Corpus Christi Texas Real Estate Lien Note refers to a legal document that serves as evidence of a debt secured by a lien on a property located in Corpus Christi, Texas. This financial instrument outlines the terms and conditions of the debt repayment, including the principal amount, interest rate, payment schedule, and any penalties or fees. Real estate lien notes in Corpus Christi, Texas can be broadly categorized into several types, each serving a specific purpose: 1. Construction Lien Note: These lien notes are commonly used in Corpus Christi, Texas, to secure loans for construction and development projects. They provide protection to lenders by placing a lien on the property until the debt is repaid in full. 2. Mortgage Lien Note: A mortgage lien note is a common type of real estate lien note in Corpus Christi, Texas. It is used when purchasing a property, and it places a lien on the property to secure the repayment of the mortgage loan. 3. Home Equity Lien Note: This type of Corpus Christi real estate lien note is used to secure loans against the equity in a property owned by the borrower. It allows homeowners to borrow against the value of their property for various purposes. 4. Tax Lien Note: Tax lien notes are issued by local governments in Corpus Christi, Texas, to secure unpaid property tax debts. These lien notes give the government the right to seize the property if the taxes remain unpaid for an extended period. 5. Judgment Lien Note: A judgment lien note is created when a court grants a creditor a legal claim on a debtor's property in Corpus Christi, Texas, as a result of a lawsuit. It ensures the creditor has a right to payment from the proceeds if the property is sold. It is crucial for buyers, sellers, lenders, and investors involved in Corpus Christi, Texas real estate transactions to understand the implications and obligations associated with real estate lien notes. Seeking legal advice from a real estate attorney is often recommended navigating the complexities of these transactions and ensure compliance with local laws and regulations.

Corpus Christi Texas Real Estate Lien Note

Description

How to fill out Corpus Christi Texas Real Estate Lien Note?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Corpus Christi Texas Real Estate Lien Note gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Corpus Christi Texas Real Estate Lien Note takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

