Collin Texas Real Estate Lien Note refers to a legal document that serves as evidence of a borrower's debt and outlines the terms and conditions of a loan secured by real property in Collin County, Texas. This note is typically created when a property owner borrows money from a lender to purchase or refinance a property. There are various types of Collin Texas Real Estate Lien Notes, including: 1. Collateralized Mortgage Note: This type of lien note is used when the borrower pledges the property itself as collateral for the loan. In case of default, the lender has the right to foreclose on the property to recover the outstanding debt. 2. Deed of Trust Note: This lien note involves a three-party agreement between the borrower (trust or), lender (beneficiary), and a trustee who holds legal title to the property on the lender's behalf. In this case, the trustee has the power to initiate foreclosure proceedings if the borrower defaults on the loan. 3. Land Contract Note: This lien note is used in situations where the seller finances the purchase of the property for the buyer. The buyer makes regular installment payments to the seller, while the seller maintains legal title until the debt is fully repaid. Once the debt is satisfied, the buyer receives the deed to the property. 4. Wraparound Note: This type of lien note is created when a new loan wraps around an existing mortgage. The borrower gets a new loan from a lender, which includes the balance of the original mortgage plus any additional funds needed. The new lender pays the existing lender, and the borrower makes payments to the new lender. These Collin Texas Real Estate Lien Notes are crucial documents in real estate transactions, as they define the rights and obligations of both the borrower and the lender. It is essential for all parties involved to carefully review and understand the terms and conditions stated in the lien note before signing it.

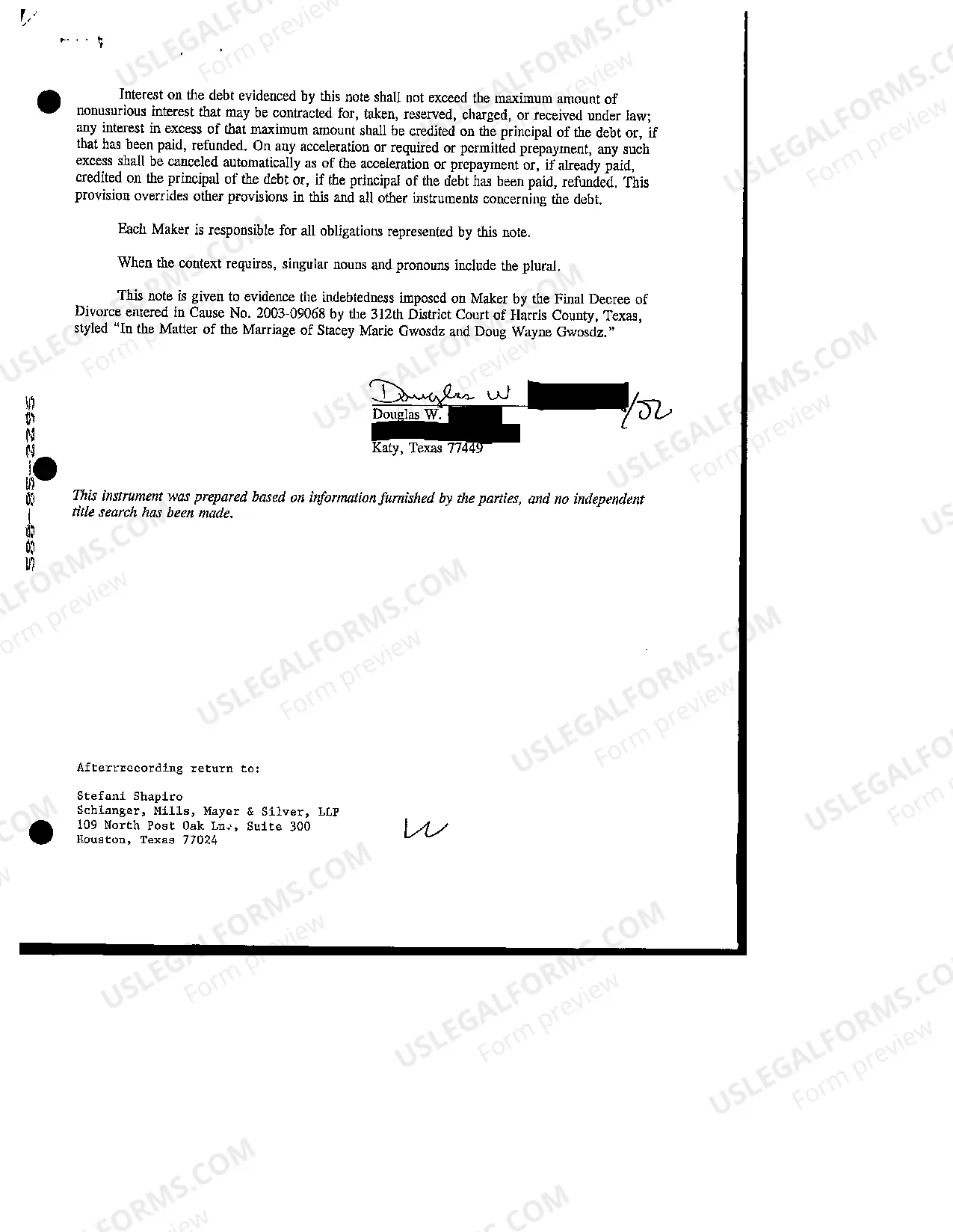

Collin Texas Real Estate Lien Note

Description

How to fill out Collin Texas Real Estate Lien Note?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, as a rule, are very costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Collin Texas Real Estate Lien Note or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Collin Texas Real Estate Lien Note adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Collin Texas Real Estate Lien Note is proper for you, you can choose the subscription option and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!