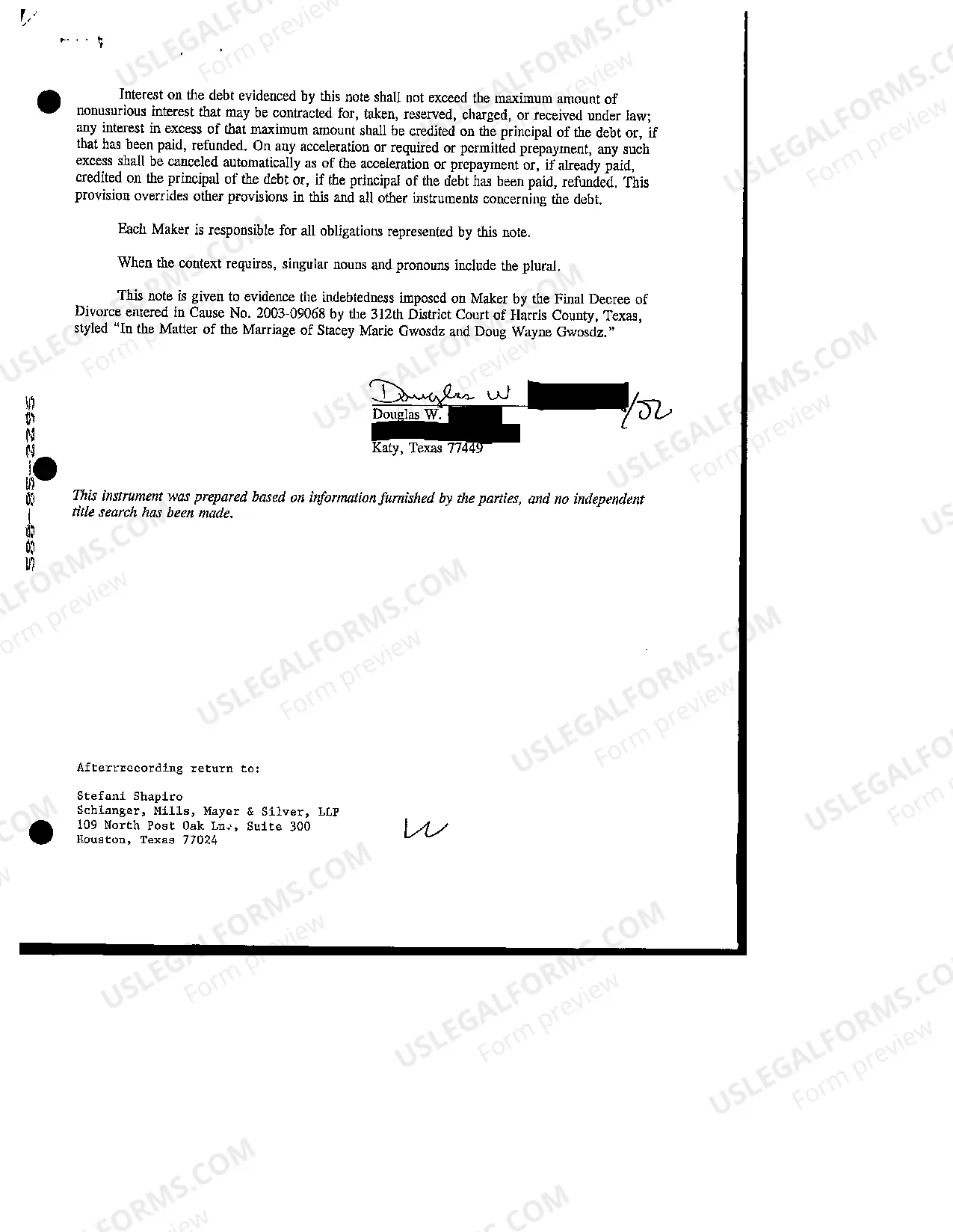

Pearland Texas Real Estate Lien Note is a legal document that serves as evidence of a financial obligation related to a real estate property located in Pearland, Texas. It represents a lien, which is a legal claim against the property by a party for the repayment of a debt or financial obligation. The Pearland Texas Real Estate Lien Note outlines the terms of the loan, including the principal amount borrowed, the interest rate, the repayment schedule, and any additional fees or charges associated with the loan. It specifies the rights and responsibilities of both the borrower and the lender, as well as the consequences of defaulting on the loan. There are different types of Pearland Texas Real Estate Lien Notes, each catering to specific circumstances: 1. First Lien Note: This type of lien note holds the first priority claim against the property in the event of foreclosure or sale. It takes precedence over any subsequent lien notes. 2. Second Lien Note: If there is already an existing first lien note on the property, a second lien note can be issued. In case of foreclosure or sale, the second lien note holder would be paid after the first lien note holder. 3. Subordinate Lien Note: A subordinate lien note is issued when there are multiple liens on a property. It acknowledges the priority of existing lien notes and agrees to take a secondary position in case of foreclosure or sale. 4. Purchase Money Lien Note: A purchase money lien note is created when the seller of the property finances a portion of the purchase price, often referred to as seller financing. It serves as a lien against the property until the buyer fully repays the loan. 5. Construction Lien Note: When real estate development or construction takes place, a construction lien note may be used. It provides financing throughout the construction process and is secured by the property being developed. 6. Tax Lien Note: If property taxes are not paid, the government may place a tax lien on the property. A tax lien note can be issued to secure the repayment of the delinquent taxes. 7. Mechanics Lien Note: This type of lien note is utilized when contractors or subcontractors are not paid for their work on a property. A mechanics lien note secures the outstanding payment and is typically involved in construction or renovation projects. It is important to consult with a legal professional or a real estate attorney to fully understand the implications and intricacies associated with Pearland Texas Real Estate Lien Notes, as they can vary depending on individual circumstances and the specific type of lien note issued.

Pearland Texas Real Estate Lien Note

Description

How to fill out Pearland Texas Real Estate Lien Note?

We always want to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney services that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Pearland Texas Real Estate Lien Note or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Pearland Texas Real Estate Lien Note complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Pearland Texas Real Estate Lien Note would work for you, you can choose the subscription option and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!