Title: Understanding Harris Texas Bond to Indemnify Against Lien: Types and Detailed Description Introduction: The Harris Texas Bond to Indemnify Against Lien is a crucial tool used in the construction industry to protect property owners and contractors from potential financial losses caused by unexpected construction liens. This bond ensures that property owners will not face any legal complications or delays in their construction projects due to potential liens filed against their property. Detailed Description: 1. Definition and Purpose of Harris Texas Bond to Indemnify Against Lien: The Harris Texas Bond to Indemnify Against Lien serves as a form of insurance that guarantees financial compensation for property owners, should a lien be placed on their property. It aims to protect property owners from any unforeseen financial burdens caused by contractors or suppliers failing to pay their subcontractors or material suppliers, who may subsequently file liens. 2. Functioning of Harris Texas Bond to Indemnify Against Lien: When a contractor or supplier fails to fulfill their payment obligations to subcontractors or material suppliers, the affected party can file a lien against the property. However, if the property owner has obtained a Harris Texas Bond to Indemnify Against Lien, they are protected from the financial consequences of such liens. The bond acts as a financial guarantee, covering any outstanding payments and legal costs associated with resolving the lien. 3. Types of Harris Texas Bonds to Indemnify Against Lien: a. Subcontractor Bond: This type of bond protects property owners from potential liens filed by unpaid subcontractors. It ensures that the project can proceed smoothly, avoiding any disruptions or legal disputes resulting from unpaid subcontractor bills. b. Supplier Bond: The supplier bond safeguards property owners from any liens filed by material suppliers who have not received payment for their materials or services provided during the construction process. It assures property owners that they won't be held liable for non-payment issues between the contractor and the supplier. c. Mechanic's Lien Bond: Also known as a construction lien bond, or simply a lien bond, this variant indemnifies property owners against mechanic's liens filed by any party involved in the construction project. It provides financial protection when contractors, subcontractors, suppliers, or laborers fail to receive payment for their services or materials. This bond is the most comprehensive option, covering all potential liens that may arise. Conclusion: Understanding the Harris Texas Bond to Indemnify Against Lien is essential for property owners and contractors involved in construction projects. This bond acts as a shield against unexpected financial burdens due to liens while ensuring uninterrupted project progress. By utilizing different types of bonds tailored to specific needs, property owners can confidently embark on their construction projects, mitigating the risks associated with non-payment issues.

