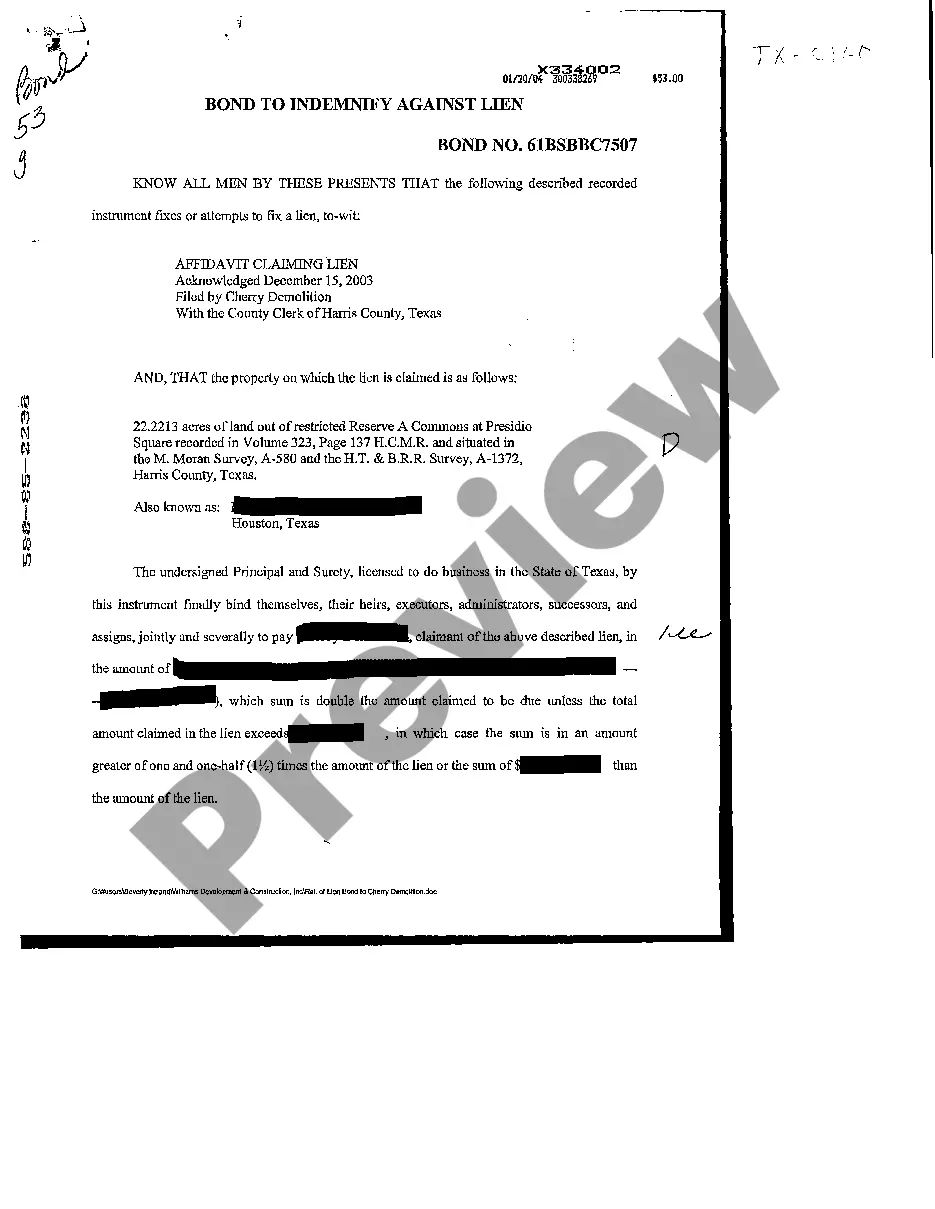

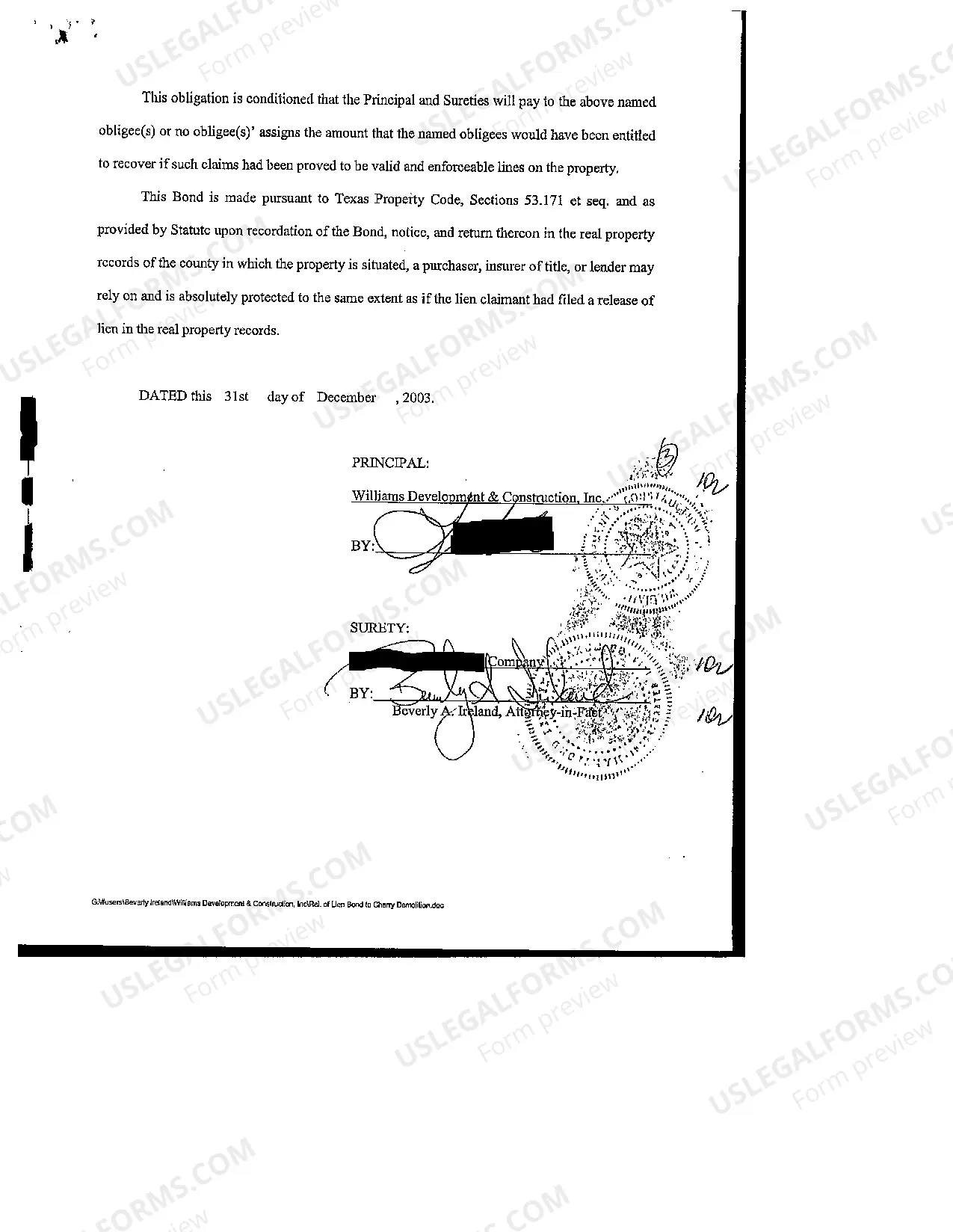

The Grand Prairie Texas Bond to Indemnify Against Lien is a legal tool used in the state of Texas to protect property owners against potential liens. When initiating a construction project or making improvements to a property, there is a risk that subcontractors or suppliers may file a lien against the property for non-payment. To safeguard against such liens, property owners in Grand Prairie, Texas can opt for a bond to indemnify themselves. By obtaining a Grand Prairie Texas Bond to Indemnify Against Lien, property owners transfer the risk of potential liens to a surety bond provider. Should a subcontractor or supplier file a valid lien against the property, the surety bond provider will step in to pay the claim and protect the property owner's interests. There are two types of Grand Prairie Texas Bonds to Indemnify Against Lien: 1. Payment Bond: This type of bond ensures that subcontractors and suppliers involved in the construction project receive their due payments for labor and materials. If the project owner fails to make timely payments, the bond will cover the unpaid amounts, preventing any potential liens against the property. 2. Performance Bond: This bond guarantees that the contractor responsible for the construction or improvement project will complete the work as agreed upon in the contract. In case the contractor defaults or fails to complete the project, the bond will cover any financial losses incurred by the property owner in finding a replacement contractor. Both types of bonds provide essential protection to property owners in Grand Prairie, Texas, by mitigating the risk of liens and ensuring that construction projects proceed smoothly and without financial complications. It is important to consult with a knowledgeable bond provider or legal expert to determine the appropriate bond type and coverage for individual projects.

Grand Prairie Texas Bond to Indemnify Against Lien

Description

How to fill out Grand Prairie Texas Bond To Indemnify Against Lien?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any law education to create such paperwork from scratch, mainly because of the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform provides a massive collection with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Grand Prairie Texas Bond to Indemnify Against Lien or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Grand Prairie Texas Bond to Indemnify Against Lien quickly using our reliable platform. In case you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Grand Prairie Texas Bond to Indemnify Against Lien:

- Ensure the template you have chosen is good for your area because the rules of one state or area do not work for another state or area.

- Review the document and go through a brief description (if available) of cases the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment method and proceed to download the Grand Prairie Texas Bond to Indemnify Against Lien once the payment is done.

You’re good to go! Now you can go on and print out the document or complete it online. Should you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.