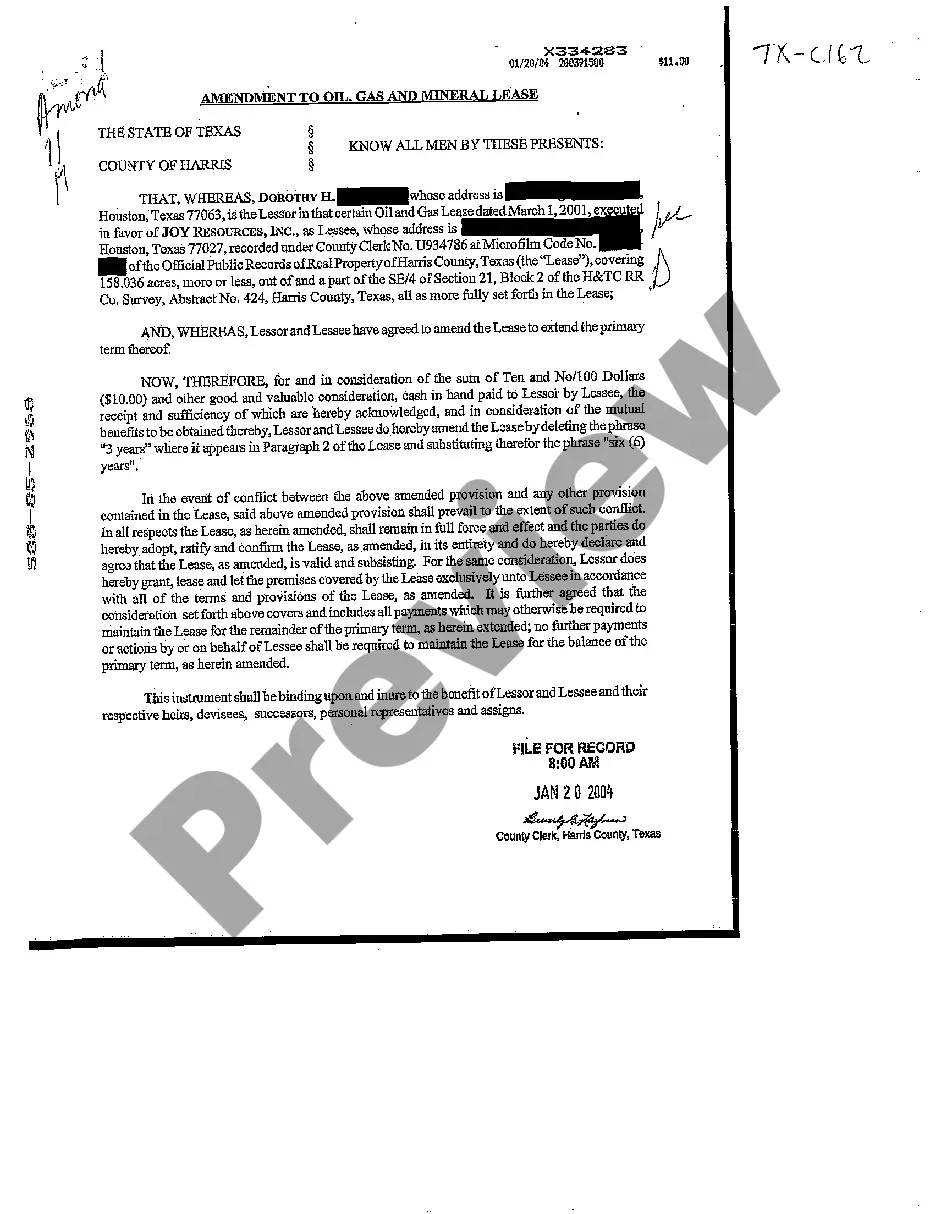

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease refers to the modifications or revisions made to an existing lease agreement pertaining to oil, gas, and mineral rights in Sugar Land, Texas. This amendment is crucial in adapting the terms and conditions of the lease to the changing circumstances or requirements of the parties involved. By incorporating relevant keywords, the following content provides a detailed description of what the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease entails: 1. Purpose of the Amendment: The Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease aims to update, alter, or supplement the original lease agreement between the lessor and lessee regarding the exploration, extraction, and utilization of oil, gas, and mineral resources within specified properties in Sugar Land, Texas. This amendment allows the parties to address any changes in regulations, advancements in technology, financial arrangements, or other circumstances impacting their original lease agreement. 2. Key Provisions: a. Expansion or Reduction of Leased Areas: The amendment may include provisions allowing for the expansion or reduction of the leased areas based on the parties' requirements, potential discoveries, or economic conditions affecting the oil, gas, and mineral industry. b. Adjustments in Royalty Payments: The amendment may outline modifications to the royalty payment terms in the original lease agreement. This can involve adjusting the percentage of revenue paid to the lessor for the extraction and sale of oil, gas, or other minerals from the leased premises. c. Changes in Lease Term: The amendment can extend or shorten the lease term specified in the original agreement. The parties may opt for an extension to continue exploration and extraction activities, or a shorter term due to changes in economic viability or other factors. d. Alterations to Payment and Accounting Procedures: The amendment may introduce amendments to the methods of payment, invoicing, accounting, and reporting requirements to ensure transparency and efficiency in financial transactions related to the lease. e. Surface and Environmental Considerations: The amendment may address matters concerning surface usage, environmental obligations, reclamation efforts, and the implementation of best practices mitigating any potential negative impact caused by the extraction activities. 3. Types of Sugar Land Texas Amendments to Oil, Gas, and Mineral Lease: The specific types of amendments to the lease agreement may vary depending on the circumstances, preferences of the parties involved, and industry dynamics. Some possible variants of the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease include: a. Extension or Renewal Amendment: This type of amendment is used to extend the lease period beyond the original termination date to continue exploring or extracting oil, gas, or mineral resources. b. Area Modification Amendment: This amendment deals with changes in the leased area, either expanding or reducing the land covered by the lease agreement. c. Royalty Adjustment Amendment: This amendment focuses on modifying the royalty payment terms, which might include alterations to the royalty percentage, payment frequency, or accounting practices. d. Financial or Contractual Amendment: This amendment encompasses any revisions related to financial arrangements, billing procedures, accounting methods, or indemnification