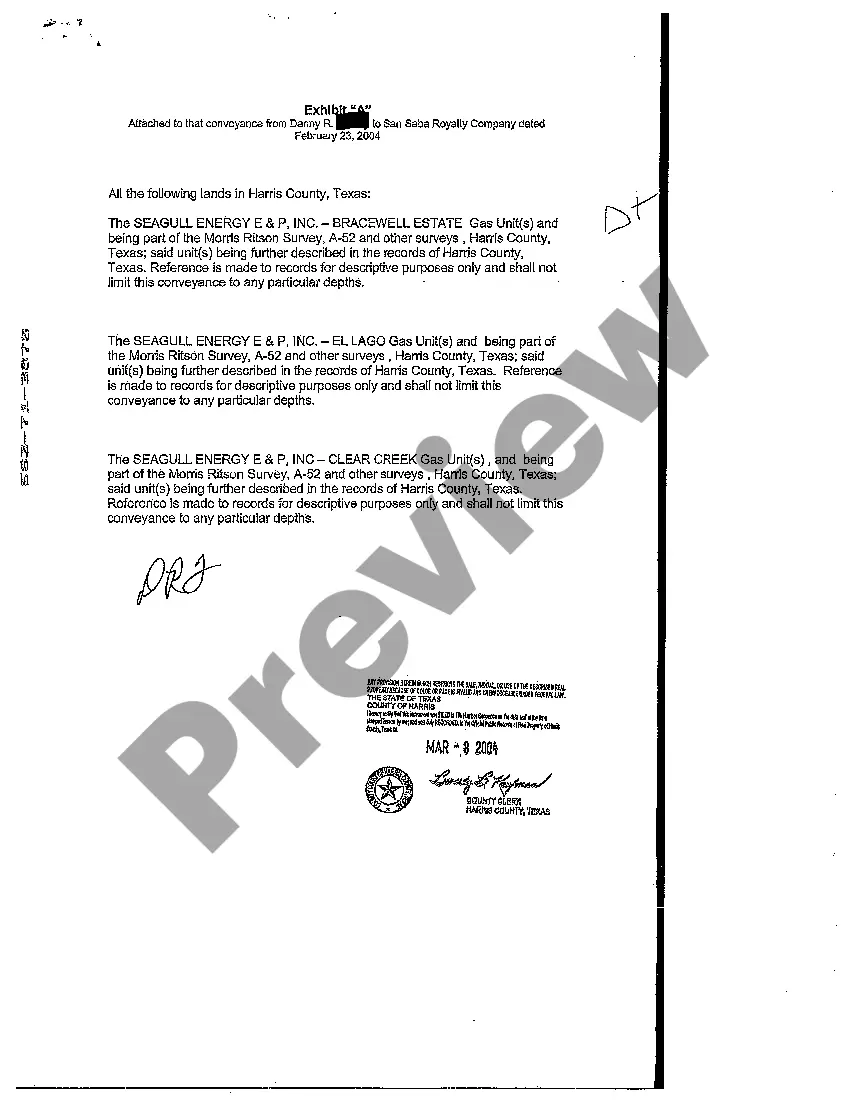

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

An Irving Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that pertains to the transfer of rights and interests in mineral resources located in Irving, Texas. It is utilized when the ownership or rights to extract minerals, receive royalties, or receive overriding royalties need to be conveyed from one party to another. This conveyance deed serves as a means to formalize and transfer these mineral, royalty, and overriding royalty interests from the granter (the current owner) to the grantee (the prospective new owner). The document entails the specifics of the conveyance, outlining the rights, interests, and any associated obligations. Keywords: Irving Texas, mineral, royalty, overriding royalty, conveyance deed, transfer, ownership, rights, interests. Types of Irving Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds include: 1. Mineral Conveyance Deed: This type of deed focuses on the transfer of ownership rights of minerals, such as oil, gas, coal, or other valuable resources found in Irving, Texas. The mineral conveyance deed allows the grantee to exploit the minerals and enjoy the associated benefits. 2. Royalty Conveyance Deed: This deed specifically pertains to the transfer of royalty rights. Royalties are monetary compensations paid to the owner of mineral rights based on a percentage of the revenue earned from the extraction or production of minerals. The royalty conveyance deed enables the recipient to receive ongoing payments based on the terms outlined in the deed. 3. Overriding Royalty Conveyance Deed: This type of conveyance deed is related to overriding royalties, which are similar to traditional royalties but are separate from the ownership of the mineral rights. Overriding royalties are reserved for those who have ownership interests in the minerals but are not the actual owners of the rights. An overriding royalty conveyance deed transfers rights to these additional royalties to the grantee. These different types of conveyance deeds cater to the various aspects of mineral ownership and associated financial benefits. They ensure that the transfer is done legally, protecting the rights and interests of all parties involved in Irving, Texas.An Irving Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that pertains to the transfer of rights and interests in mineral resources located in Irving, Texas. It is utilized when the ownership or rights to extract minerals, receive royalties, or receive overriding royalties need to be conveyed from one party to another. This conveyance deed serves as a means to formalize and transfer these mineral, royalty, and overriding royalty interests from the granter (the current owner) to the grantee (the prospective new owner). The document entails the specifics of the conveyance, outlining the rights, interests, and any associated obligations. Keywords: Irving Texas, mineral, royalty, overriding royalty, conveyance deed, transfer, ownership, rights, interests. Types of Irving Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds include: 1. Mineral Conveyance Deed: This type of deed focuses on the transfer of ownership rights of minerals, such as oil, gas, coal, or other valuable resources found in Irving, Texas. The mineral conveyance deed allows the grantee to exploit the minerals and enjoy the associated benefits. 2. Royalty Conveyance Deed: This deed specifically pertains to the transfer of royalty rights. Royalties are monetary compensations paid to the owner of mineral rights based on a percentage of the revenue earned from the extraction or production of minerals. The royalty conveyance deed enables the recipient to receive ongoing payments based on the terms outlined in the deed. 3. Overriding Royalty Conveyance Deed: This type of conveyance deed is related to overriding royalties, which are similar to traditional royalties but are separate from the ownership of the mineral rights. Overriding royalties are reserved for those who have ownership interests in the minerals but are not the actual owners of the rights. An overriding royalty conveyance deed transfers rights to these additional royalties to the grantee. These different types of conveyance deeds cater to the various aspects of mineral ownership and associated financial benefits. They ensure that the transfer is done legally, protecting the rights and interests of all parties involved in Irving, Texas.