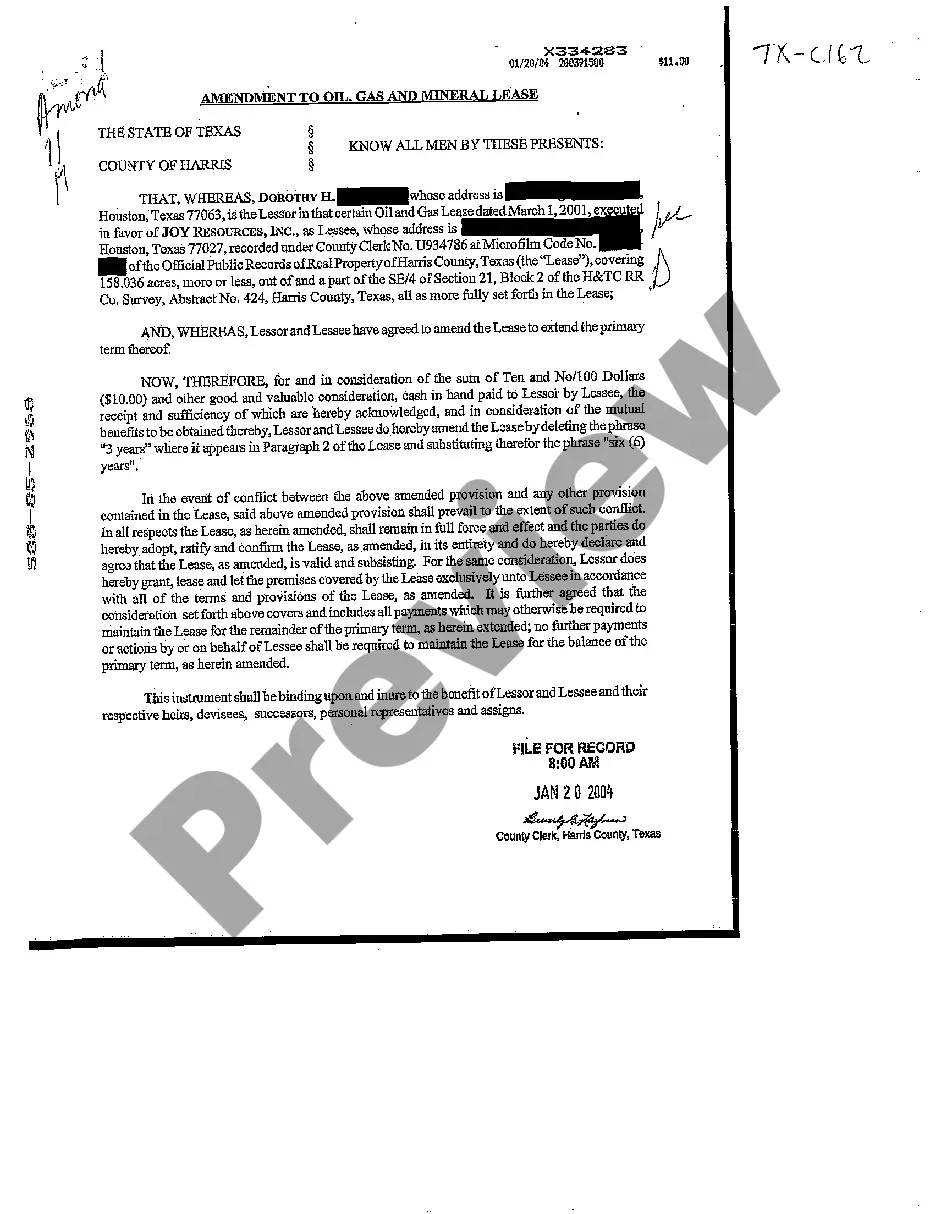

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Beaumont Texas Amendment to Oil, Gas, and Mineral Lease refers to a legal document that modifies or adds provisions to an existing lease agreement in the exploration and extraction of oil, gas, and mineral resources in Beaumont, Texas. This amendment is crucial in ensuring that the lease agreement aligns with the evolving industry standards, regulatory changes, and the specific needs of both the lessor (landowner) and the lessee (oil, gas, and mineral exploration company). There are several types of Beaumont Texas Amendment to Oil, Gas, and Mineral Lease, each serving various purposes. Some key types include: 1. Royalty Amendment: This amendment typically modifies the terms associated with the royalty payment structure. It may involve adjustments to the royalty percentage, minimum royalty payments, or the inclusion of new clauses to clarify the royalty calculation methods. 2. Surface Rights Amendment: This type of amendment typically addresses the concerns related to the use of the landowner's surface rights for oil, gas, and mineral exploration activities. It may establish guidelines for access roads, drill site locations, pipeline construction, and compensation for any damages to the landowner's property. 3. Term Amendment: This amendment modifies the duration of the lease agreement. It can either extend or shorten the initial term of the lease, depending on the mutual agreement between the lessor and the lessee. 4. Assignment Amendment: An assignment amendment is used when a party wishes to transfer or assign their rights and obligations under the lease agreement to another entity. It outlines the terms and conditions associated with the transfer of interest. 5. Bonus Amendment: This type of amendment typically deals with the upfront payments made by the lessee to the lessor as a signing bonus for the lease agreement. It may include modifications to the bonus amount or the timeline for payment. 6. Drilling and Operations Amendment: This amendment establishes regulations and guidelines related to drilling and operational activities on the leased property. It covers aspects such as well location, depth, casing requirements, environmental protection measures, and safety protocols. Overall, the Beaumont Texas Amendment to Oil, Gas, and Mineral Lease serves as a mechanism to ensure that the lease agreement remains up-to-date, fair, and mutually beneficial for all parties involved. It addresses critical aspects of the lease, such as royalties, surface