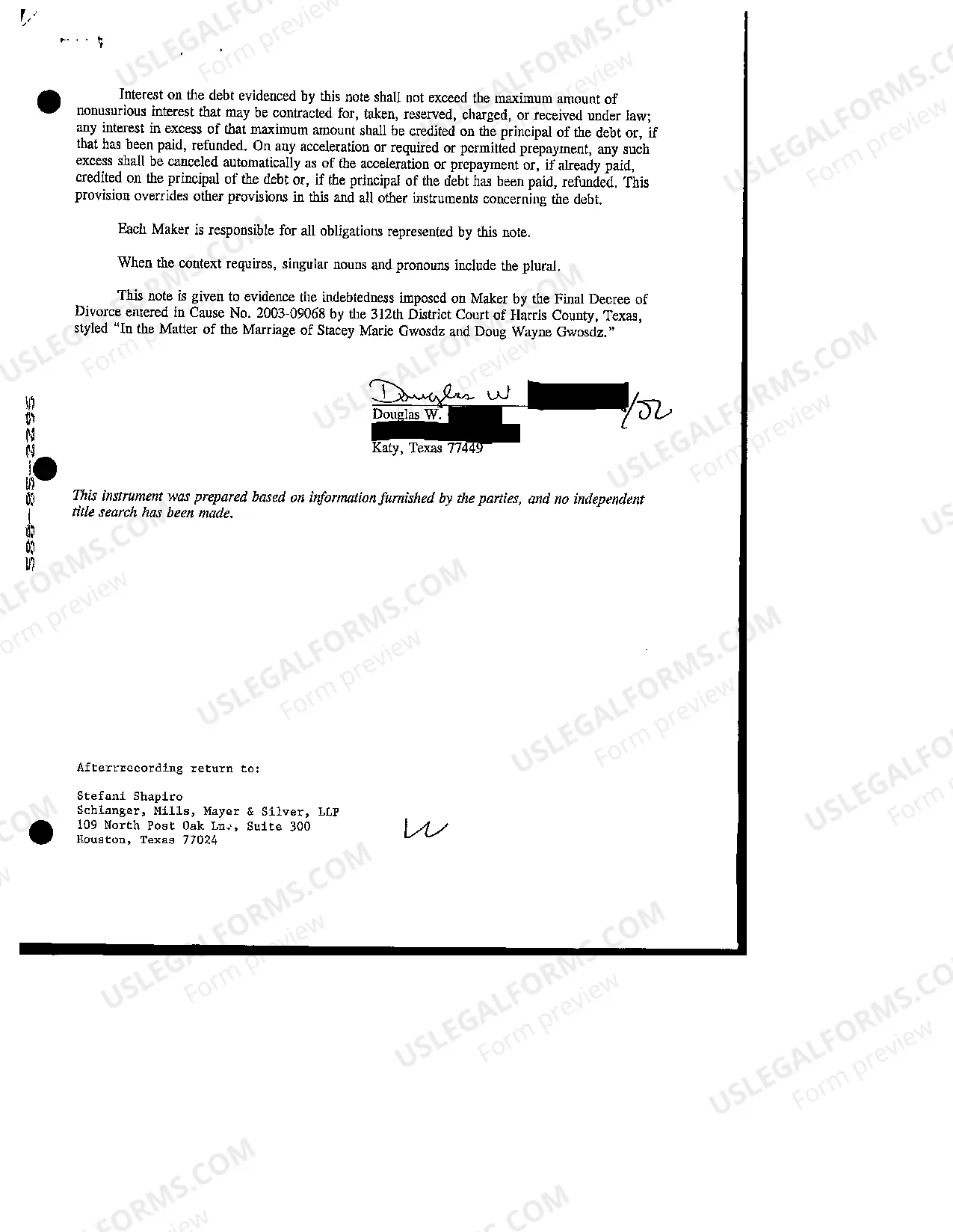

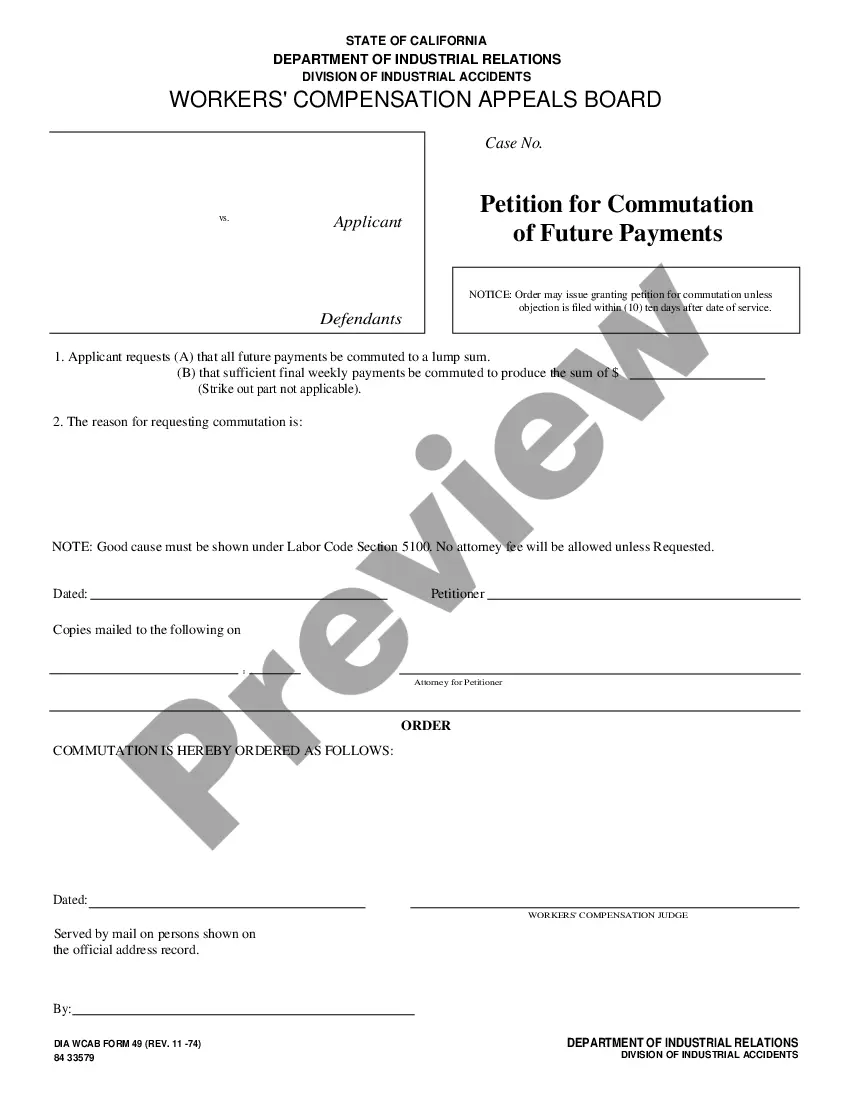

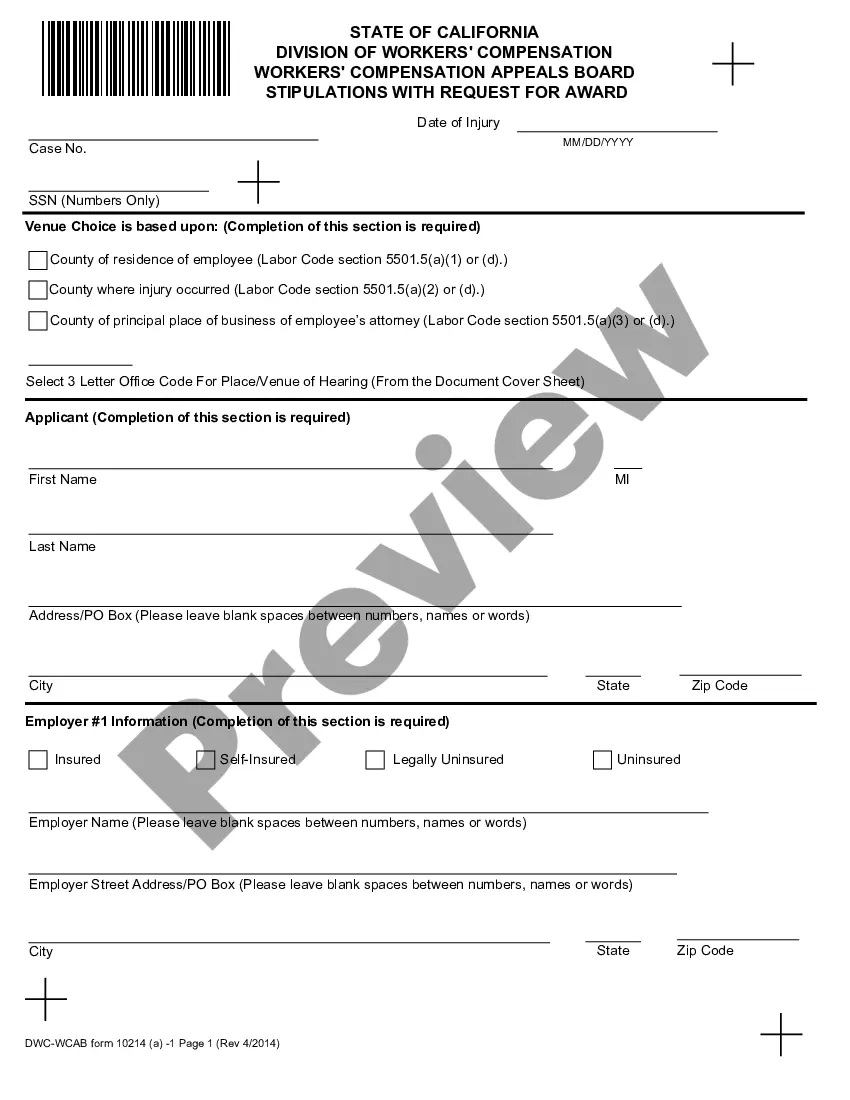

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Corpus Christi Texas Real Estate Lien Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!