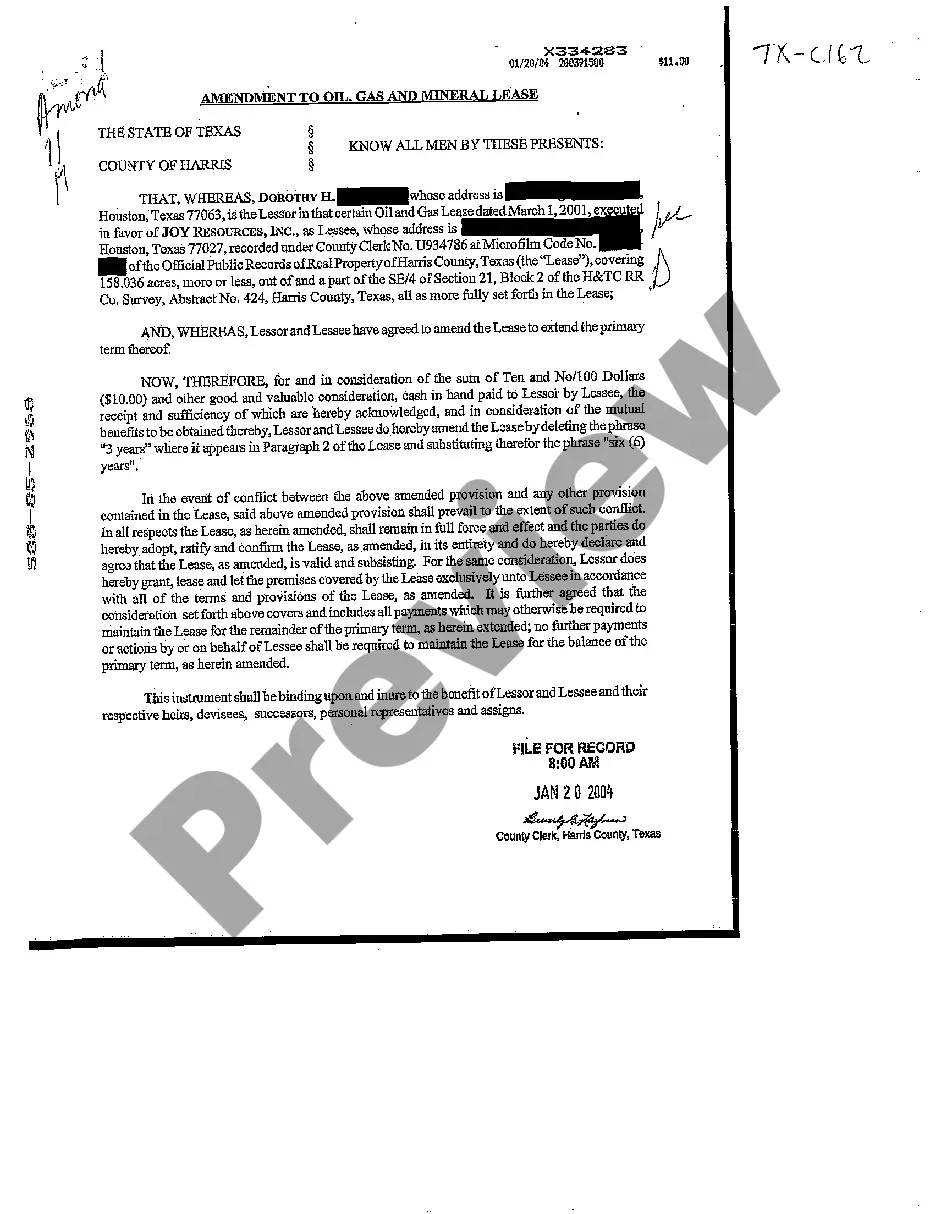

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Harris Texas Amendment to Oil, Gas, and Mineral Lease refers to a legal document that modifies or adds specific provisions to an existing lease agreement pertaining to oil, gas, and mineral exploration and extraction in the Harris County, Texas area. This amendment is crucial as it enables the parties involved to address any changes, updates, or clarifications necessary to the original lease agreement. Keywords: Harris Texas, Amendment, Oil, Gas, Mineral Lease, exploration, extraction, Harris County, Texas. The Harris Texas Amendment to Oil, Gas, and Mineral Lease can vary based on the requirements and circumstances of the parties involved. Here are a few common types of amendments: 1. Extension Amendment: This type of amendment extends the duration of the original lease agreement beyond the initially agreed-upon period. It may include provisions related to the extension timeframe, renewal terms, and any associated costs or fees. 2. Royalty Amendment: A royalty amendment modifies the percentage of royalties paid to the lessor (landowner) by the lessee (oil, gas, or mineral company) for the extraction or production of resources from the leased property. The amendment may address changes to the royalty rate, payment frequency, or any other related conditions. 3. Surface Rights Amendment: This amendment focuses on surface access rights granted to the lessee for conducting exploration, drilling, or other activities on the leased property surface. It may outline the scope of surface operations, environmental protection measures, indemnification clauses, and financial compensation for surface damage. 4. Assignment Amendment: An assignment amendment permits the transfer of the leased property rights from the original lessee to a third party. It will establish the terms, conditions, and consent requirements for transferring or assigning the lease to ensure compliance with local laws and regulations. 5. Pooling Amendment: In situations where multiple leases might be combined to develop a larger drilling unit, a pooling amendment establishes the terms for pooling or unitization between multiple leaseholders. It addresses matters such as sharing production costs, revenue allocation, and the establishment of the pooled unit boundaries. 6. Force Mature Amendment: This type of amendment deals with unforeseen circumstances that may impact the lessee's ability to perform under the lease agreement, such as natural disasters, wars, or governmental actions. It outlines the rights and responsibilities of each party during the force majeure event, including the potential suspension of obligations. It's important to consult legal professionals or experts in the oil, gas, and mineral industry to draft or interpret the specific details of a Harris Texas Amendment to Oil, Gas, and Mineral Lease in