A McAllen Texas real estate lien note is a legal document that serves as evidence of a debt or an obligation secured by a property or real estate in McAllen, Texas. It is commonly used in real estate transactions to protect the rights of lenders or other parties with a financial interest in the property. A real estate lien note contains specific information about the debt such as the principal amount borrowed, interest rates, payment terms, and any other relevant terms and conditions. By signing a lien note, the borrower agrees to repay the debt according to the specified terms and permits the lender to place a lien on the property as collateral. In McAllen, Texas, there are different types of real estate lien notes that may be utilized depending on the circumstances and parties involved: 1. Mortgage Lien Note: One of the most common types used when purchasing a property, a mortgage lien note establishes a debt for the borrower and outlines the terms of repayment. It includes a pledge of the property as collateral, allowing the lender to foreclose on the property in the event of default. 2. Deed of Trust Lien Note: Similar to a mortgage lien note, a deed of trust lien note also acts as a security instrument in a property transaction. In Texas, the deed of trust is the primary instrument used instead of a mortgage. It outlines the terms of the loan, and in case of default, a trustee is appointed to initiate foreclosure proceedings on behalf of the lender. 3. Mechanic's Lien Note: This type of lien note is used when a contractor or supplier has not been paid for services or materials provided during the construction or improvement of a property. A mechanic's lien note establishes the debt and secures the contractor's right to place a lien on the property until payment is made. 4. Property Tax Lien Note: In cases where property taxes remain unpaid, the local government can place a lien on the property. A property tax lien note is used to secure the debt and outlines the terms and conditions for repayment, including any penalties or interest. 5. Judgment Lien Note: If a court orders a debtor to pay a sum of money to a creditor, and the debtor fails to comply, the creditor can obtain a judgment lien on the debtor's property. A judgment lien note is used to record the details of the judgment and secure the debt. McAllen Texas real estate lien notes play a vital role in protecting the interests of lenders and other parties involved in real estate transactions. It is crucial for both borrowers and lenders to understand the terms and conditions outlined in the lien note to ensure a smooth and successful real estate transaction in McAllen, Texas.

McAllen Texas Real Estate Lien Note

State:

Texas

City:

McAllen

Control #:

TX-C161

Format:

PDF

Instant download

This form is available by subscription

Description

Real Estate Lien Note

A McAllen Texas real estate lien note is a legal document that serves as evidence of a debt or an obligation secured by a property or real estate in McAllen, Texas. It is commonly used in real estate transactions to protect the rights of lenders or other parties with a financial interest in the property. A real estate lien note contains specific information about the debt such as the principal amount borrowed, interest rates, payment terms, and any other relevant terms and conditions. By signing a lien note, the borrower agrees to repay the debt according to the specified terms and permits the lender to place a lien on the property as collateral. In McAllen, Texas, there are different types of real estate lien notes that may be utilized depending on the circumstances and parties involved: 1. Mortgage Lien Note: One of the most common types used when purchasing a property, a mortgage lien note establishes a debt for the borrower and outlines the terms of repayment. It includes a pledge of the property as collateral, allowing the lender to foreclose on the property in the event of default. 2. Deed of Trust Lien Note: Similar to a mortgage lien note, a deed of trust lien note also acts as a security instrument in a property transaction. In Texas, the deed of trust is the primary instrument used instead of a mortgage. It outlines the terms of the loan, and in case of default, a trustee is appointed to initiate foreclosure proceedings on behalf of the lender. 3. Mechanic's Lien Note: This type of lien note is used when a contractor or supplier has not been paid for services or materials provided during the construction or improvement of a property. A mechanic's lien note establishes the debt and secures the contractor's right to place a lien on the property until payment is made. 4. Property Tax Lien Note: In cases where property taxes remain unpaid, the local government can place a lien on the property. A property tax lien note is used to secure the debt and outlines the terms and conditions for repayment, including any penalties or interest. 5. Judgment Lien Note: If a court orders a debtor to pay a sum of money to a creditor, and the debtor fails to comply, the creditor can obtain a judgment lien on the debtor's property. A judgment lien note is used to record the details of the judgment and secure the debt. McAllen Texas real estate lien notes play a vital role in protecting the interests of lenders and other parties involved in real estate transactions. It is crucial for both borrowers and lenders to understand the terms and conditions outlined in the lien note to ensure a smooth and successful real estate transaction in McAllen, Texas.