rights, tenure, assignments, bonuses, and drilling operations.The Beaumont Texas Amendment to Oil, Gas, and Mineral Lease refers to a legal document that modifies or adds provisions to an existing lease agreement in the exploration and extraction of oil, gas, and mineral resources in Beaumont, Texas. This amendment is crucial in ensuring that the lease agreement aligns with the evolving industry standards, regulatory changes, and the specific needs of both the lessor (landowner) and the lessee (oil, gas, and mineral exploration company). There are several types of Beaumont Texas Amendment to Oil, Gas, and Mineral Lease, each serving various purposes. Some key types include: 1. Royalty Amendment: This amendment typically modifies the terms associated with the royalty payment structure. It may involve adjustments to the royalty percentage, minimum royalty payments, or the inclusion of new clauses to clarify the royalty calculation methods. 2. Surface Rights Amendment: This type of amendment typically addresses the concerns related to the use of the landowner's surface rights for oil, gas, and mineral exploration activities. It may establish guidelines for access roads, drill site locations, pipeline construction, and compensation for any damages to the landowner's property. 3. Term Amendment: This amendment modifies the duration of the lease agreement. It can either extend or shorten the initial term of the lease, depending on the mutual agreement between the lessor and the lessee. 4. Assignment Amendment: An assignment amendment is used when a party wishes to transfer or assign their rights and obligations under the lease agreement to another entity. It outlines the terms and conditions associated with the transfer of interest. 5. Bonus Amendment: This type of amendment typically deals with the upfront payments made by the lessee to the lessor as a signing bonus for the lease agreement. It may include modifications to the bonus amount or the timeline for payment. 6. Drilling and Operations Amendment: This amendment establishes regulations and guidelines related to drilling and operational activities on the leased property. It covers aspects such as well location, depth, casing requirements, environmental protection measures, and safety protocols. Overall, the Beaumont Texas Amendment to Oil, Gas, and Mineral Lease serves as a mechanism to ensure that the lease agreement remains up-to-date, fair, and mutually beneficial for all parties involved. It addresses critical aspects of the lease, such as royalties, surface rights, tenure, assignments, bonuses, and drilling operations.