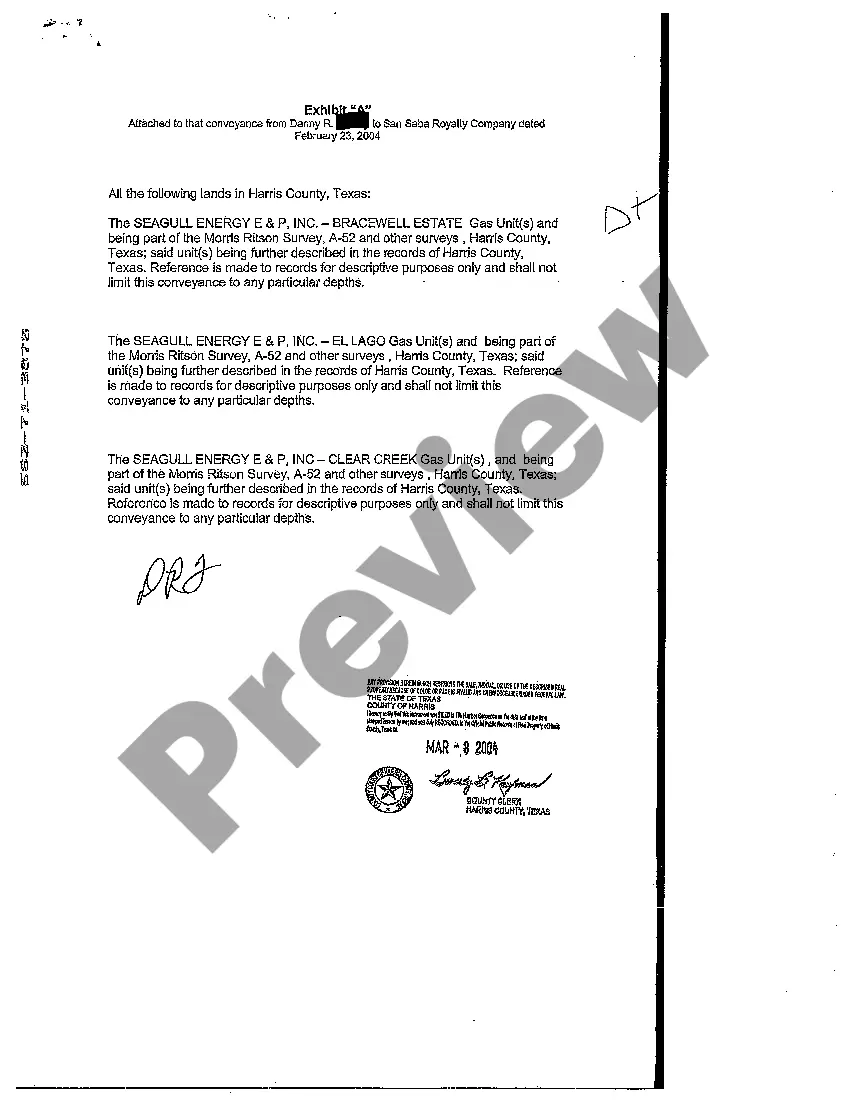

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document often used in the state of Texas to transfer ownership or royalty rights related to mineral resources. This deed holds significant importance in the oil, gas, and mining industries, ensuring the smooth transfer of rights and interests between parties involved. The different types of Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds include: 1. Mineral Deed: This type of conveyance deed specifically focuses on transferring the ownership rights of the minerals present in a particular land or property. It allows the grantee to extract, explore, and exploit the minerals, while the granter retains certain royalties or overriding royalties. 2. Royalty Deed: Unlike the Mineral Deed, a Royalty Deed primarily deals with conveying the royalty interests in minerals rather than transferring ownership. The granter, known as the royalty interest owner, assigns a set portion or percentage of future royalty payments from the production of minerals to the grantee. 3. Overriding Royalty Interest Deed: This conveyance deed involves the transfer of an overriding royalty interest (ORRIS) attached to a property or lease. An ORRIS is the right to receive a specific percentage of the revenues generated from the property's minerals, typically over and above any other royalty interests. The Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed plays a crucial role in determining the rights, obligations, and financial arrangements between the granter and the grantee. It outlines essential details such as property description, terms of conveyance, consideration, and any further obligations like future delivery of necessary paperwork or records. For a valid conveyance, the deed must be properly executed, acknowledged, and recorded according to Texas state laws. It is highly recommended consulting a qualified attorney or legal professional familiar with mineral rights and conveyance deeds to draft or review such documents, ensuring compliance with all relevant regulations and protecting the interests of both parties involved. In summary, the Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed are crucial instruments for transferring ownership or royalty interests related to mineral resources in Texas. These deeds ensure legal clarity and protect the rights and interests of both the granter and grantee. Proper understanding and execution of these conveyance deeds are essential for successful and lawful transactions in the mineral industry.Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document often used in the state of Texas to transfer ownership or royalty rights related to mineral resources. This deed holds significant importance in the oil, gas, and mining industries, ensuring the smooth transfer of rights and interests between parties involved. The different types of Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds include: 1. Mineral Deed: This type of conveyance deed specifically focuses on transferring the ownership rights of the minerals present in a particular land or property. It allows the grantee to extract, explore, and exploit the minerals, while the granter retains certain royalties or overriding royalties. 2. Royalty Deed: Unlike the Mineral Deed, a Royalty Deed primarily deals with conveying the royalty interests in minerals rather than transferring ownership. The granter, known as the royalty interest owner, assigns a set portion or percentage of future royalty payments from the production of minerals to the grantee. 3. Overriding Royalty Interest Deed: This conveyance deed involves the transfer of an overriding royalty interest (ORRIS) attached to a property or lease. An ORRIS is the right to receive a specific percentage of the revenues generated from the property's minerals, typically over and above any other royalty interests. The Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed plays a crucial role in determining the rights, obligations, and financial arrangements between the granter and the grantee. It outlines essential details such as property description, terms of conveyance, consideration, and any further obligations like future delivery of necessary paperwork or records. For a valid conveyance, the deed must be properly executed, acknowledged, and recorded according to Texas state laws. It is highly recommended consulting a qualified attorney or legal professional familiar with mineral rights and conveyance deeds to draft or review such documents, ensuring compliance with all relevant regulations and protecting the interests of both parties involved. In summary, the Pasadena Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed are crucial instruments for transferring ownership or royalty interests related to mineral resources in Texas. These deeds ensure legal clarity and protect the rights and interests of both the granter and grantee. Proper understanding and execution of these conveyance deeds are essential for successful and lawful transactions in the mineral industry.