A Sugar Land Texas Real Estate Lien Note is a legal document that serves as evidence of a debt owed on a property in Sugar Land, Texas. It is a written promise to repay a loan secured by a specific real estate property. Essentially, a Real Estate Lien Note is created when a property owner borrows money against their property, usually from a lender or a private party, to fund their real estate purchase or other financial needs. The note outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any other relevant conditions. Keywords: Sugar Land Texas, real estate, lien note, legal document, debt, property, loan, lender, private party, interest rate, repayment schedule. There are several types of Sugar Land Texas Real Estate Lien Notes, including: 1. First Mortgage Lien Note: This type of lien note holds the highest priority over other lien notes on a property. It is usually obtained by the borrower at the time of property purchase or refinancing. 2. Second Mortgage Lien Note: If a property owner takes on an additional loan or refinances their existing mortgage, a second mortgage lien note may be created. This note ranks below the first mortgage lien note in priority. 3. Home Equity Line of Credit Lien Note: Homeowners in Sugar Land, Texas may also opt for a home equity line of credit (HELOT) on their property. This allows them to borrow against the equity built in their home. A lien note is created to secure this credit line. 4. Mechanics Lien Note: In the construction industry, contractors and suppliers may file mechanics liens against a property if they remain unpaid for their services or materials provided. These liens are documented through a lien note. 5. Tax Lien Note: If a property owner fails to pay their property taxes to the local government, a tax lien may be placed against the property. A tax lien note is generated to document this debt. 6. Judgment Lien Note: When a court grants a judgment in favor of a creditor, the creditor may place a judgment lien on the debtor's property. A judgment lien note is created to capture this legal claim. In all cases, a Sugar Land Texas Real Estate Lien Note serves as a guarantee to the lender or claimant that they have a legal right to claim repayment from the property owner in the event of default or non-payment.

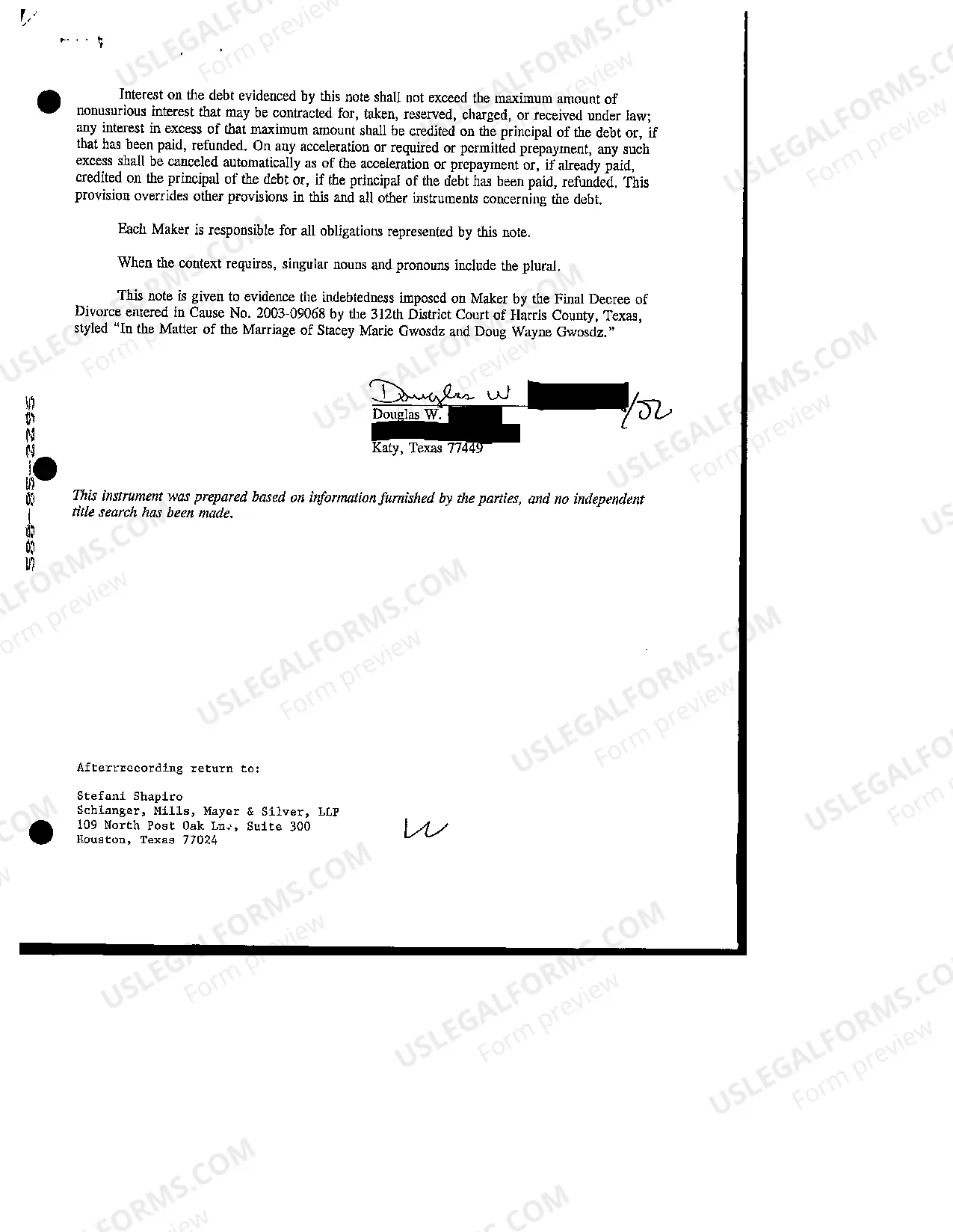

Sugar Land Texas Real Estate Lien Note

Description

How to fill out Sugar Land Texas Real Estate Lien Note?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Sugar Land Texas Real Estate Lien Note? US Legal Forms is your go-to option.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Sugar Land Texas Real Estate Lien Note conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the form is good for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Sugar Land Texas Real Estate Lien Note in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours researching legal paperwork online once and for all.