Amarillo Texas Real Estate Lien Note refers to a legal document that establishes a financial claim or encumbrance against a property in Amarillo, Texas. It serves as evidence of a debt owed by the real estate owner and allows the lien holder to secure their interest in the property until the debt is resolved. The Amarillo Texas Real Estate Lien Note is an essential tool for lenders or individuals who lend money for real estate transactions and want to protect their investments. By establishing a lien on the property, the lender ensures that they can seek repayment by selling the property if the borrower defaults on the loan agreement. There are different types of Amarillo Texas Real Estate Lien Notes, each suited to various situations and purposes. Some of these include: 1. Mortgage Lien Note: This is the most common type of lien note used in real estate transactions. It secures the lender's interest in the property and provides them with the right to foreclose and sell the property if the borrower fails to repay the loan. 2. Mechanic's Lien Note: This type of lien note is used by contractors, subcontractors, or suppliers who have provided labor or materials for the improvement or construction of a property but have not been paid. It allows them to claim a lien against the property if their invoices remain unpaid. 3. Tax Lien Note: In cases where property taxes are not paid, local governmental bodies may place a tax lien on the property. A tax lien note serves as a legal document confirming the amount owed in back taxes and establishes the lien holder's right to collect the unpaid taxes by seizing and selling the property. 4. Judgment Lien Note: If a party wins a lawsuit against a property owner in Amarillo, Texas, they may be granted a judgment lien note. This document ensures that the creditor can enforce the judgment by placing a lien on the property until the debt owed under the judgment is paid. 5. Li's Pendent Note: Also known as a notice of pending litigation, an is pendent note is filed when a legal action is initiated that involves the property. It puts potential buyers on notice that there is a legal dispute affecting the property title. In conclusion, the Amarillo Texas Real Estate Lien Note is a crucial legal document that protects the rights of lenders, contractors, tax authorities, and others who have financial interests in a property. Understanding the different types of lien notes helps ensure that each party's rights and obligations are appropriately documented and enforced in Amarillo's real estate market.

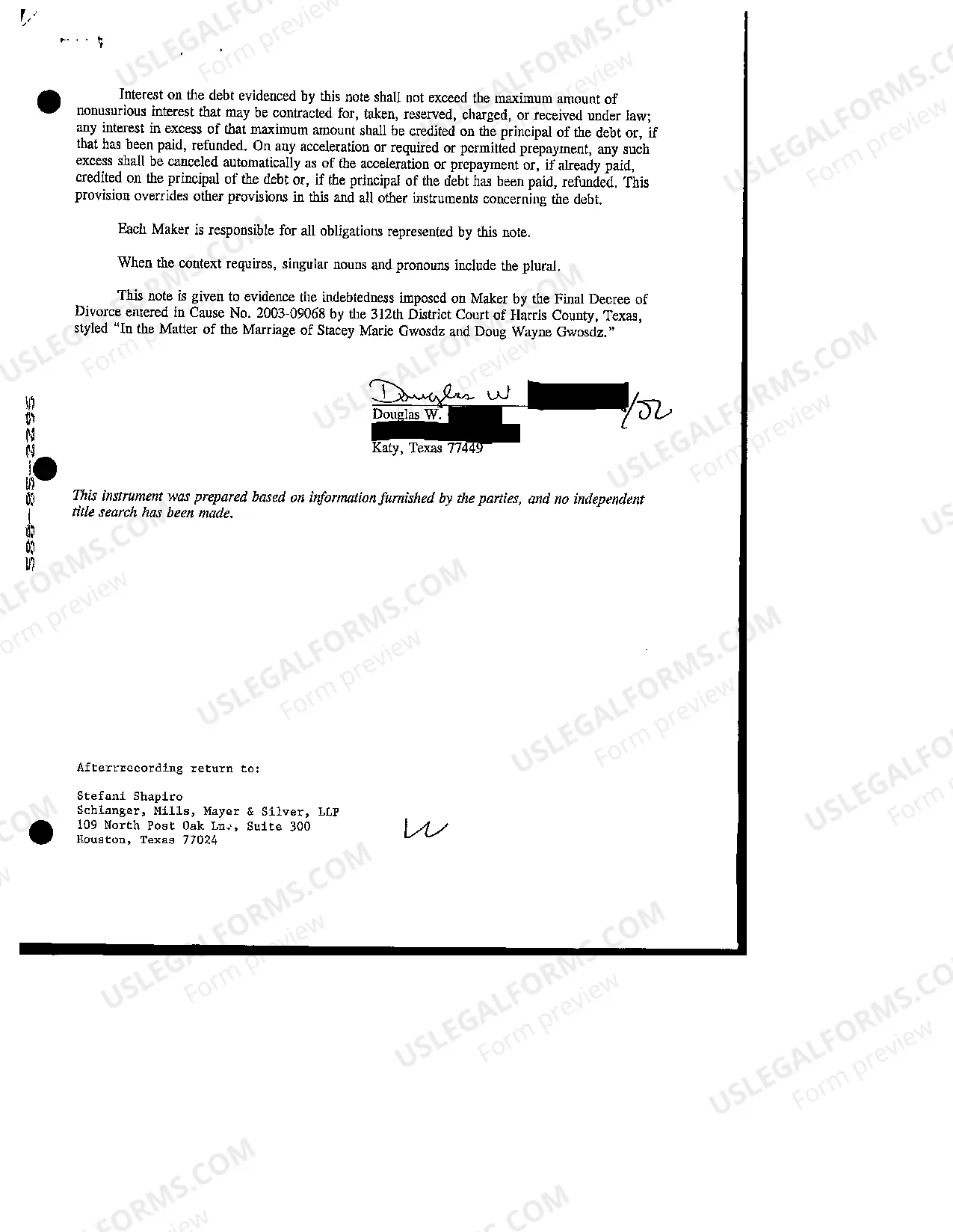

Amarillo Texas Real Estate Lien Note

Description

How to fill out Amarillo Texas Real Estate Lien Note?

Do you need a trustworthy and affordable legal forms supplier to buy the Amarillo Texas Real Estate Lien Note? US Legal Forms is your go-to option.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Amarillo Texas Real Estate Lien Note conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is intended for.

- Start the search over in case the form isn’t good for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Amarillo Texas Real Estate Lien Note in any available format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal papers online for good.