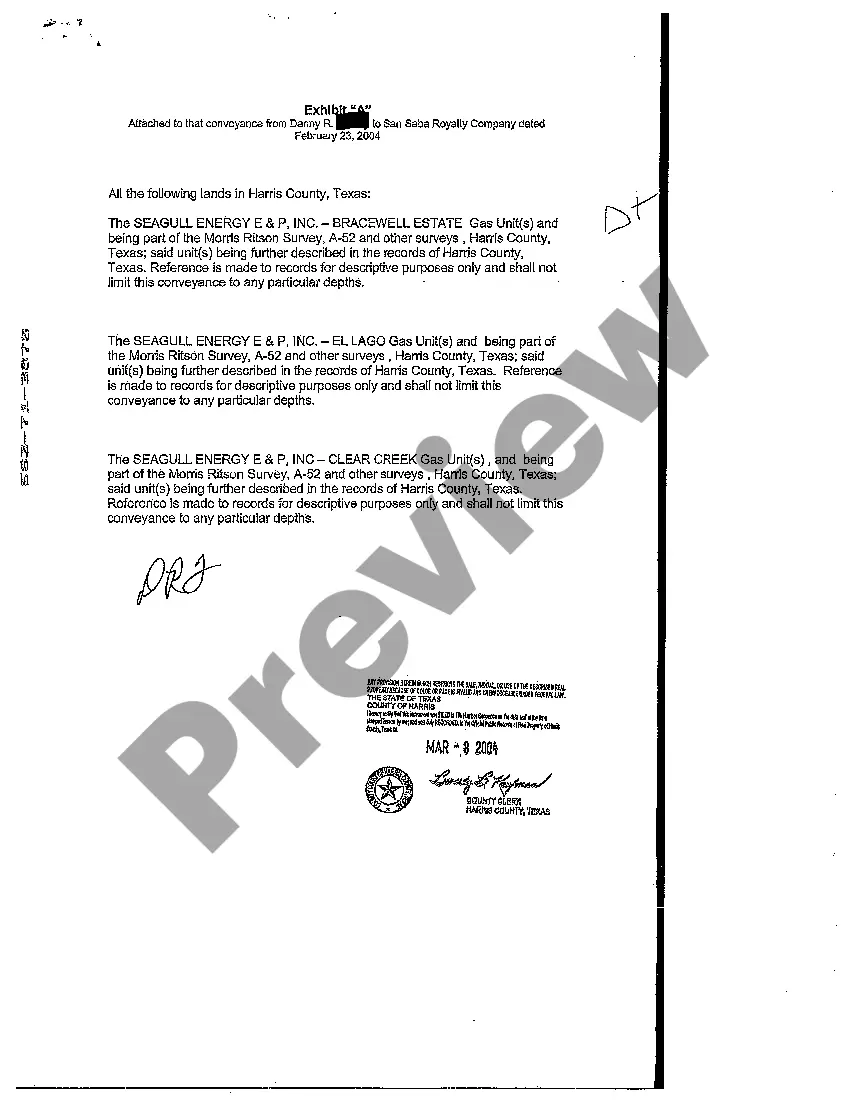

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

McKinney, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed refer to legal documents that pertain to the transfer of mineral rights, royalty interests, and overriding royalty interests in the context of properties located in McKinney, Texas. These deeds are crucial in the oil and gas industry and ensure the smooth transfer of ownership and management of these valuable assets. There are several types of McKinney Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, each serving a distinct purpose: 1. Mineral Conveyance Deed: A Mineral Conveyance Deed is used when transferring ownership of mineral rights from one party to another. This deed covers rights to extract, produce, and profit from minerals found beneath the surface of the property, such as oil, gas, coal, ores, and other valuable substances. 2. Royalty Conveyance Deed: A Royalty Conveyance Deed is utilized when transferring royalty interests associated with mineral extraction or production. It enables one party to convey a portion of their royalty interest to another party, thereby entitling the recipient to a specified percentage of the revenue generated from the extracted minerals. 3. Overriding Royalty Conveyance Deed: An Overriding Royalty Conveyance Deed is used to convey overriding royalty interests, which are distinct from mineral rights and traditional royalties. Overriding royalties entitle the owner to a percentage of revenue derived from the sale or production of minerals, regardless of their ownership interest. Typically, these interests are created by landowners who lease their property to oil and gas companies. The McKinney Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds contain vital information such as the legal description of the property, the identities of the granter (seller) and grantee (buyer), and the specific interests being conveyed. Moreover, relevant keywords associated with these deeds include "mineral rights transfer McKinney," "royalty interest conveyance Texas," "overriding royalty deed McKinney," "oil and gas property conveyance," and "Mineral, Royalty, and Overriding Royalty Deed McKinney Texas." When entering into such transactions, it is crucial to consult legal professionals experienced in oil and gas law to ensure the deeds accurately reflect the parties' intentions and protect their interests. McKinney, Texas, with its rich potential for oil and gas exploration, demands careful consideration and execution of Mineral, Royalty, and Overriding Royalty Conveyance Deeds.McKinney, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed refer to legal documents that pertain to the transfer of mineral rights, royalty interests, and overriding royalty interests in the context of properties located in McKinney, Texas. These deeds are crucial in the oil and gas industry and ensure the smooth transfer of ownership and management of these valuable assets. There are several types of McKinney Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, each serving a distinct purpose: 1. Mineral Conveyance Deed: A Mineral Conveyance Deed is used when transferring ownership of mineral rights from one party to another. This deed covers rights to extract, produce, and profit from minerals found beneath the surface of the property, such as oil, gas, coal, ores, and other valuable substances. 2. Royalty Conveyance Deed: A Royalty Conveyance Deed is utilized when transferring royalty interests associated with mineral extraction or production. It enables one party to convey a portion of their royalty interest to another party, thereby entitling the recipient to a specified percentage of the revenue generated from the extracted minerals. 3. Overriding Royalty Conveyance Deed: An Overriding Royalty Conveyance Deed is used to convey overriding royalty interests, which are distinct from mineral rights and traditional royalties. Overriding royalties entitle the owner to a percentage of revenue derived from the sale or production of minerals, regardless of their ownership interest. Typically, these interests are created by landowners who lease their property to oil and gas companies. The McKinney Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds contain vital information such as the legal description of the property, the identities of the granter (seller) and grantee (buyer), and the specific interests being conveyed. Moreover, relevant keywords associated with these deeds include "mineral rights transfer McKinney," "royalty interest conveyance Texas," "overriding royalty deed McKinney," "oil and gas property conveyance," and "Mineral, Royalty, and Overriding Royalty Deed McKinney Texas." When entering into such transactions, it is crucial to consult legal professionals experienced in oil and gas law to ensure the deeds accurately reflect the parties' intentions and protect their interests. McKinney, Texas, with its rich potential for oil and gas exploration, demands careful consideration and execution of Mineral, Royalty, and Overriding Royalty Conveyance Deeds.