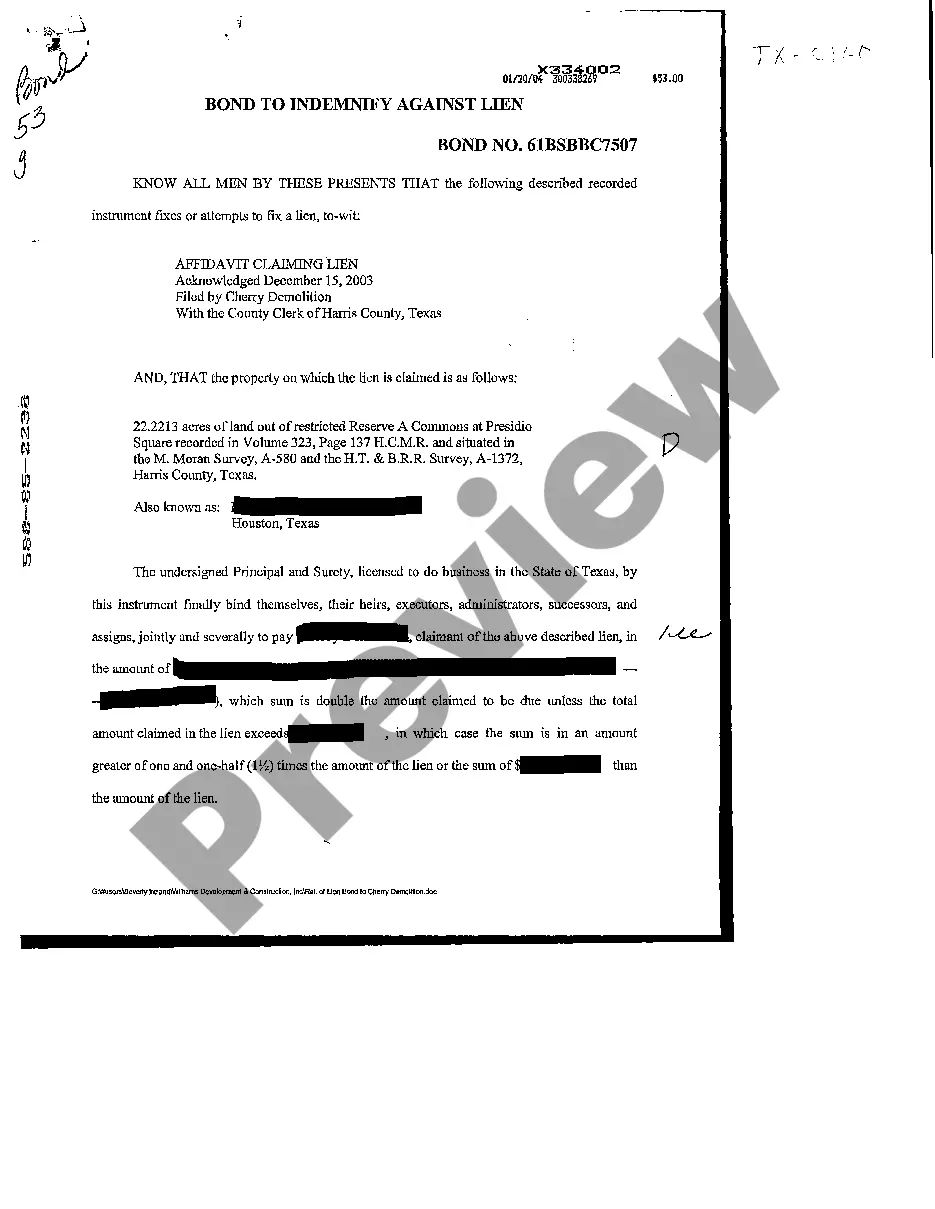

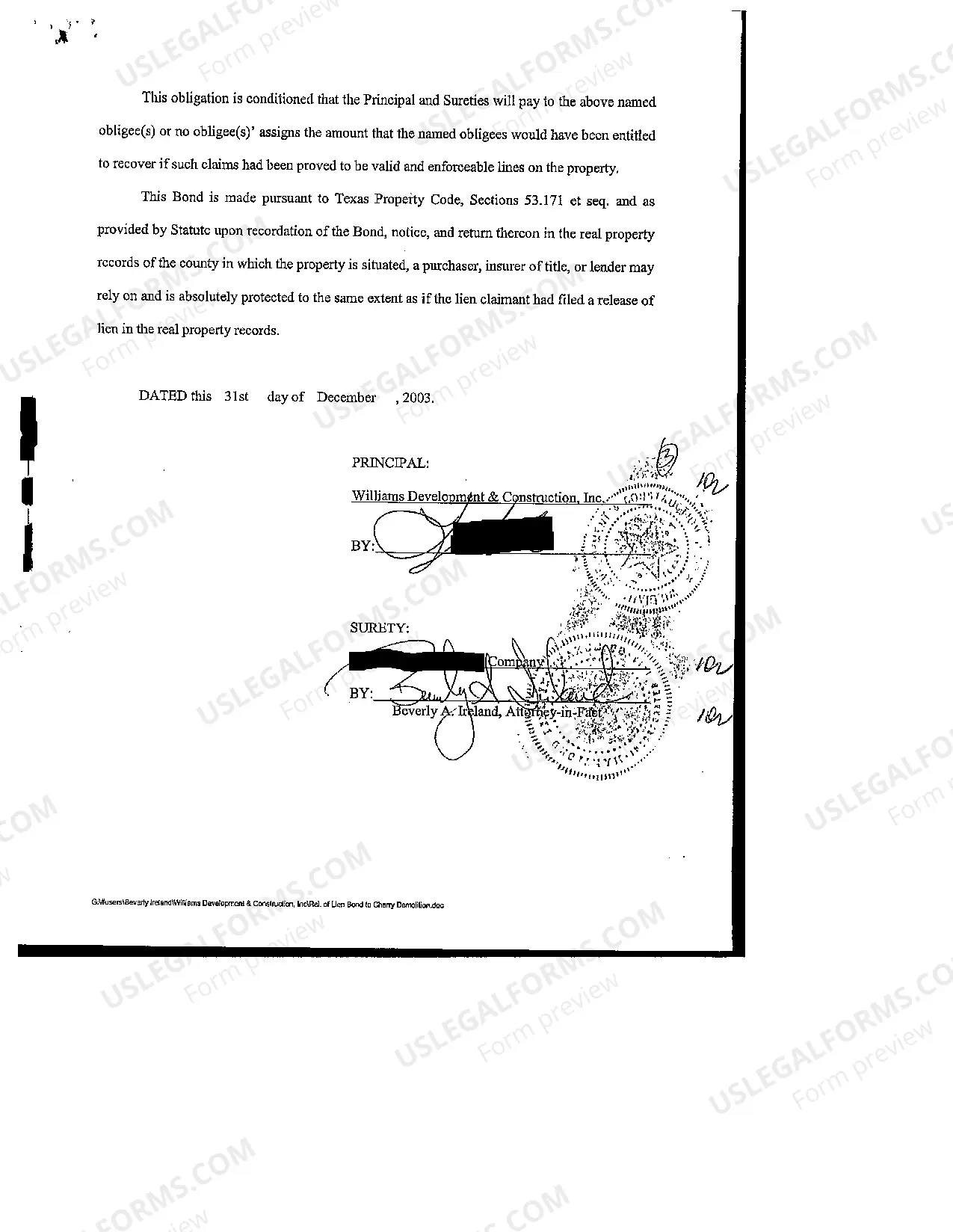

Houston Texas Bond to Indemnify Against Lien is a legal instrument used to safeguard against potential liens placed on a property. Liens can arise when a contractor or subcontractor files a claim for unpaid services, materials, or labor provided for a construction project. These bonds act as a financial guarantee for the property owner, ensuring that any valid liens placed against the property will be satisfied. There are different types of Houston Texas Bonds to Indemnify Against Lien, including the Subdivision Improvement Bond, the Completion Bond, and the Indemnity Bond. — The Subdivision Improvement Bond is commonly used in development projects, such as constructing subdivisions or residential communities. It guarantees that the developer will complete public infrastructure improvements, such as roads, sidewalks, drainage systems, and utilities. This bond protects the municipality or governing body in case the developer fails to fulfill their contractual obligations. — The Completion Bond is a type of bond often used in construction projects to ensure that the contractor completes the project as agreed upon in the contract. This bond protects the property owner by indemnifying them against any liens that may arise due to incomplete work or failure to satisfy financial obligations to subcontractors or suppliers. — The Indemnity Bond is a broader type of bond that provides protection against any type of lien that may be placed on a property. It acts as a guarantee that the property owner will be reimbursed for any valid liens filed against the property, regardless of the specific circumstances leading to their creation. In summary, Houston Texas Bonds to Indemnify Against Lien serve as vital financial protections for property owners and developers in the event of liens arising from construction projects. The Subdivision Improvement Bond, Completion Bond, and Indemnity Bond are different variations of this instrument, each tailored to specific scenarios and contractual obligations.

Houston Texas Bond to Indemnify Against Lien

Category:

State:

Texas

City:

Houston

Control #:

TX-C160

Format:

PDF

Instant download

This form is available by subscription

Description

Bond to Indemnify Against Lien