accordance with applicable laws and regulations.The Harris Texas Amendment to Oil, Gas, and Mineral Lease refers to a legal document that modifies or adds specific provisions to an existing lease agreement pertaining to oil, gas, and mineral exploration and extraction in the Harris County, Texas area. This amendment is crucial as it enables the parties involved to address any changes, updates, or clarifications necessary to the original lease agreement. Keywords: Harris Texas, Amendment, Oil, Gas, Mineral Lease, exploration, extraction, Harris County, Texas. The Harris Texas Amendment to Oil, Gas, and Mineral Lease can vary based on the requirements and circumstances of the parties involved. Here are a few common types of amendments: 1. Extension Amendment: This type of amendment extends the duration of the original lease agreement beyond the initially agreed-upon period. It may include provisions related to the extension timeframe, renewal terms, and any associated costs or fees. 2. Royalty Amendment: A royalty amendment modifies the percentage of royalties paid to the lessor (landowner) by the lessee (oil, gas, or mineral company) for the extraction or production of resources from the leased property. The amendment may address changes to the royalty rate, payment frequency, or any other related conditions. 3. Surface Rights Amendment: This amendment focuses on surface access rights granted to the lessee for conducting exploration, drilling, or other activities on the leased property surface. It may outline the scope of surface operations, environmental protection measures, indemnification clauses, and financial compensation for surface damage. 4. Assignment Amendment: An assignment amendment permits the transfer of the leased property rights from the original lessee to a third party. It will establish the terms, conditions, and consent requirements for transferring or assigning the lease to ensure compliance with local laws and regulations. 5. Pooling Amendment: In situations where multiple leases might be combined to develop a larger drilling unit, a pooling amendment establishes the terms for pooling or unitization between multiple leaseholders. It addresses matters such as sharing production costs, revenue allocation, and the establishment of the pooled unit boundaries. 6. Force Mature Amendment: This type of amendment deals with unforeseen circumstances that may impact the lessee's ability to perform under the lease agreement, such as natural disasters, wars, or governmental actions. It outlines the rights and responsibilities of each party during the force majeure event, including the potential suspension of obligations. It's important to consult legal professionals or experts in the oil, gas, and mineral industry to draft or interpret the specific details of a Harris Texas Amendment to Oil, Gas, and Mineral Lease in accordance with applicable laws and regulations.