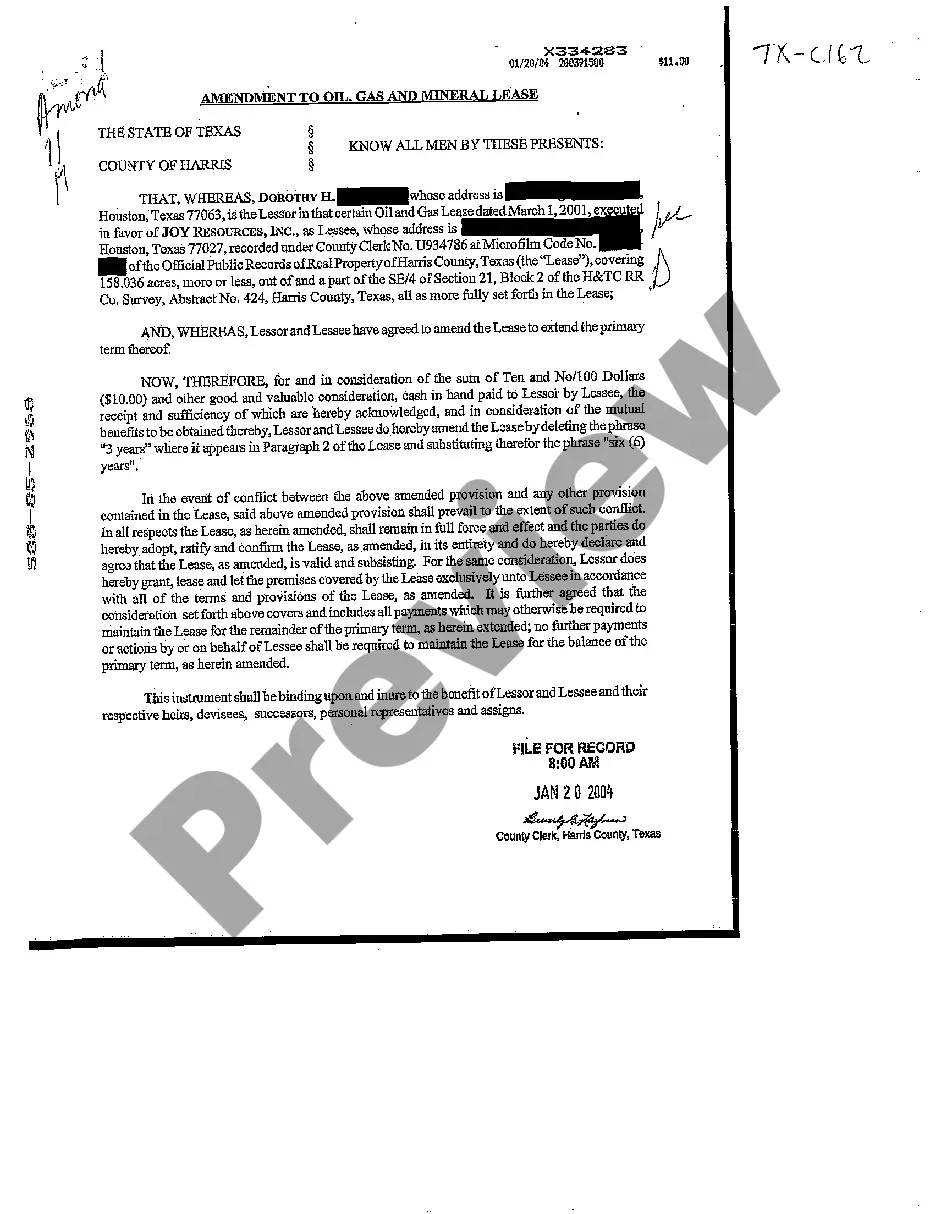

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Corpus Christi Texas Amendment to Oil, Gas, and Mineral Lease is a legal document that modifies the original terms and conditions of a lease agreement related to the exploration, extraction, and production of oil, gas, and mineral resources in the Corpus Christi region of Texas. This amendment is crucial in protecting the rights and interests of both the lessor (landowner) and the lessee (oil, gas, or mineral company) and ensures clarity regarding the lease terms. The amendment can cover various aspects, including but not limited to lease duration, royalty rates, bonus payments, drilling obligations, production terms, and surface use provisions. This document is essential for addressing any changes or updates required to align with the evolving industry practices, regulatory requirements, and technological advancements. In Corpus Christi, there may be different types of amendments based on specific circumstances and needs. Some of these include: 1. Extension Amendment: This type of amendment addresses the extension of the original lease period. It outlines the terms and conditions for the extended lease duration, such as rental payments, royalty rates, and additional drilling obligations. 2. Royalty Amendment: This amendment focuses on modifications to the royalty rate, which is the percentage of production value paid to the lessor. It may include adjustments based on market conditions, new regulations, or changes in the overall industry landscape. 3. Surface Use Amendment: If changes are required regarding the access or use of surface areas for drilling, construction, or related activities, a surface use amendment is necessary. This amendment outlines any alterations to the surface rights, measures to protect the environment, and compensation for any surface damages. 4. Bonus Payment Amendment: A bonus payment is an upfront fee paid by the lessee to the lessor upon signing the lease agreement. If adjustments to the bonus payment terms need to be made, such as installment options or changes in payment amount, a bonus payment amendment is created. 5. Obligation Amendment: This type of amendment addresses modifications to drilling and production obligations. It may cover changes to the number of wells to be drilled, minimum production thresholds, or alternative drilling requirements. The nature and content of Corpus Christi Texas Amendments to Oil, Gas, and Mineral Lease depend on the specific circumstances and the agreements reached between the involved parties. It is crucial to consult legal professionals or experts in oil, gas, and mineral lease agreements to ensure the amendment accurately reflects the desired changes while protecting