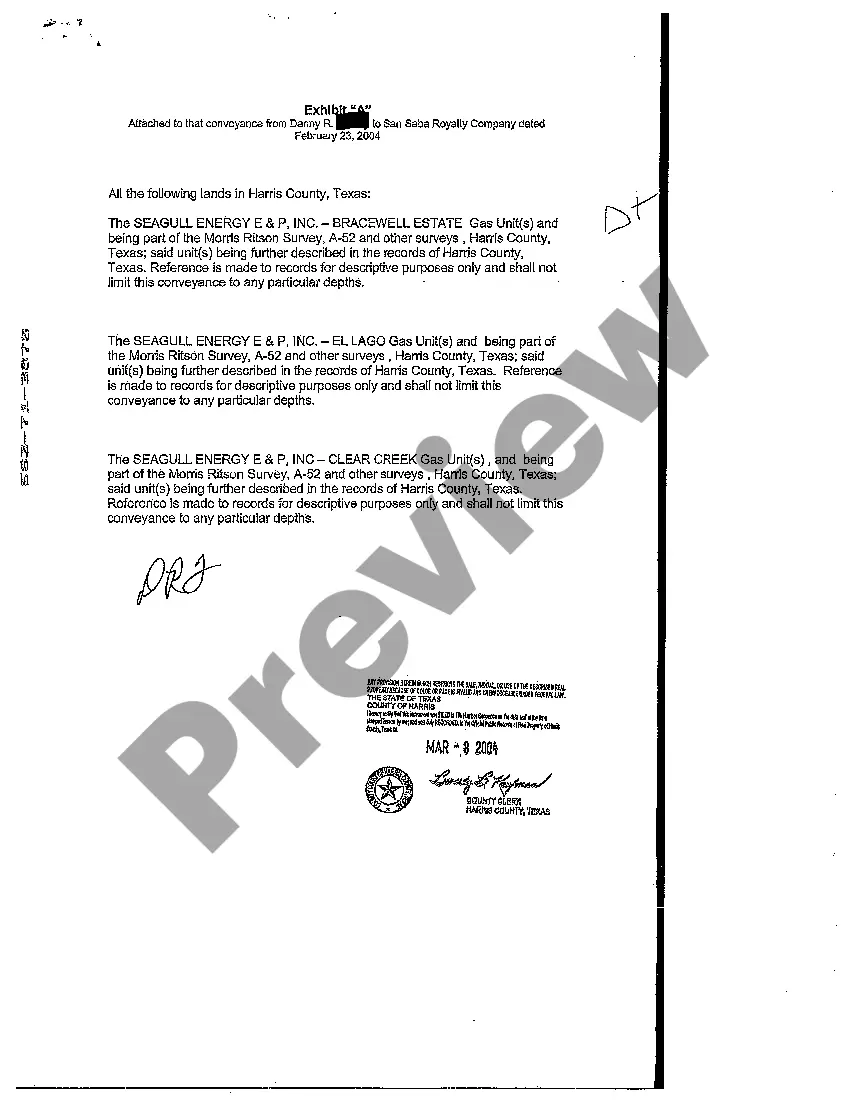

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

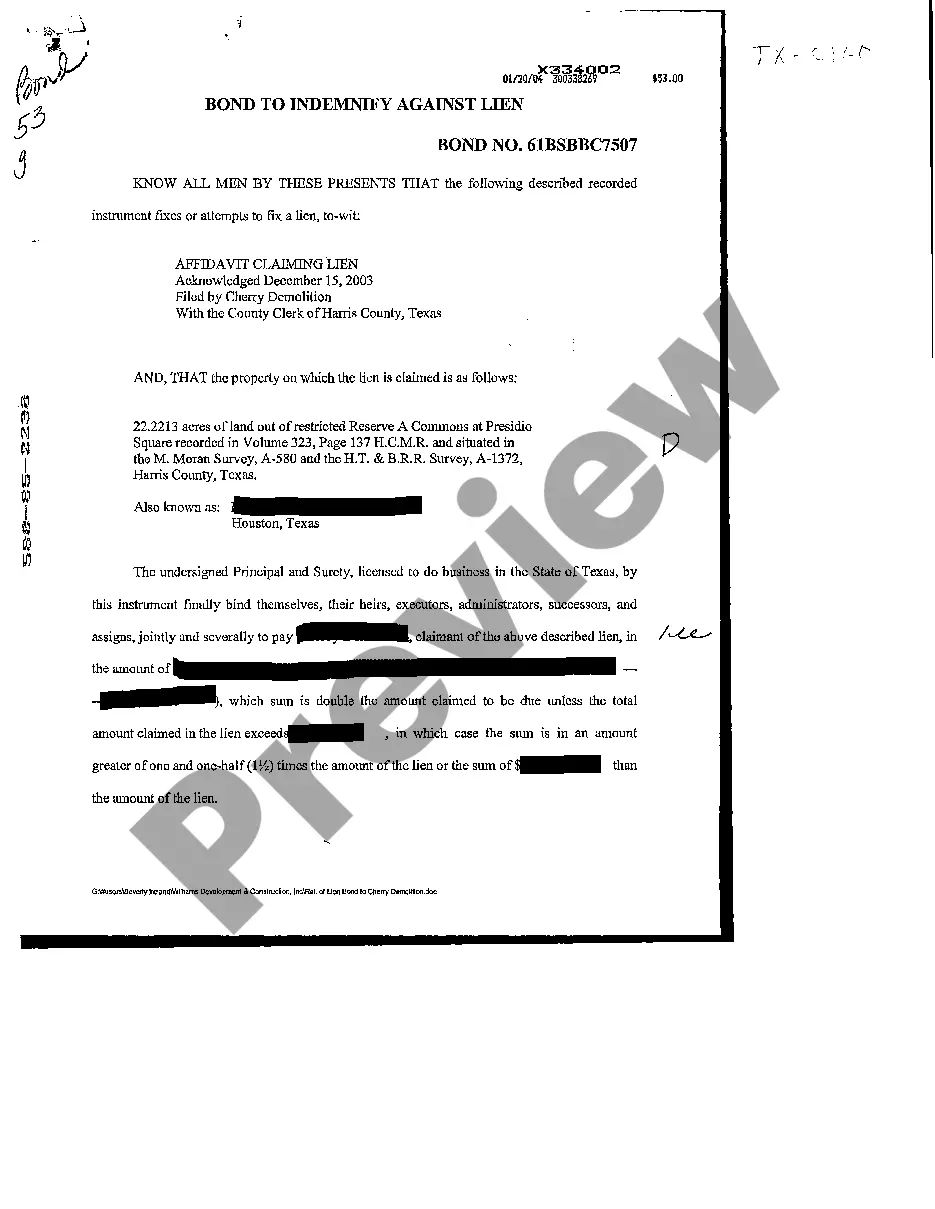

Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed Explained In Pearland, Texas, the Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers ownership and rights associated with minerals, royalties, and overriding royalties from one party, known as the granter, to another party, known as the grantee. This deed is crucial for individuals and companies involved in the extraction and production of minerals and natural resources in Pearland, Texas. Mineral rights refer to the ownership of minerals found beneath the surface of a property. These include but are not limited to oil, natural gas, coal, metals, and gemstones. By possessing mineral rights, the owner has the authority to exploit and profit from the extraction and production of these valuable resources. Royalty rights, on the other hand, grant the owner a percentage of the revenue generated from the production of minerals. The royalty owner or "royalty interest holder" receives a specific portion, typically calculated as a percentage, of the gross production revenue. This income is often referred to as "royalty income" and is paid out by the mineral rights lessee or operator. Overriding royalty interests (ORRIS) are similar to royalty interests, but they are created separately from the mineral rights. While mineral rights are typically acquired by purchasing or leasing the property, overriding royalty interests are commonly reserved by a previous owner or granted to an individual or entity for their involvement in facilitating the extraction and production process. Orris provides a specific percentage of the gross production revenue, just like royalties. Different types of Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds may vary based on the specific context and terms outlined within the document. These may include variations in the percentage of minerals, royalties, or overriding royalties being transferred, specific rights granted to the grantee, and any conditions or restrictions agreed upon by both parties. For example, a Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed may be created to transfer 100% ownership of mineral rights, allowing the grantee to have complete control over the extraction, production, and revenue generated from the minerals. Alternatively, a deed may only convey a specific percentage, granting the grantee a partial interest in the minerals. It is important to consult with legal professionals specializing in property law and mineral rights before executing any Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed. They can provide guidance on the specific requirements, obligations, and potential implications associated with these deeds, ensuring that the rights and interests of both parties are protected throughout the process.Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed Explained In Pearland, Texas, the Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers ownership and rights associated with minerals, royalties, and overriding royalties from one party, known as the granter, to another party, known as the grantee. This deed is crucial for individuals and companies involved in the extraction and production of minerals and natural resources in Pearland, Texas. Mineral rights refer to the ownership of minerals found beneath the surface of a property. These include but are not limited to oil, natural gas, coal, metals, and gemstones. By possessing mineral rights, the owner has the authority to exploit and profit from the extraction and production of these valuable resources. Royalty rights, on the other hand, grant the owner a percentage of the revenue generated from the production of minerals. The royalty owner or "royalty interest holder" receives a specific portion, typically calculated as a percentage, of the gross production revenue. This income is often referred to as "royalty income" and is paid out by the mineral rights lessee or operator. Overriding royalty interests (ORRIS) are similar to royalty interests, but they are created separately from the mineral rights. While mineral rights are typically acquired by purchasing or leasing the property, overriding royalty interests are commonly reserved by a previous owner or granted to an individual or entity for their involvement in facilitating the extraction and production process. Orris provides a specific percentage of the gross production revenue, just like royalties. Different types of Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds may vary based on the specific context and terms outlined within the document. These may include variations in the percentage of minerals, royalties, or overriding royalties being transferred, specific rights granted to the grantee, and any conditions or restrictions agreed upon by both parties. For example, a Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed may be created to transfer 100% ownership of mineral rights, allowing the grantee to have complete control over the extraction, production, and revenue generated from the minerals. Alternatively, a deed may only convey a specific percentage, granting the grantee a partial interest in the minerals. It is important to consult with legal professionals specializing in property law and mineral rights before executing any Pearland, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed. They can provide guidance on the specific requirements, obligations, and potential implications associated with these deeds, ensuring that the rights and interests of both parties are protected throughout the process.