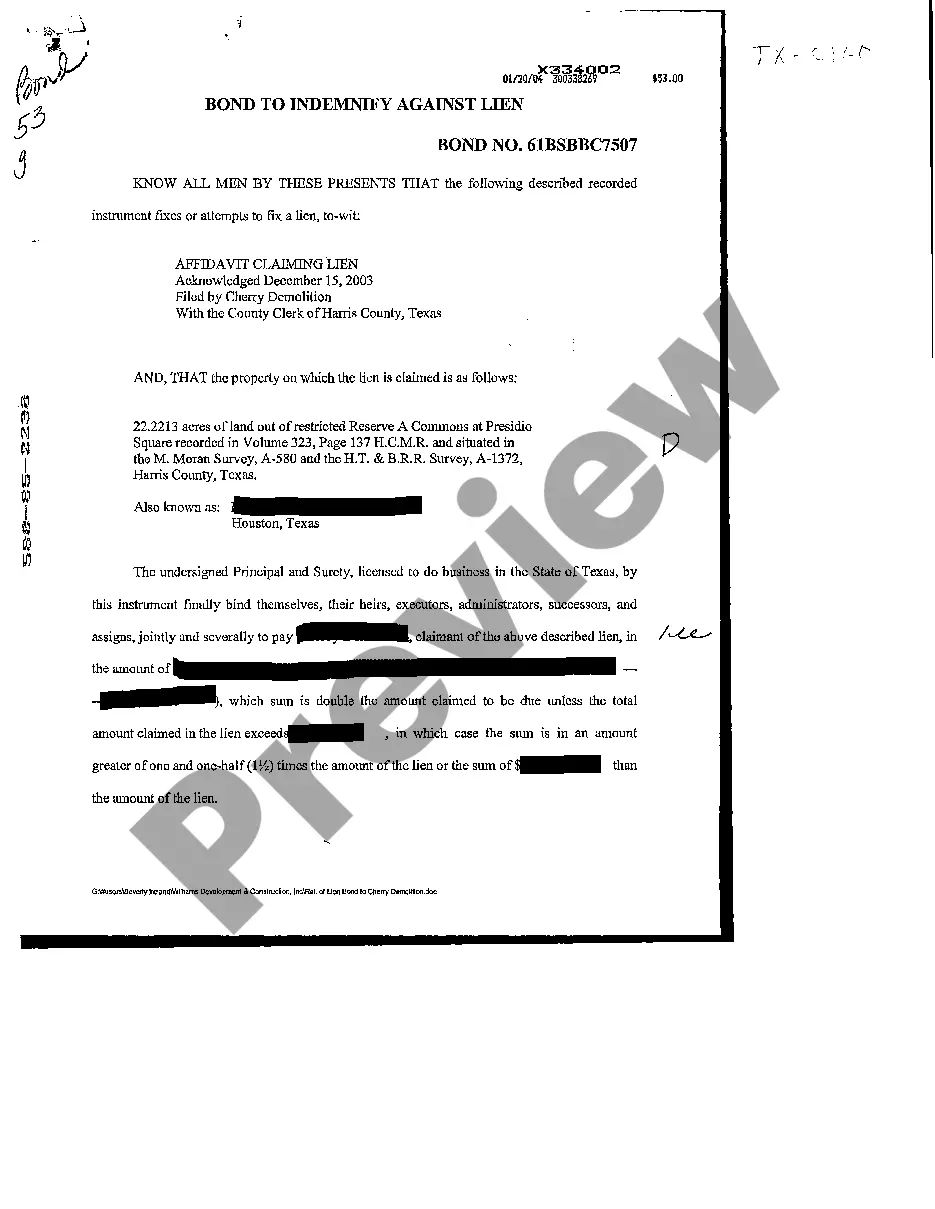

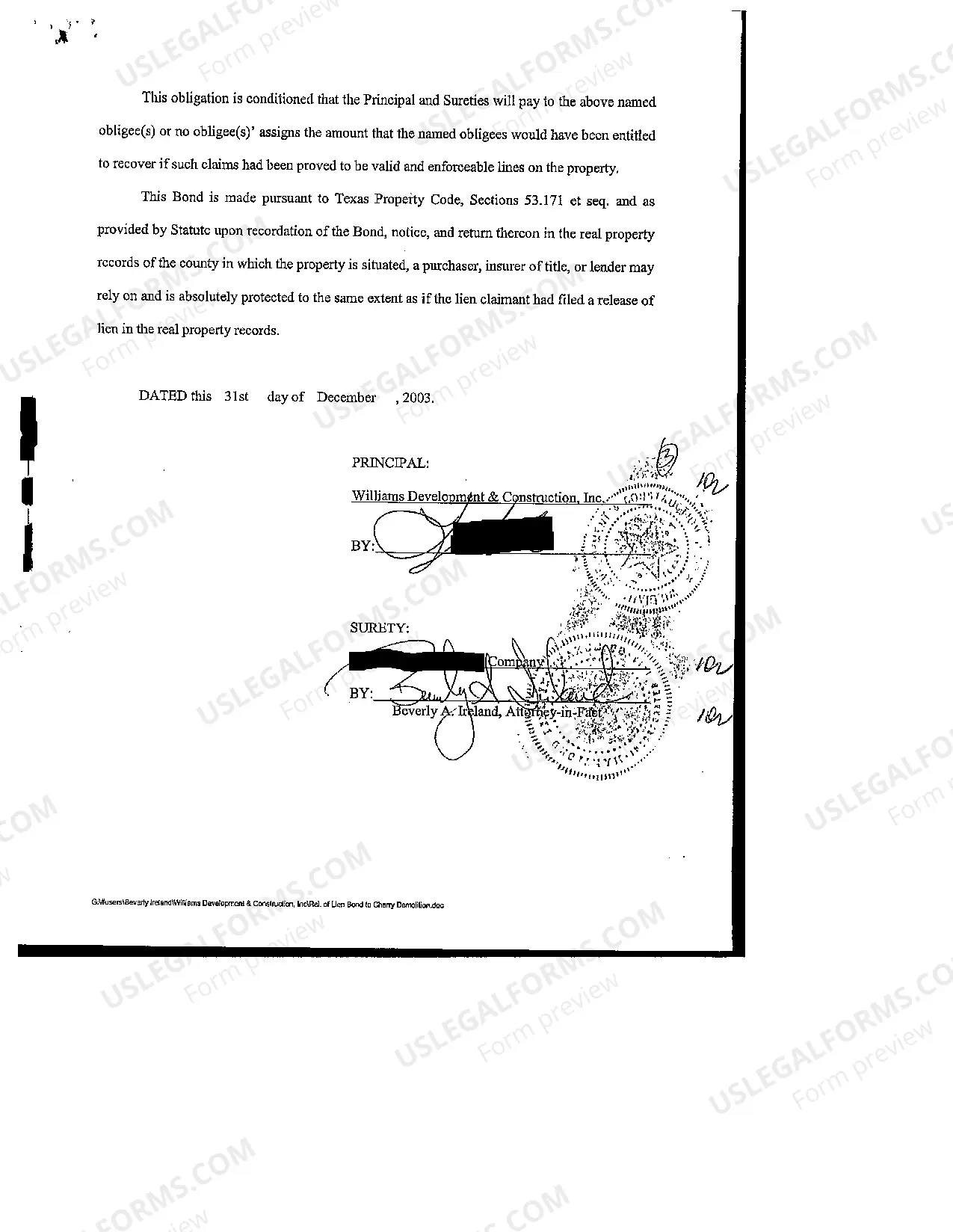

Harris Texas Bond to Indemnify Against Lien

Description

How to fill out Harris Texas Bond To Indemnify Against Lien?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal services that, usually, are very costly. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Harris Texas Bond to Indemnify Against Lien or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Harris Texas Bond to Indemnify Against Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Harris Texas Bond to Indemnify Against Lien would work for you, you can select the subscription option and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!