the rights and interests of both parties.The Corpus Christi Texas Amendment to Oil, Gas, and Mineral Lease is a legal document that modifies the original terms and conditions of a lease agreement related to the exploration, extraction, and production of oil, gas, and mineral resources in the Corpus Christi region of Texas. This amendment is crucial in protecting the rights and interests of both the lessor (landowner) and the lessee (oil, gas, or mineral company) and ensures clarity regarding the lease terms. The amendment can cover various aspects, including but not limited to lease duration, royalty rates, bonus payments, drilling obligations, production terms, and surface use provisions. This document is essential for addressing any changes or updates required to align with the evolving industry practices, regulatory requirements, and technological advancements. In Corpus Christi, there may be different types of amendments based on specific circumstances and needs. Some of these include: 1. Extension Amendment: This type of amendment addresses the extension of the original lease period. It outlines the terms and conditions for the extended lease duration, such as rental payments, royalty rates, and additional drilling obligations. 2. Royalty Amendment: This amendment focuses on modifications to the royalty rate, which is the percentage of production value paid to the lessor. It may include adjustments based on market conditions, new regulations, or changes in the overall industry landscape. 3. Surface Use Amendment: If changes are required regarding the access or use of surface areas for drilling, construction, or related activities, a surface use amendment is necessary. This amendment outlines any alterations to the surface rights, measures to protect the environment, and compensation for any surface damages. 4. Bonus Payment Amendment: A bonus payment is an upfront fee paid by the lessee to the lessor upon signing the lease agreement. If adjustments to the bonus payment terms need to be made, such as installment options or changes in payment amount, a bonus payment amendment is created. 5. Obligation Amendment: This type of amendment addresses modifications to drilling and production obligations. It may cover changes to the number of wells to be drilled, minimum production thresholds, or alternative drilling requirements. The nature and content of Corpus Christi Texas Amendments to Oil, Gas, and Mineral Lease depend on the specific circumstances and the agreements reached between the involved parties. It is crucial to consult legal professionals or experts in oil, gas, and mineral lease agreements to ensure the amendment accurately reflects the desired changes while protecting the rights and interests of both parties.