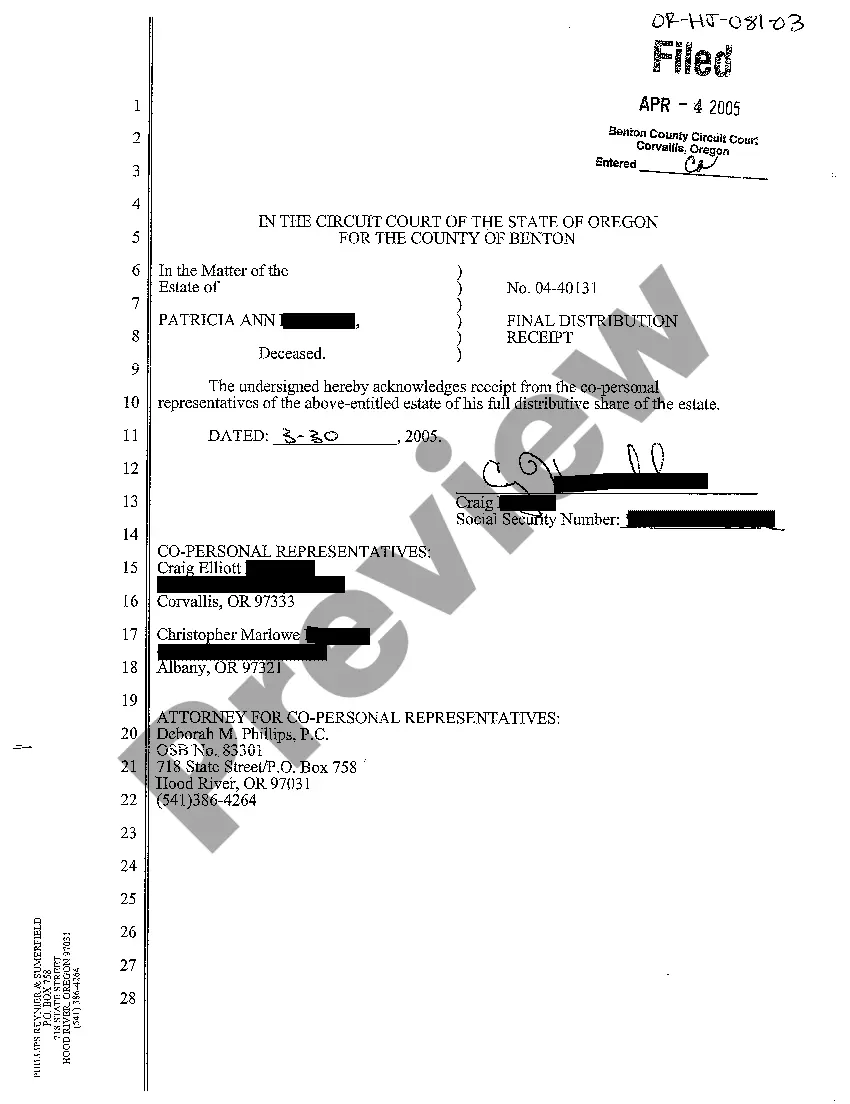

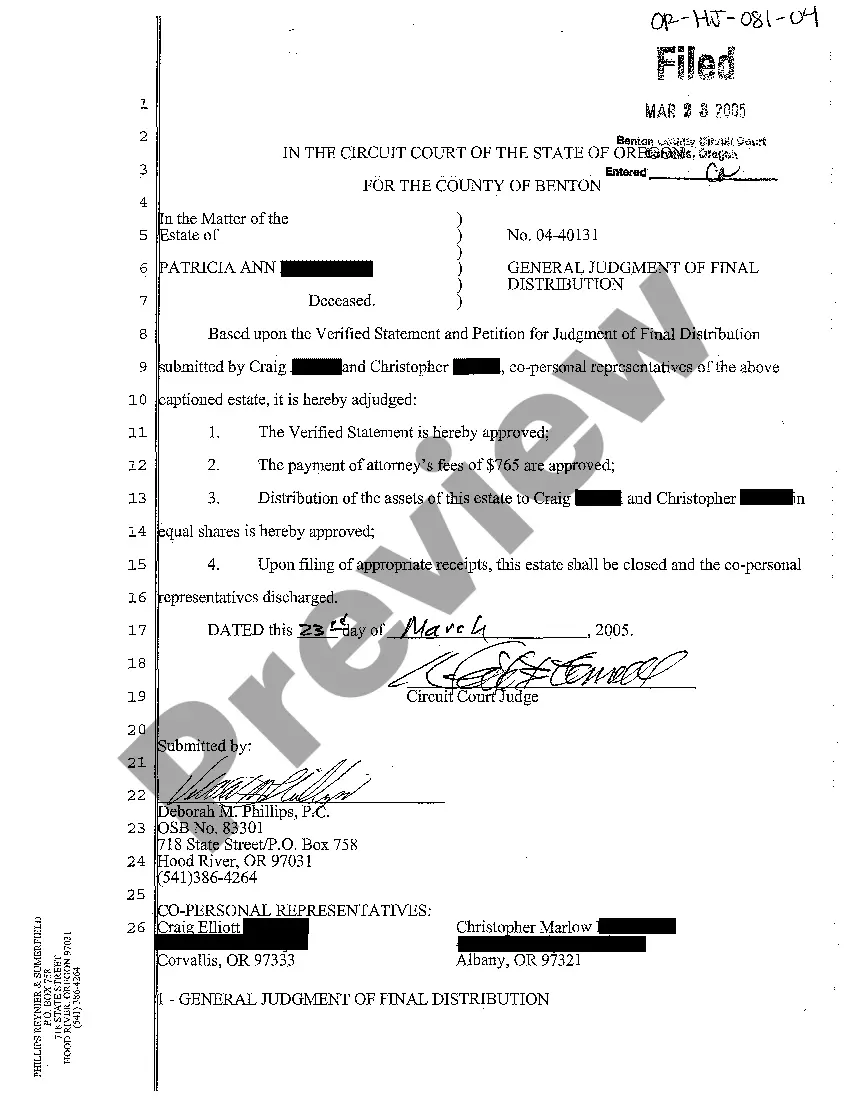

A San Antonio Texas Real Estate Lien Note refers to a legal document that serves as evidence of a loan or debt secured by a lien on a property located in San Antonio, Texas. It outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional terms agreed upon between the borrower and lender. There are different types of San Antonio Texas Real Estate Lien Notes, depending on the specific type of lien placed on the property. These can include: 1. Mortgage Lien Note: This is the most common type of lien note in real estate transactions. It is used when a borrower obtains a mortgage loan from a lender to finance the purchase of a property. The mortgage serves as security for the loan, and the lien note outlines the terms and conditions of repayment. 2. Deed of Trust Lien Note: In Texas, deeds of trust are often used instead of mortgages. A deed of trust is a three-party agreement between the borrower (trust or), lender (beneficiary), and a neutral third party (trustee). The deed of trust lien note serves as evidence of the loan and outlines the repayment terms, with the property serving as collateral. 3. Mechanics' Lien Note: This type of lien note is used when a contractor, subcontractor, or supplier has not been paid for their work or materials used in a construction project. A mechanics' lien note creates a lien on the property to secure the unpaid amount, and it outlines the repayment terms. 4. Tax Lien Note: If a property owner fails to pay property taxes, the government may place a tax lien on the property. A tax lien note is used to document the debt and outlines the repayment terms, typically including penalties and interest. It is important to note that the specific terms and requirements of San Antonio Texas Real Estate Lien Notes may vary based on state and local laws, as well as the individual agreement between the borrower and lender.

San Antonio Texas Real Estate Lien Note

Description

How to fill out San Antonio Texas Real Estate Lien Note?

Make use of the US Legal Forms and obtain instant access to any form sample you need. Our beneficial website with a huge number of documents allows you to find and obtain virtually any document sample you require. You can save, fill, and sign the San Antonio Texas Real Estate Lien Note in just a few minutes instead of browsing the web for several hours attempting to find the right template.

Using our library is a superb way to raise the safety of your document filing. Our experienced lawyers regularly review all the records to ensure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How do you get the San Antonio Texas Real Estate Lien Note? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can find all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions below:

- Find the form you need. Make certain that it is the template you were looking for: check its name and description, and take take advantage of the Preview feature if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Select the format to obtain the San Antonio Texas Real Estate Lien Note and change and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable form libraries on the web. We are always happy to help you in any legal case, even if it is just downloading the San Antonio Texas Real Estate Lien Note.

Feel free to make the most of our service and make your document experience as straightforward as possible!