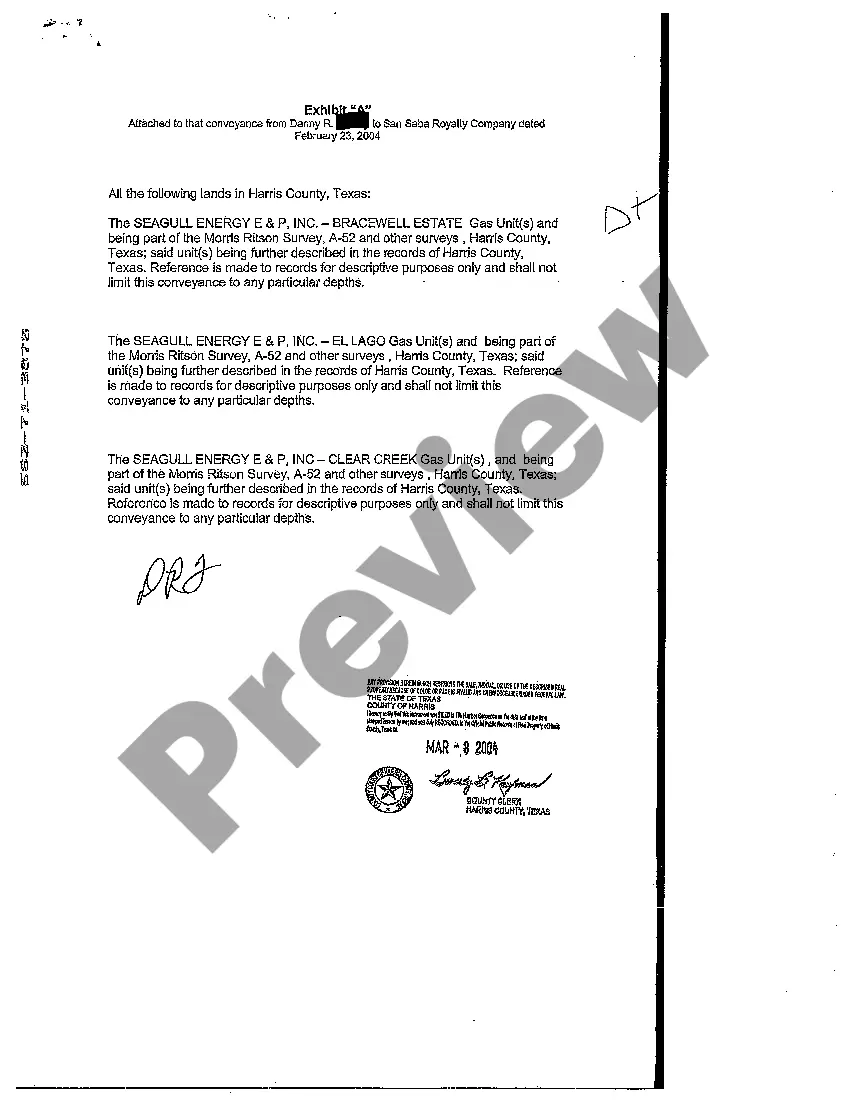

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Killeen Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed: A Comprehensive Overview In Killeen, Texas, the Mineral, Royalty, and Overriding Royalty Conveyance Deed plays a significant role in the lucrative world of oil and gas leasing and exploration. This legal instrument is designed to transfer ownership rights and interests in mineral property to a new party, known as the grantee, within the Killeen region. By examining the various types of conveyance deeds, including Mineral, Royalty, and Overriding Royalty Conveyance Deed, a clearer understanding of their purpose and importance in the region can be gained. The Killeen Texas Mineral Conveyance Deed is often one of the most sought-after types of deeds within the oil and gas industry. This specific conveyance transfers the ownership rights to the minerals present in a particular property, including oil, gas, coal, and other valuable resources. The deed defines the scope and extent of ownership, allowing the grantee to exploit and profit from these minerals. By acquiring the mineral rights, the grantee gains the authority to drill, explore, extract, and produce these resources, subject to any legal limitations and obligations imposed by local regulations. On the other hand, the Killeen Texas Royalty Conveyance Deed focuses primarily on the transfer of royalty interests associated with mineral extraction and production. Royalties refer to the financial compensation received by the mineral rights' owner (the granter) in exchange for allowing the grantee to extract and produce minerals. This conveyance deed allows the grantee to collect a percentage or a fixed sum from the revenue generated by the sale of extracted minerals. By acquiring royalty interests, the grantee enjoys a passive income stream tied to the successful commercial exploitation of the minerals present in the conveyed property. Lastly, the Killeen Texas Overriding Royalty Conveyance Deed operates similarly to the royalty conveyance, but with some key distinctions. This type of conveyance transfers a permanent share of a producing lease's profits to the grantee. Overriding royalties are distinct from ordinary royalties as they exist independently of the ownership of mineral rights, allowing individuals or entities without ownership rights to benefit from the production of oil, gas, or other minerals. While mineral owners typically retain a portion of the profits from a lease, overriding royalty interest holders, through the conveyance deed, secure a direct right to a percentage of the lease's profit. In summary, the Killeen Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds serve as vital legal tools in the transfer and acquisition of mineral rights, royalty interests, and overriding royalties within the region. These conveyance deeds allow parties to monetize and exploit the valuable mineral resources found in Killeen, Texas, ensuring fair compensation and the proper