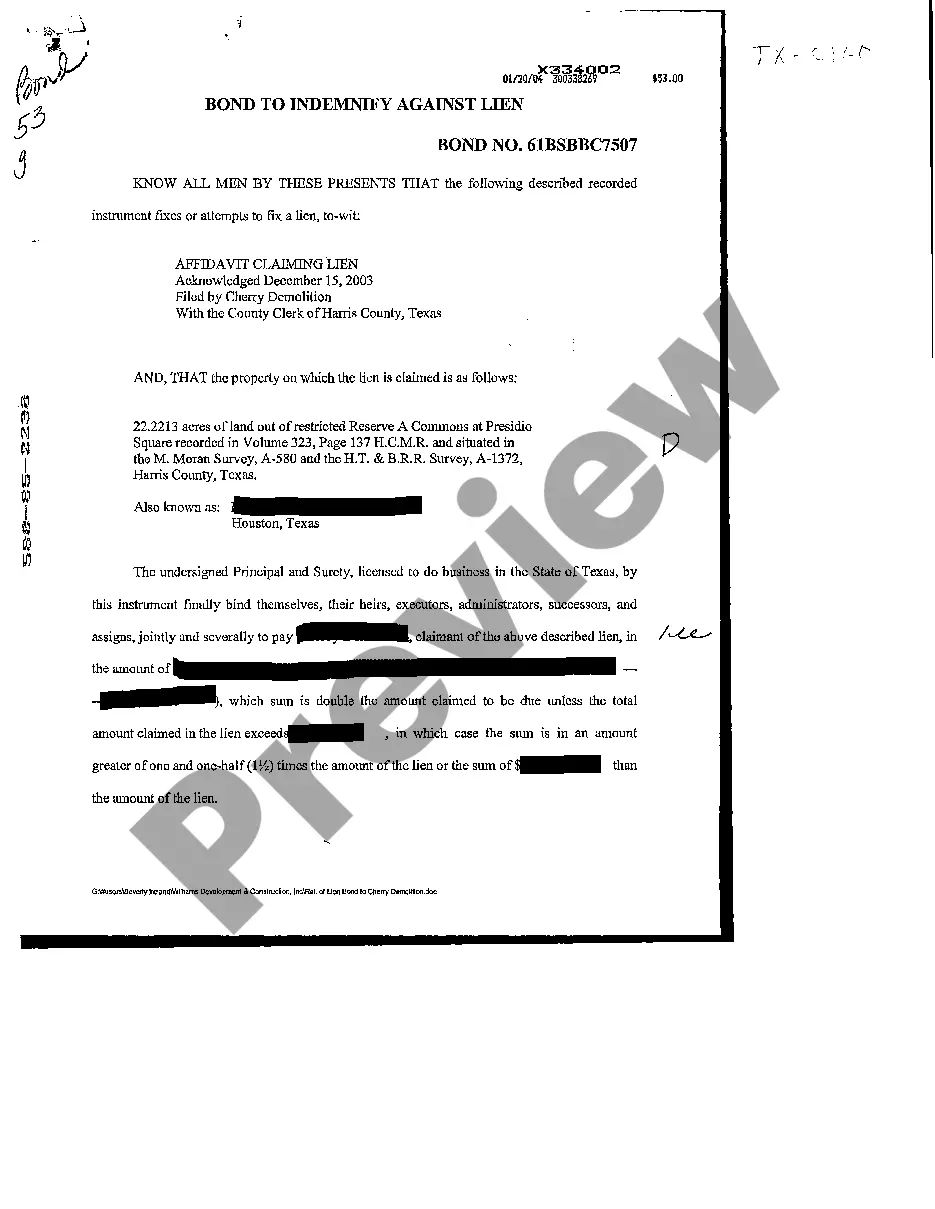

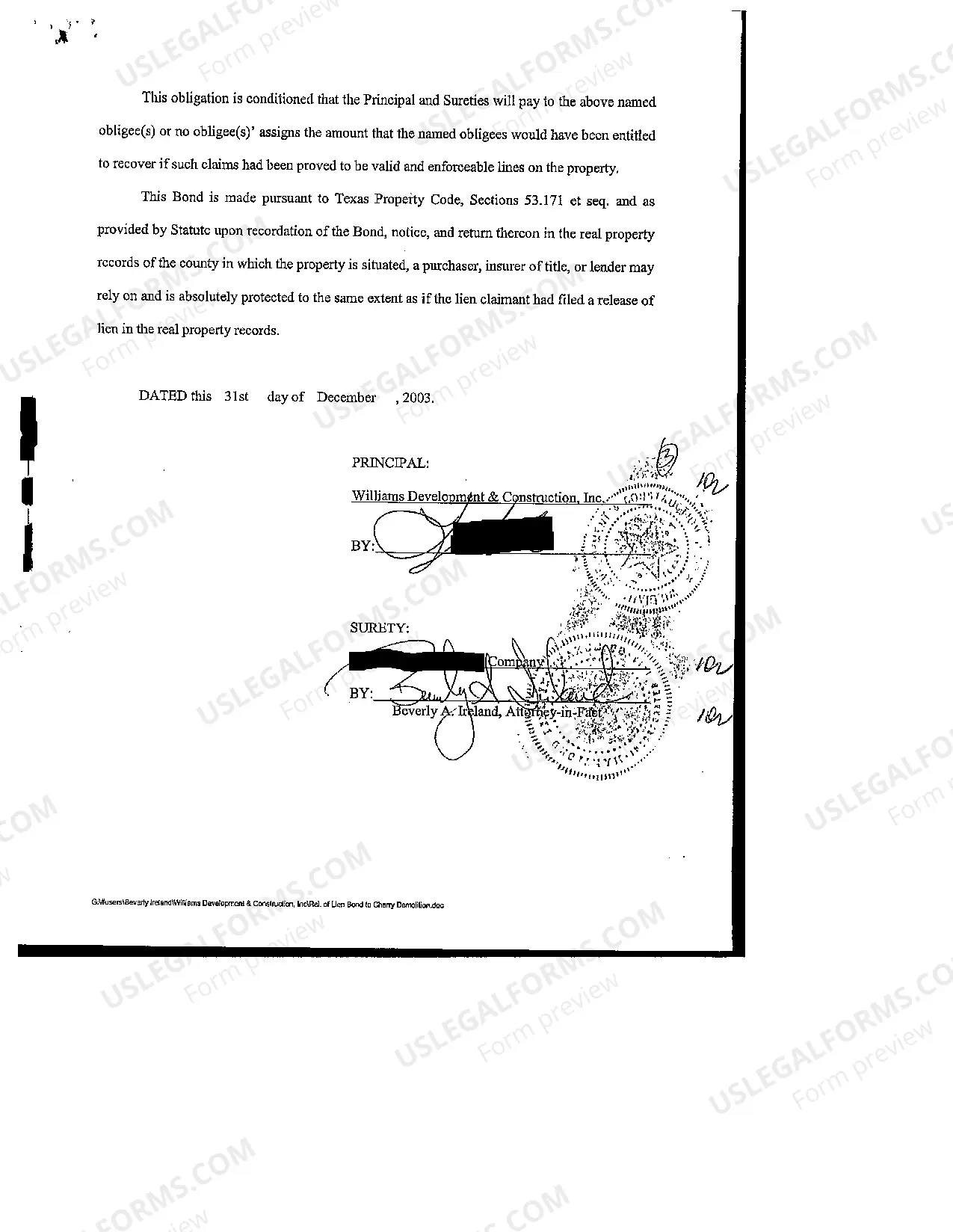

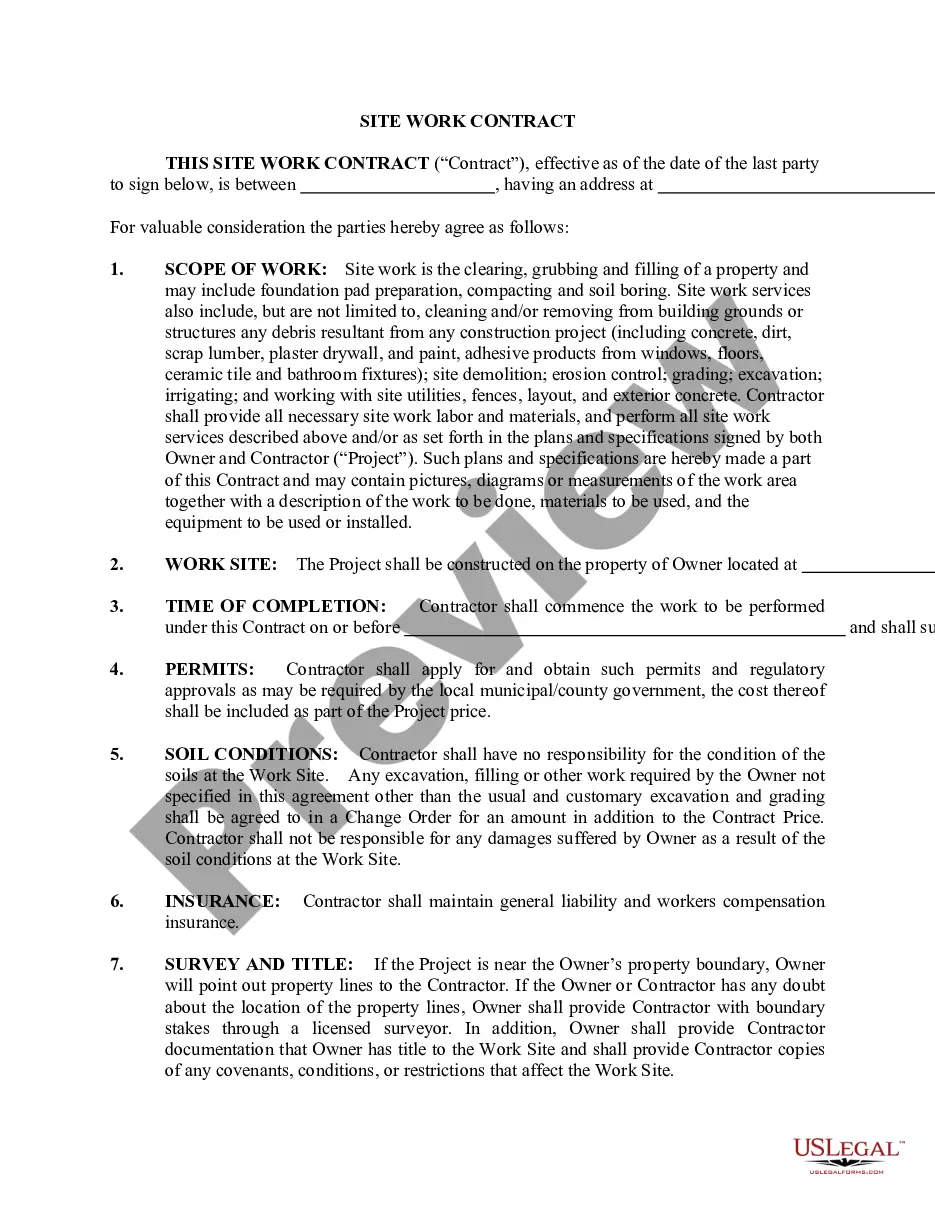

A Fort Worth Texas Bond to Indemnify Against Lien is a type of surety bond that individuals or companies can obtain to protect themselves against potential liens that may arise on their property. This bond serves as a form of financial security, ensuring that if a lien claim is filed, the bond issuer will cover any damages or losses incurred by the party seeking indemnification. The purpose of this bond is to guarantee payment to subcontractors, suppliers, or laborers who have provided services or materials for a specific project but have not been compensated as agreed. By obtaining this bond, property owners can provide assurance to these parties that they will be reimbursed for their work, ultimately encouraging smooth project completion. Fort Worth Texas offers different types of bonds to indemnify