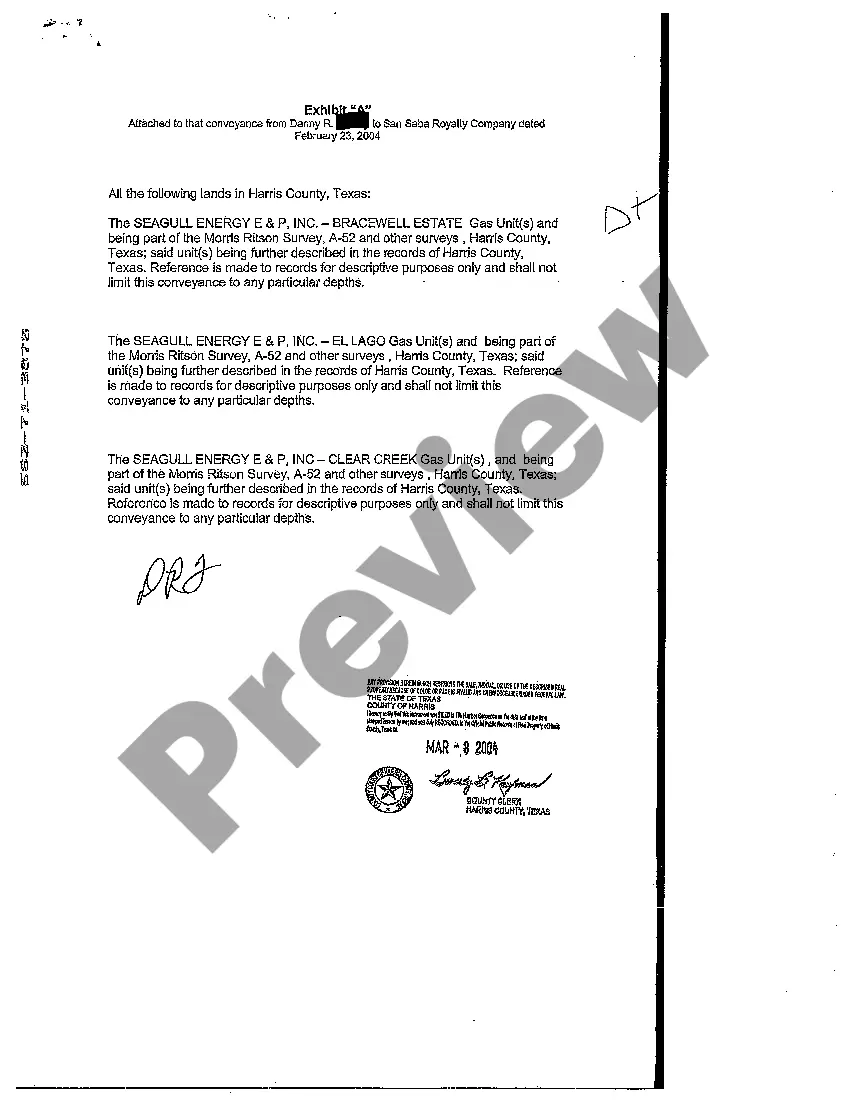

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Sugar Land, Texas is an area known for its rich mineral deposits, particularly in the oil and gas industry. To facilitate the transfer of mineral rights and royalties, a Mineral, Royalty, and Overriding Royalty Conveyance Deed is used. This legal document is crucial for conveying ownership of these valuable resources to interested parties. One type of Sugar Land, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Mineral Conveyance Deed. This type of deed specifically deals with the conveyance of ownership or rights to the underlying minerals found in a particular property. It outlines the legal transfer of these mineral rights from one party to another, ensuring the new owner has full control and entitlement over any oil, gas, or other valuable minerals present on the property. The Royalty Conveyance Deed, on the other hand, focuses on the transfer of royalty interests related to the extraction and production of minerals. When someone owns royalty interests, they are entitled to a portion of the revenue generated from the sale or production of extracted minerals on the property they hold those rights for. This type of deed ensures the rightful transfer of these royalty interests to a new owner. Lastly, the Overriding Royalty Conveyance Deed deals with the transfer of overriding royalty interests. Overriding royalty interests are distinct from mineral rights and royalties as they are typically reserved for those who are not the property owners but have a stake in the production or extraction of minerals. Such interests are usually granted to entities or individuals involved in the extraction process, such as operators, working interest owners, or third-party investors. This deed ensures the smooth transfer of these overriding royalty interests. In all types of Sugar Land, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, it is crucial to include key information such as the legal description of the property, comprehensive details of the conveyed interests (whether mineral, royalty, or overriding royalty), the consideration or compensation involved, and any pertinent terms and conditions agreed upon by the parties involved. Whether you are a property owner looking to convey your mineral rights, a buyer interested in securing royalty interests, or an investor seeking overriding royalty interests, a well-drafted Sugar Land, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is essential to protect your interests and ensure a legally binding transfer of ownership. Seek the assistance of qualified legal professionals when dealing with such complex transactions to ensure accuracy and to navigate any potential complications.Sugar Land, Texas is an area known for its rich mineral deposits, particularly in the oil and gas industry. To facilitate the transfer of mineral rights and royalties, a Mineral, Royalty, and Overriding Royalty Conveyance Deed is used. This legal document is crucial for conveying ownership of these valuable resources to interested parties. One type of Sugar Land, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is the Mineral Conveyance Deed. This type of deed specifically deals with the conveyance of ownership or rights to the underlying minerals found in a particular property. It outlines the legal transfer of these mineral rights from one party to another, ensuring the new owner has full control and entitlement over any oil, gas, or other valuable minerals present on the property. The Royalty Conveyance Deed, on the other hand, focuses on the transfer of royalty interests related to the extraction and production of minerals. When someone owns royalty interests, they are entitled to a portion of the revenue generated from the sale or production of extracted minerals on the property they hold those rights for. This type of deed ensures the rightful transfer of these royalty interests to a new owner. Lastly, the Overriding Royalty Conveyance Deed deals with the transfer of overriding royalty interests. Overriding royalty interests are distinct from mineral rights and royalties as they are typically reserved for those who are not the property owners but have a stake in the production or extraction of minerals. Such interests are usually granted to entities or individuals involved in the extraction process, such as operators, working interest owners, or third-party investors. This deed ensures the smooth transfer of these overriding royalty interests. In all types of Sugar Land, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, it is crucial to include key information such as the legal description of the property, comprehensive details of the conveyed interests (whether mineral, royalty, or overriding royalty), the consideration or compensation involved, and any pertinent terms and conditions agreed upon by the parties involved. Whether you are a property owner looking to convey your mineral rights, a buyer interested in securing royalty interests, or an investor seeking overriding royalty interests, a well-drafted Sugar Land, Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is essential to protect your interests and ensure a legally binding transfer of ownership. Seek the assistance of qualified legal professionals when dealing with such complex transactions to ensure accuracy and to navigate any potential complications.