A Round Rock Texas Real Estate Lien Note is a legal document that represents a claim against a property in Round Rock, Texas. It serves as a legal tool to secure the repayment of a debt or outstanding amount owed by the property owner. This lien note is typically used in real estate transactions such as mortgage loans or construction projects. Keywords: Round Rock Texas, real estate, lien note, legal document, claim, property, repayment, debt, outstanding amount, property owner, real estate transactions, mortgage loans, construction projects. There are different types of Round Rock Texas Real Estate Lien Notes, namely: 1. Mortgage Lien Note: This type of lien note is used when individuals or businesses borrow money from a lender to purchase a property in Round Rock, Texas. The note outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and the property serving as collateral. In the event of default, the lender can enforce the lien on the property, potentially leading to foreclosure. 2. Mechanic's Lien Note: This lien note is commonly associated with construction projects in Round Rock. When a contractor, subcontractor, or supplier performs work or provides materials for a property improvement project and does not receive payment, they can file a mechanic's lien note against the property. This note helps secure their right to payment by giving them a legal claim on the property. 3. Property Tax Lien Note: If property taxes remain unpaid, the government may place a tax lien on the property. This type of lien note establishes the government's right to collect the outstanding property taxes. If the property owner fails to pay, the government can enforce the lien by seizing the property or initiating a foreclosure proceeding. 4. Homeowners Association (HOA) Lien Note: Homeowners associations in Round Rock can also place liens on properties when the homeowner fails to pay their association fees, fines, or charges. The HOA lien note allows the association to collect the outstanding dues by having a claim against the property. Failure to satisfy the lien could result in legal action or a potential sale of the property. In summary, a Round Rock Texas Real Estate Lien Note is a legal document used to establish a claim against a property, specifically in Round Rock, Texas. Various types of lien notes exist, including mortgage lien notes, mechanic's lien notes, property tax lien notes, and HOA lien notes, all serving different purposes within the realm of real estate transactions.

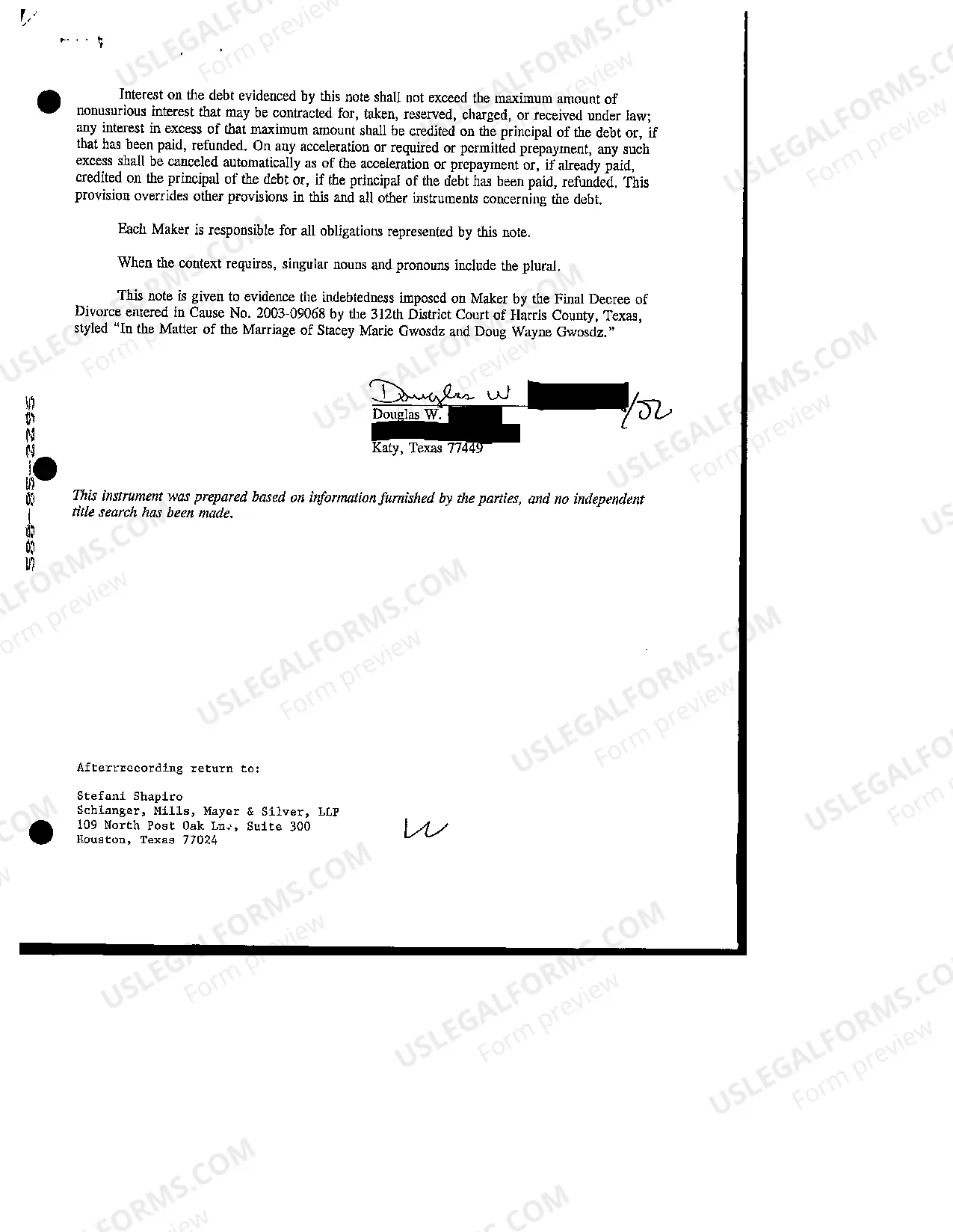

Round Rock Texas Real Estate Lien Note

Description

How to fill out Round Rock Texas Real Estate Lien Note?

Do you need a trustworthy and affordable legal forms provider to buy the Round Rock Texas Real Estate Lien Note? US Legal Forms is your go-to option.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Round Rock Texas Real Estate Lien Note conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Round Rock Texas Real Estate Lien Note in any provided format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time researching legal papers online for good.