against liens, such as a mechanic's lien bond and a payment bond. A mechanic's lien bond is typically obtained by property owners who have received a lien claim from a subcontractor or supplier. This bond is designed to release the lien from the property and substitute it with a guarantee of payment from the bond issuer. On the other hand, a payment bond is commonly used in construction projects to ensure that subcontractors and suppliers are compensated for their work, even if the general contractor or property owner fails to make payment. This type of bond can be crucial to promote fair payment practices within the construction industry and avoid disruptions in the project's progress. By obtaining a Fort Worth Texas Bond to Indemnify Against Lien, property owners can effectively protect their property from potential liens while upholding their obligations to subcontractors, suppliers, and laborers involved in their projects. This bond not only promotes trust and accountability within business relationships but also helps to maintain the economic health of the construction industry in Fort Worth, Texas.

Fort Worth Texas Bond to Indemnify Against Lien

Description

How to fill out Fort Worth Texas Bond To Indemnify Against Lien?

Do you need a reliable and inexpensive legal forms provider to get the Fort Worth Texas Bond to Indemnify Against Lien? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of separate state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Fort Worth Texas Bond to Indemnify Against Lien conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is intended for.

- Restart the search in case the template isn’t good for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Fort Worth Texas Bond to Indemnify Against Lien in any provided file format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online for good.