legal framework for both granters and grantees.Killeen Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed: A Comprehensive Overview In Killeen, Texas, the Mineral, Royalty, and Overriding Royalty Conveyance Deed plays a significant role in the lucrative world of oil and gas leasing and exploration. This legal instrument is designed to transfer ownership rights and interests in mineral property to a new party, known as the grantee, within the Killeen region. By examining the various types of conveyance deeds, including Mineral, Royalty, and Overriding Royalty Conveyance Deed, a clearer understanding of their purpose and importance in the region can be gained. The Killeen Texas Mineral Conveyance Deed is often one of the most sought-after types of deeds within the oil and gas industry. This specific conveyance transfers the ownership rights to the minerals present in a particular property, including oil, gas, coal, and other valuable resources. The deed defines the scope and extent of ownership, allowing the grantee to exploit and profit from these minerals. By acquiring the mineral rights, the grantee gains the authority to drill, explore, extract, and produce these resources, subject to any legal limitations and obligations imposed by local regulations. On the other hand, the Killeen Texas Royalty Conveyance Deed focuses primarily on the transfer of royalty interests associated with mineral extraction and production. Royalties refer to the financial compensation received by the mineral rights' owner (the granter) in exchange for allowing the grantee to extract and produce minerals. This conveyance deed allows the grantee to collect a percentage or a fixed sum from the revenue generated by the sale of extracted minerals. By acquiring royalty interests, the grantee enjoys a passive income stream tied to the successful commercial exploitation of the minerals present in the conveyed property. Lastly, the Killeen Texas Overriding Royalty Conveyance Deed operates similarly to the royalty conveyance, but with some key distinctions. This type of conveyance transfers a permanent share of a producing lease's profits to the grantee. Overriding royalties are distinct from ordinary royalties as they exist independently of the ownership of mineral rights, allowing individuals or entities without ownership rights to benefit from the production of oil, gas, or other minerals. While mineral owners typically retain a portion of the profits from a lease, overriding royalty interest holders, through the conveyance deed, secure a direct right to a percentage of the lease's profit. In summary, the Killeen Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds serve as vital legal tools in the transfer and acquisition of mineral rights, royalty interests, and overriding royalties within the region. These conveyance deeds allow parties to monetize and exploit the valuable mineral resources found in Killeen, Texas, ensuring fair compensation and the proper legal framework for both granters and grantees.