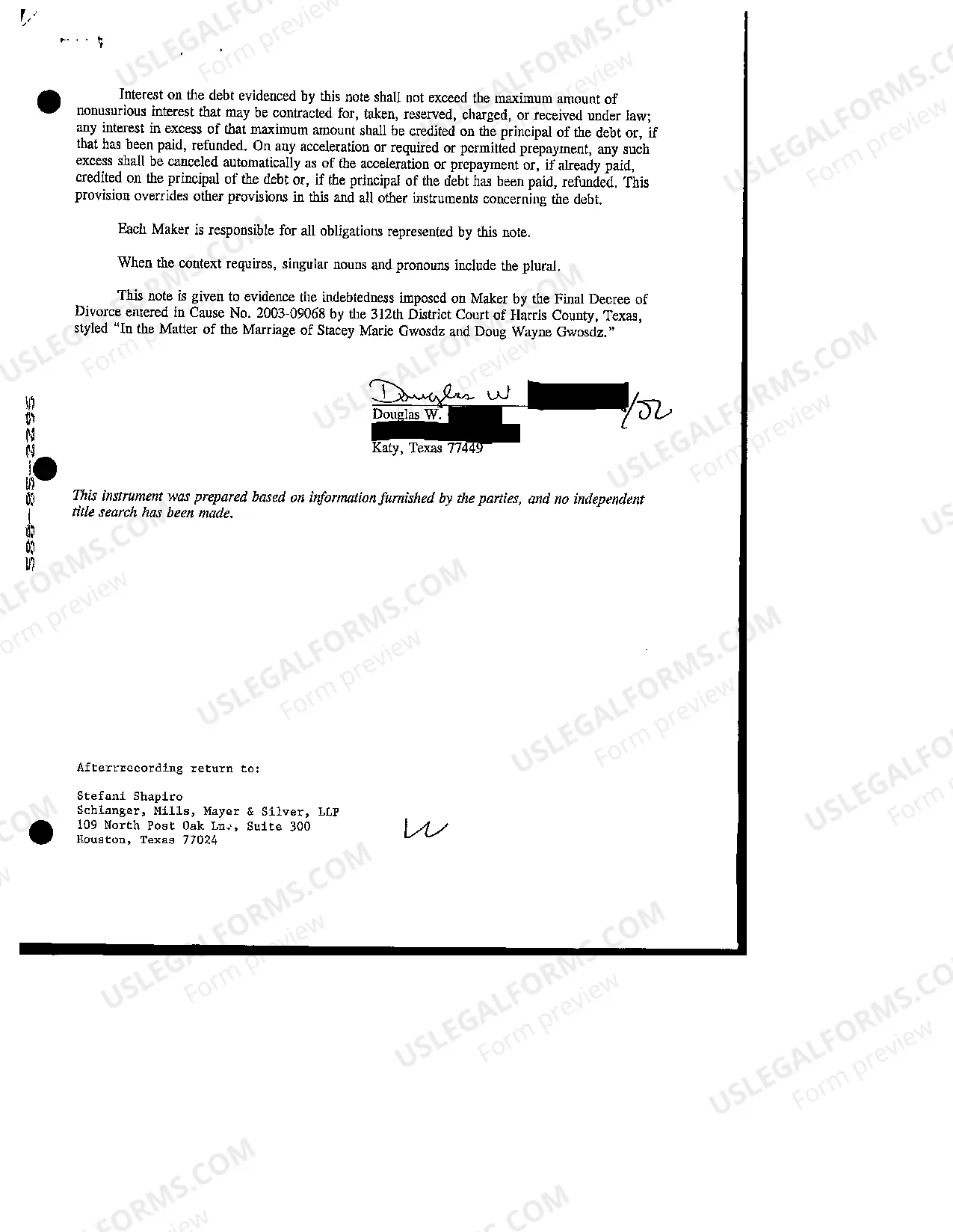

Free preview

How to fill out McAllen Texas Real Estate Lien Note?

If you’ve already used our service before, log in to your account and download the McAllen Texas Real Estate Lien Note on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your McAllen Texas Real Estate Lien Note. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!