Houston Texas Bond to Indemnify Against Lien is a legal instrument used to safeguard against potential liens placed on a property. Liens can arise when a contractor or subcontractor files a claim for unpaid services, materials, or labor provided for a construction project. These bonds act as a financial guarantee for the property owner, ensuring that any valid liens placed against the property will be satisfied. There are different types of Houston Texas Bonds to Indemnify Against Lien, including the Subdivision Improvement Bond, the Completion Bond, and the Indemnity Bond. — The Subdivision Improvement Bond is commonly used in development projects, such as constructing subdivisions or residential communities. It guarantees that the developer will complete public infrastructure improvements, such as roads, sidewalks, drainage systems, and utilities. This bond protects the municipality or governing body in case the developer fails to fulfill their contractual obligations. — The Completion Bond is a type of bond often used in construction projects to ensure that the contractor completes the project as agreed upon in the contract. This bond protects the property owner by indemnifying them against any liens that may arise due to incomplete work or failure to satisfy financial obligations to subcontractors or suppliers. — The Indemnity Bond is a broader type of bond that provides protection against any type of lien that may be placed on a property. It acts as a guarantee that the property owner will be reimbursed for any valid liens filed against the property, regardless of the specific circumstances leading to their creation. In summary, Houston Texas Bonds to Indemnify Against Lien serve as vital financial protections for property owners and developers in the event of liens arising from construction projects. The Subdivision Improvement Bond, Completion Bond, and Indemnity Bond are different variations of this instrument, each tailored to specific scenarios and contractual obligations.

Free preview

How to fill out Houston Texas Bond To Indemnify Against Lien?

If you’ve already used our service before, log in to your account and download the Houston Texas Bond to Indemnify Against Lien on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Houston Texas Bond to Indemnify Against Lien. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!