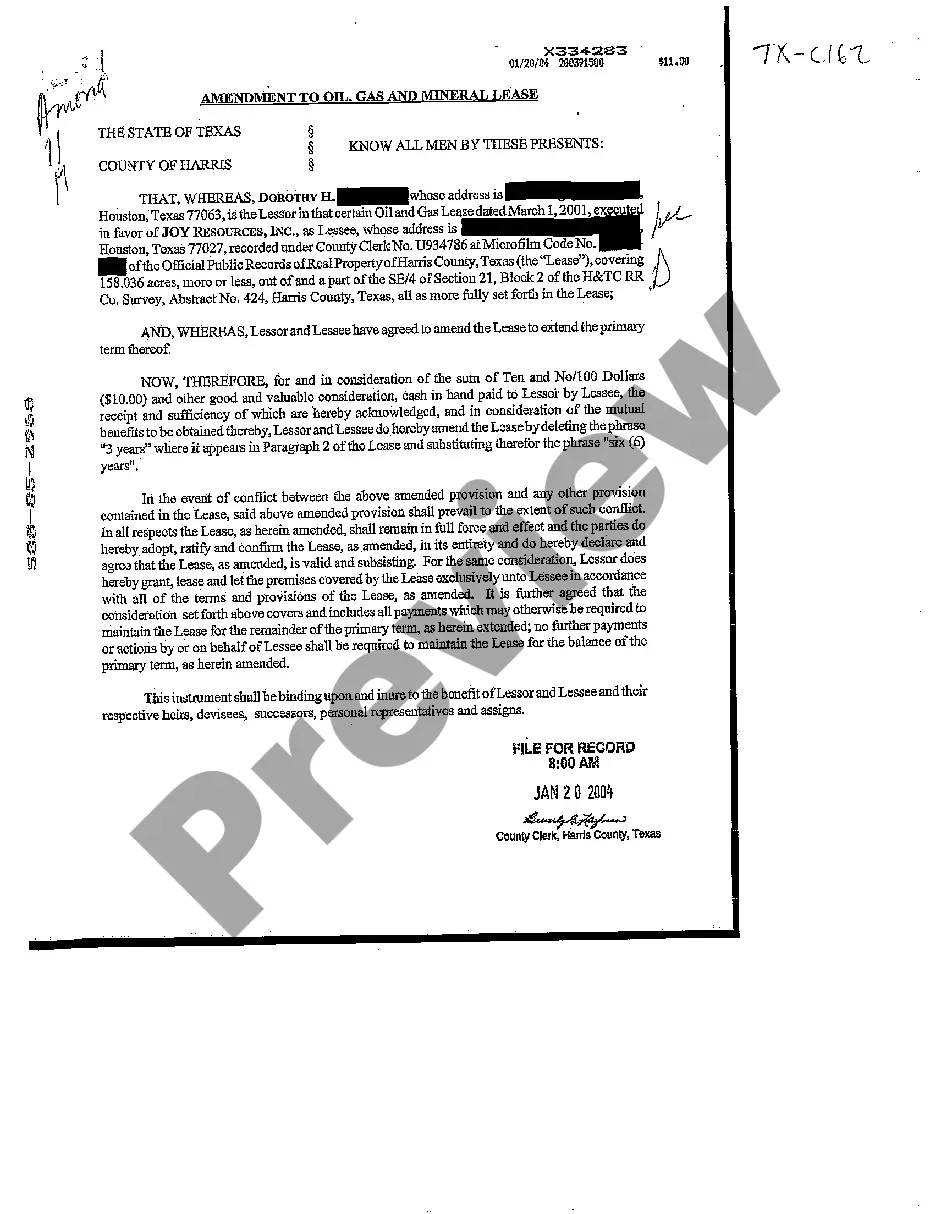

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Pasadena Texas Amendment to Oil, Gas, and Mineral Lease is a legal document that specifies modifications or updates made to an existing lease agreement pertaining to oil, gas, and mineral rights in Pasadena, Texas. This amendment is significant for ensuring the fair and lawful usage of these resources while protecting the rights and interests of both the lessor (landowner) and the lessee (oil, gas, or mineral company). Some potential keywords and phrases that can be used to describe the Pasadena Texas Amendment to Oil, Gas, and Mineral Lease are as follows: 1. Lease modification: The amendment serves as a modification to an existing lease agreement. 2. Pasadena, Texas: The document is specifically relevant to the city of Pasadena, located in the state of Texas. 3. Oil, gas, and mineral rights: The lease pertains to the rights to extract or utilize oil, gas, and other minerals present on a particular property. 4. Lessor: The landowner who grants the lease to the lessee. 5. Lessee: The company or entity that receives the lease and is authorized to explore, drill, extract, or produce oil, gas, or minerals on the leased property. 6. Rights and interests: The amendment clarifies and protects the rights and interests of both the lessor and lessee in utilizing the leased resources. 7. Legal document: The Pasadena Texas Amendment to Oil, Gas, and Mineral Lease is a legally binding document that requires adherence to specific terms and conditions. 8. Resource extraction: The amendment outlines rules and regulations in relation to the extraction of resources, ensuring responsible and sustainable practices. 9. Environmental considerations: The Pasadena Texas Amendment may address environmental concerns and specify measures or regulations to minimize the impact of resource extraction on the environment and surrounding communities. 10. Compensation and royalties: The amendment may encompass provisions regarding the payments and royalties to be provided to the lessor in exchange for granting access to the leased property. Regarding different types of Pasadena Texas Amendments to Oil, Gas, and Mineral Lease, it is possible to encounter various amendments based on the nature and scope of modifications made to the original lease agreement. These may include: 1. Term extension: An amendment that extends the duration of the lease beyond its original agreed-upon term. 2. Acreage expansion: This type of amendment allows the lessee to broaden the area covered by the lease, potentially expanding their operations. 3. Additional resource exploration: An amendment granting the lessee permission to explore and extract additional resources beyond those initially specified in the original lease. 4. Use of advanced extraction technologies: An amendment that permits the lessee to employ new technologies or techniques for resource extraction, ensuring the lease stays up-to-date with evolving industry practices. 5. Environmental compliance: This type of amendment focuses on incorporating stricter environmental regulations aimed at reducing the negative impacts of resource extraction activities. 6. Compensation and royalty adjustments: An amendment that revises the financial terms, compensation, or royalty rates outlined in the original lease agreement. 7. Obligations and responsibilities: This type of amendment may modify or clarify the obligations and responsibilities of both the lessor and lessee regarding the lease agreement. It is important to consult legal professionals or relevant authorities to obtain accurate and up-to-date information on specific variations or types of Pasadena Texas Amendments to Oil, Gas, and Mineral Lease that may exist.