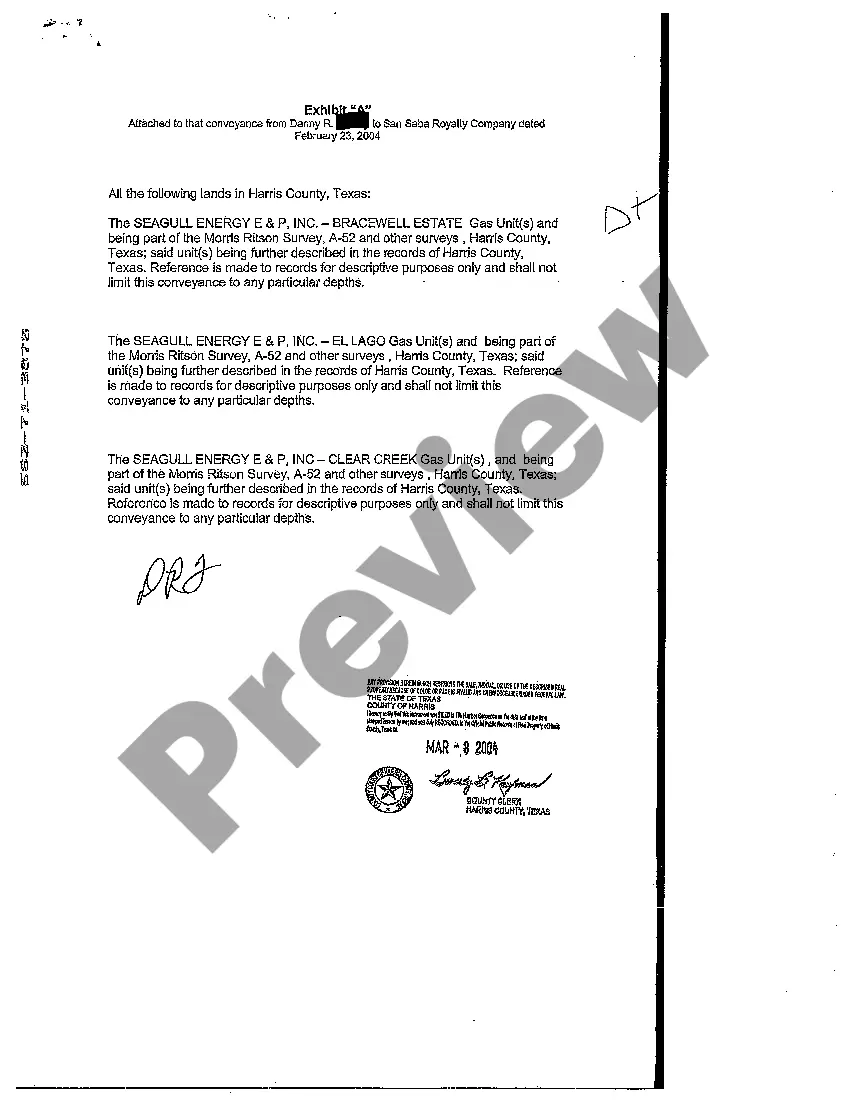

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Plano, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed: A Comprehensive Overview When it comes to the extraction and ownership of mineral rights, Plano, Texas has a well-defined legal framework in place, which includes the Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed. This important legal document establishes the transfer of ownership and rights related to minerals, royalties, and overriding royalties within the region. A Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legally binding contract that allows the transfer of mineral rights from one party to another. It serves as evidence of the conveyance, detailing the specific terms, conditions, and rights associated with the transferred mineral interests. Key Terms and Definitions: 1. Mineral Rights: These rights grant ownership or the ability to extract minerals, such as oil, gas, and minerals found underground. The owner of mineral rights possesses the exclusive rights to exploit those minerals. 2. Royalty: A royalty is a payment made to the owner of the mineral rights by the mineral extraction company, based on a percentage of the total production. It is a form of compensation to the mineral rights' owner for allowing the extraction on their property. 3. Overriding Royalty: An overriding royalty is a share of the royalty interest retained by the original owner, even after the mineral rights have been conveyed to another party. This means that the overriding royalty owner will still receive a percentage of the total royalty payments generated. Types of Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds: 1. Absolute Conveyance Deed: This type of conveyance deed permanently transfers the ownership of mineral rights, royalties, and overriding royalties from one party to another. It grants the recipient full control and exclusive rights over the conveyed interests and extinguishes all previous ownership claims. 2. Partial Conveyance Deed: In some cases, a partial conveyance deed is used to transfer a portion or specific percentage of mineral rights, royalties, or overriding royalties. This means that the original owner retains partial ownership and rights while the recipient acquires the specified portion. 3. Assignment Deed: An assignment deed is used when the original owner of mineral rights, royalties, or overriding royalties wishes to transfer their interests to another party without fully extinguishing their ownership. This type of deed grants temporary rights or assigns specific interests in a limited period or specific purposes. Regardless of the specific type of Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed, it is crucial to ensure that the document includes detailed legal descriptions, accurate identification of the parties involved, comprehensive details about the transferred interests, and any specific conditions or limitations. In conclusion, Plano, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds are essential legal instruments for the transfer and establishment of rights related to minerals, royalties, and overriding royalties. Whether it be an absolute conveyance deed, partial conveyance deed, or assignment deed, these documents play a significant role in facilitating the proper and legal