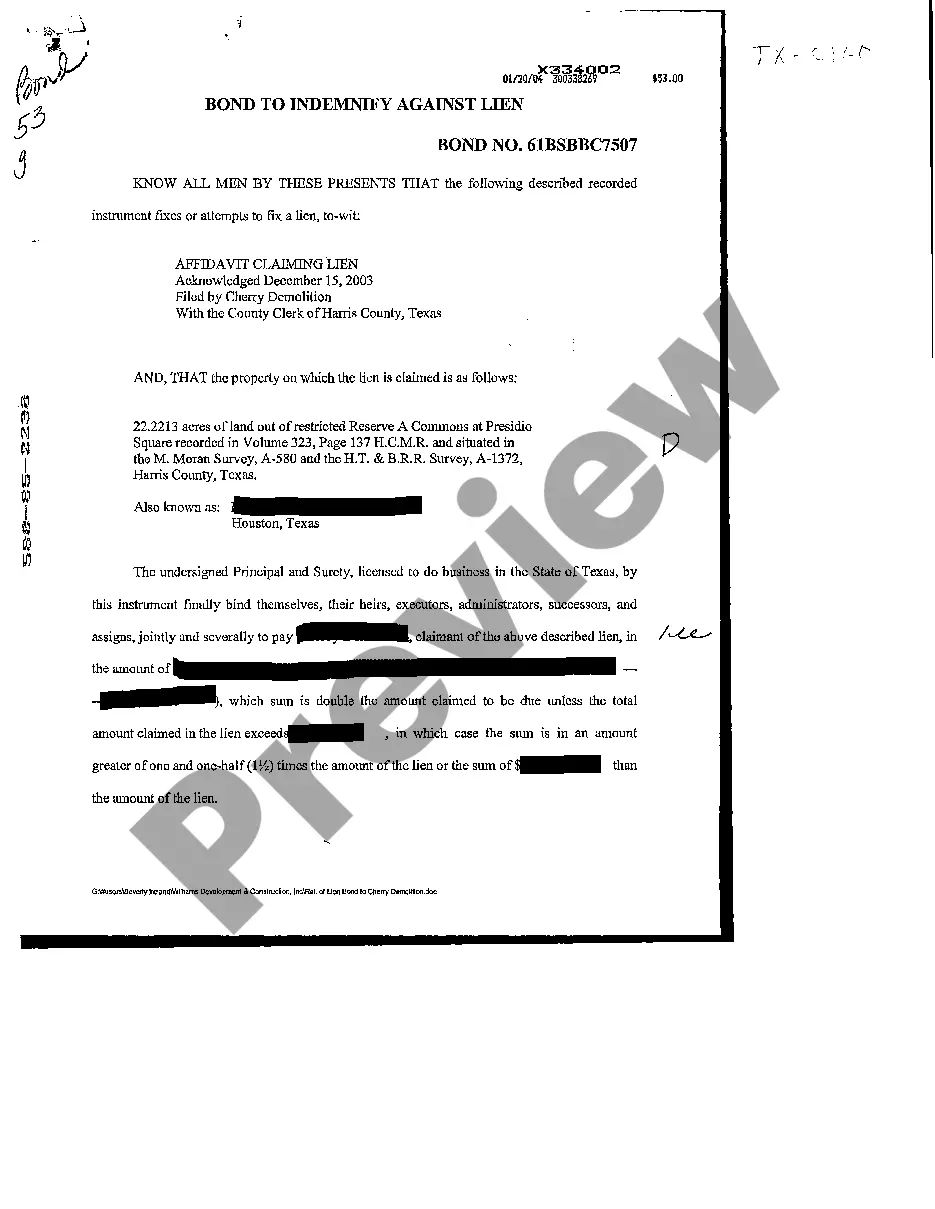

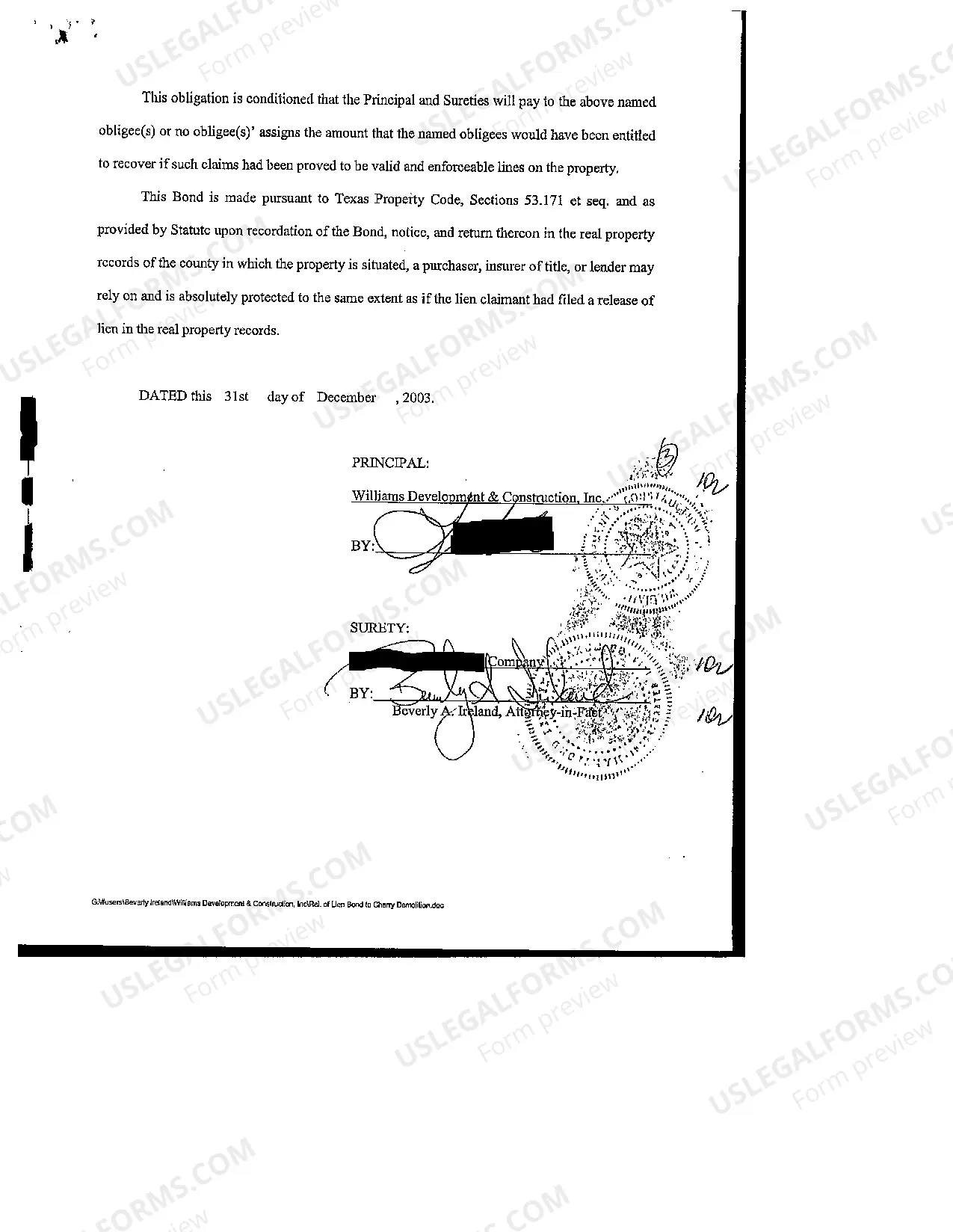

A Tarrant Texas Bond to Indemnify Against Lien is a type of surety bond that provides protection against potential liens that may arise on a property. This bond is commonly used in real estate transactions to protect the property owner from potential financial losses due to undisclosed liens or claims on the property. The purpose of the Tarrant Texas Bond to Indemnify Against Lien is to give the property owner peace of mind by ensuring that any potential lien on the property will be compensated for. It acts as a guarantee that the property is free from any undisclosed liens or claims before the transaction takes place. There are several types of Tarrant Texas Bonds to Indemnify Against Lien, depending on the specific circumstances and requirements of the transaction. Some common types of such bonds include: 1. Mechanic's Lien Bond: This bond is used when a contractor or subcontractor places a lien on a property due to unpaid construction or renovation work. The bond guarantees that the property owner will be financially protected in case a lien is filed. 2. Material Supplier's Lien Bond: This bond is used when a material supplier places a lien on a property due to unpaid materials delivered to a construction project. The bond ensures that the property owner will be financially secure even if a lien is filed. 3. Mortgage Bond: This bond is used to indemnify against potential mortgage-related liens. It provides protection to the property owner against any claims or liens arising from a mortgage transaction. 4. Tax Lien Bond: This bond is used when there is an outstanding tax lien on the property. It guarantees that the property owner will be financially protected if the tax authorities place a lien on the property due to unpaid taxes. Obtaining a Tarrant Texas Bond to Indemnify Against Lien is crucial in real estate transactions to protect the interests of the property owner. It provides financial security and ensures that any potential liens will not hinder the successful completion of the transaction. By securing this bond, the property owner can have confidence in the integrity of the property title and avoid future legal complications. In summary, a Tarrant Texas Bond to Indemnify Against Lien is a type of surety bond that protects property owners from potential financial losses due to undisclosed liens or claims on a property. It comes in different forms, including Mechanic's Lien Bond, Material Supplier's Lien Bond, Mortgage Bond, and Tax Lien Bond, depending on the specific circumstances of the transaction. Securing this bond is essential to ensure a smooth and secure real estate transaction.

Tarrant Texas Bond to Indemnify Against Lien

Description

How to fill out Tarrant Texas Bond To Indemnify Against Lien?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are extremely expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Tarrant Texas Bond to Indemnify Against Lien or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Tarrant Texas Bond to Indemnify Against Lien complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Tarrant Texas Bond to Indemnify Against Lien would work for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!