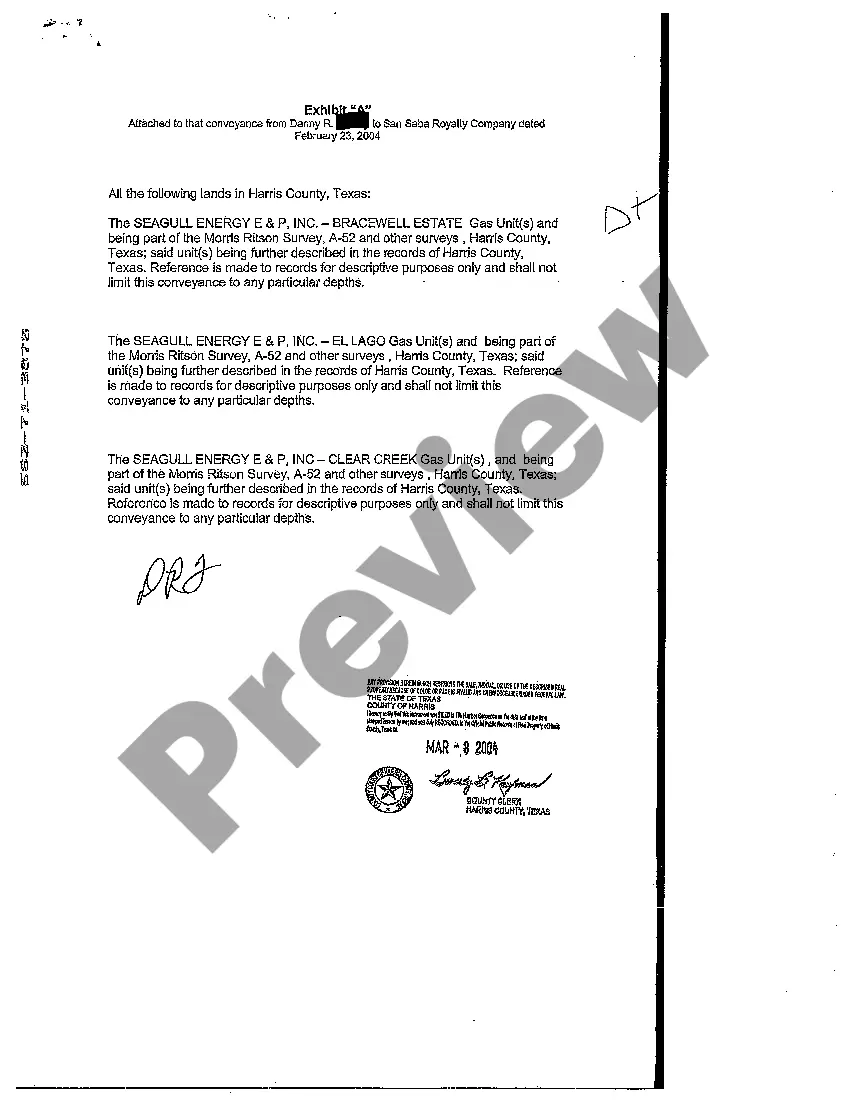

Assignor grants and sells to the assignees all mineral rights, royalty rights, and overriding royalty rights acquired by assignor or its predecessors-in-title. The assignment is made with warranty by through and under the Grantor, but no further.

Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed: Explained A Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers or conveys ownership rights of mineral interests, royalties, and overriding royalties in Tarrant County, Texas, to another party. This deed is commonly used in the oil and gas industry to establish ownership and transfer the rights to receive income from oil, gas, and mineral extraction activities. Keywords: Tarrant Texas, mineral interests, royalties, overriding royalties, conveyance deed, ownership rights, oil and gas industry, oil extraction activities, gas extraction activities, mineral extraction activities. There are several types of Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, including: 1. Mineral Conveyance Deed: This type of deed specifically transfers ownership of the mineral interests, which include minerals such as oil, gas, coal, and other valuable substances that may be extracted from the land. 2. Royalty Conveyance Deed: This deed transfers ownership of the right to receive royalties from the production of minerals on the property. Royalties are typically a percentage of the value of the minerals extracted and are paid to the owner of the mineral rights. 3. Overriding Royalty Conveyance Deed: An overriding royalty interest is a non-participating interest that entitles the owner to a share of the revenues generated by an oil or gas lease. This type of deed transfers the right to receive overriding royalties, which are usually a fixed percentage of the gross income from the production. 4. Combination Conveyance Deed: Sometimes, all three interests (mineral, royalty, and overriding royalty) may be conveyed together in a single deed, known as a combination conveyance deed. This simplifies the transfer process and ensures that all rights associated with the mineral interests are transferred to the new owner. It is important to consult with an attorney or a professional specializing in oil and gas law when drafting or executing a Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed to ensure the document accurately reflects the intentions of all parties involved and adheres to state and local laws and regulations.Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed: Explained A Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed is a legal document that transfers or conveys ownership rights of mineral interests, royalties, and overriding royalties in Tarrant County, Texas, to another party. This deed is commonly used in the oil and gas industry to establish ownership and transfer the rights to receive income from oil, gas, and mineral extraction activities. Keywords: Tarrant Texas, mineral interests, royalties, overriding royalties, conveyance deed, ownership rights, oil and gas industry, oil extraction activities, gas extraction activities, mineral extraction activities. There are several types of Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deeds, including: 1. Mineral Conveyance Deed: This type of deed specifically transfers ownership of the mineral interests, which include minerals such as oil, gas, coal, and other valuable substances that may be extracted from the land. 2. Royalty Conveyance Deed: This deed transfers ownership of the right to receive royalties from the production of minerals on the property. Royalties are typically a percentage of the value of the minerals extracted and are paid to the owner of the mineral rights. 3. Overriding Royalty Conveyance Deed: An overriding royalty interest is a non-participating interest that entitles the owner to a share of the revenues generated by an oil or gas lease. This type of deed transfers the right to receive overriding royalties, which are usually a fixed percentage of the gross income from the production. 4. Combination Conveyance Deed: Sometimes, all three interests (mineral, royalty, and overriding royalty) may be conveyed together in a single deed, known as a combination conveyance deed. This simplifies the transfer process and ensures that all rights associated with the mineral interests are transferred to the new owner. It is important to consult with an attorney or a professional specializing in oil and gas law when drafting or executing a Tarrant Texas Mineral, Royalty, and Overriding Royalty Conveyance Deed to ensure the document accurately reflects the intentions of all parties involved and adheres to state and local laws and regulations.