transfer of mineral interests in Plano, Texas.Plano, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed: A Comprehensive Overview When it comes to the extraction and ownership of mineral rights, Plano, Texas has a well-defined legal framework in place, which includes the Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed. This important legal document establishes the transfer of ownership and rights related to minerals, royalties, and overriding royalties within the region. A Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legally binding contract that allows the transfer of mineral rights from one party to another. It serves as evidence of the conveyance, detailing the specific terms, conditions, and rights associated with the transferred mineral interests. Key Terms and Definitions: 1. Mineral Rights: These rights grant ownership or the ability to extract minerals, such as oil, gas, and minerals found underground. The owner of mineral rights possesses the exclusive rights to exploit those minerals. 2. Royalty: A royalty is a payment made to the owner of the mineral rights by the mineral extraction company, based on a percentage of the total production. It is a form of compensation to the mineral rights' owner for allowing the extraction on their property. 3. Overriding Royalty: An overriding royalty is a share of the royalty interest retained by the original owner, even after the mineral rights have been conveyed to another party. This means that the overriding royalty owner will still receive a percentage of the total royalty payments generated. Types of Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds: 1. Absolute Conveyance Deed: This type of conveyance deed permanently transfers the ownership of mineral rights, royalties, and overriding royalties from one party to another. It grants the recipient full control and exclusive rights over the conveyed interests and extinguishes all previous ownership claims. 2. Partial Conveyance Deed: In some cases, a partial conveyance deed is used to transfer a portion or specific percentage of mineral rights, royalties, or overriding royalties. This means that the original owner retains partial ownership and rights while the recipient acquires the specified portion. 3. Assignment Deed: An assignment deed is used when the original owner of mineral rights, royalties, or overriding royalties wishes to transfer their interests to another party without fully extinguishing their ownership. This type of deed grants temporary rights or assigns specific interests in a limited period or specific purposes. Regardless of the specific type of Plano Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed, it is crucial to ensure that the document includes detailed legal descriptions, accurate identification of the parties involved, comprehensive details about the transferred interests, and any specific conditions or limitations. In conclusion, Plano, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds are essential legal instruments for the transfer and establishment of rights related to minerals, royalties, and overriding royalties. Whether it be an absolute conveyance deed, partial conveyance deed, or assignment deed, these documents play a significant role in facilitating the proper and legal transfer of mineral interests in Plano, Texas.