Title: Comprehensive Overview of Abilene Texas Real Estate Lien Notes and Their Types Introduction: When dealing with Abilene, Texas real estate transactions, it is vital to understand the concept of a lien note. A lien note is a legal document that acts as proof of a debt owed against a property. This comprehensive description will delve into the details and various types of Abilene Texas Real Estate Lien Notes. 1. General Understanding of Abilene Texas Real Estate Lien Notes: A real estate lien note is a contractual agreement between a borrower (property owner) and a lender, which outlines the terms and conditions of a loan secured by the property's value. These notes serve as legal documents that assure lenders will be repaid in full or receive compensation from the sale of the property if the borrower fails to fulfill their financial obligations. 2. Types of Abilene Texas Real Estate Lien Notes: a) Mortgage Lien Note: A mortgage lien note represents a loan given for the purchase or refinancing of a property. The note clearly outlines the mortgage terms, interest rates, repayment schedule, and consequences for default. Failure to meet payment obligations could lead to foreclosure. b) Deed of Trust Lien Note: A deed of trust lien note is slightly different from a mortgage lien note. In Abilene, Texas, it involves three parties: the borrower (trust or), lender (beneficiary), and a neutral third party (trustee). The trustee holds the deed of trust until the loan is repaid, acting as an intermediary to facilitate the foreclosure process if necessary. c) Construction Lien Note: A construction lien note is specific to properties undergoing construction or renovation. It secures the lender's financial interest in the project by establishing a lien on the property until payment is made in full by the borrower. This type of lien note helps protect contractors and suppliers from non-payment. d) Home Equity Lien Note: A home equity lien note is primarily used when homeowners decide to access the equity in their property. This note allows borrowers to obtain a loan against the existing equity, typically used for home improvements, debt consolidation, or other financial needs. It establishes a lien on the property, outlining the terms of the loan and the consequences of non-payment. Conclusion: Understanding the different types of Abilene Texas Real Estate Lien Notes is crucial for both buyers and sellers in the local real estate market. Whether it be a mortgage lien note, deed of trust lien note, construction lien note, or home equity lien note, these legal documents highlight the borrower's obligations and the lender's rights. It is advised to consult with a knowledgeable real estate professional or legal expert to navigate the intricacies of these lien notes effectively.

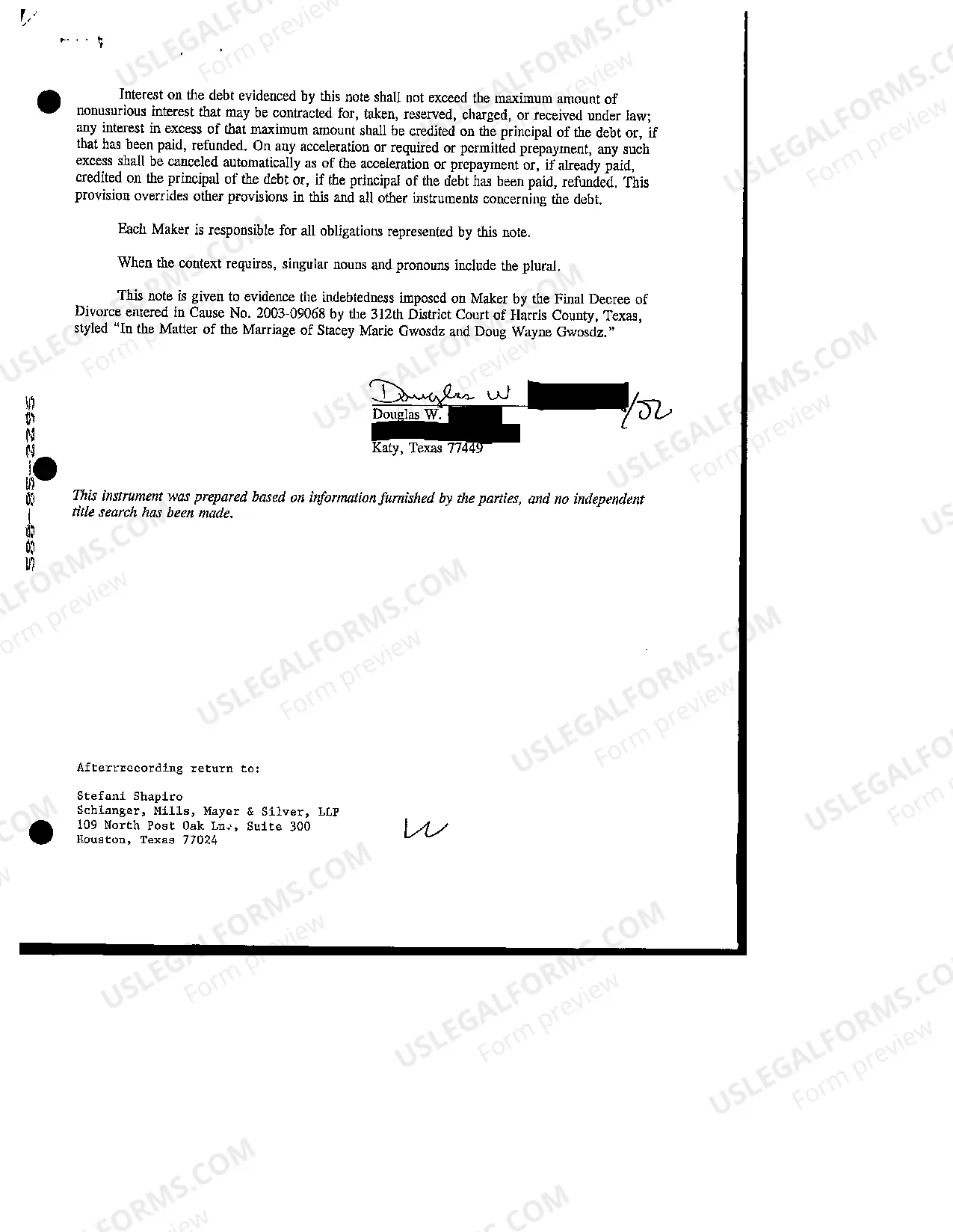

Abilene Texas Real Estate Lien Note

Description

How to fill out Abilene Texas Real Estate Lien Note?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Abilene Texas Real Estate Lien Note becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Abilene Texas Real Estate Lien Note takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Abilene Texas Real Estate Lien Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!