clauses between the lessor and lessee. e. Environmental Compliance Amendment: This amendment specifically addresses updates or enhancements related to environmental regulations, surface usage, reclamation requirements, or other environmental obligations specified in the lease agreement. In summary, the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease involves modifying and updating the terms and conditions of the original lease agreement to adapt to changing circumstances or financial considerations surrounding the exploration, extraction, and utilization of oil, gas, and mineral resources. By understanding the significance of relevant keywords and outlining various types of amendments, this content provides a detailed description of what the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease entails.The Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease refers to the modifications or revisions made to an existing lease agreement pertaining to oil, gas, and mineral rights in Sugar Land, Texas. This amendment is crucial in adapting the terms and conditions of the lease to the changing circumstances or requirements of the parties involved. By incorporating relevant keywords, the following content provides a detailed description of what the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease entails: 1. Purpose of the Amendment: The Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease aims to update, alter, or supplement the original lease agreement between the lessor and lessee regarding the exploration, extraction, and utilization of oil, gas, and mineral resources within specified properties in Sugar Land, Texas. This amendment allows the parties to address any changes in regulations, advancements in technology, financial arrangements, or other circumstances impacting their original lease agreement. 2. Key Provisions: a. Expansion or Reduction of Leased Areas: The amendment may include provisions allowing for the expansion or reduction of the leased areas based on the parties' requirements, potential discoveries, or economic conditions affecting the oil, gas, and mineral industry. b. Adjustments in Royalty Payments: The amendment may outline modifications to the royalty payment terms in the original lease agreement. This can involve adjusting the percentage of revenue paid to the lessor for the extraction and sale of oil, gas, or other minerals from the leased premises. c. Changes in Lease Term: The amendment can extend or shorten the lease term specified in the original agreement. The parties may opt for an extension to continue exploration and extraction activities, or a shorter term due to changes in economic viability or other factors. d. Alterations to Payment and Accounting Procedures: The amendment may introduce amendments to the methods of payment, invoicing, accounting, and reporting requirements to ensure transparency and efficiency in financial transactions related to the lease. e. Surface and Environmental Considerations: The amendment may address matters concerning surface usage, environmental obligations, reclamation efforts, and the implementation of best practices mitigating any potential negative impact caused by the extraction activities. 3. Types of Sugar Land Texas Amendments to Oil, Gas, and Mineral Lease: The specific types of amendments to the lease agreement may vary depending on the circumstances, preferences of the parties involved, and industry dynamics. Some possible variants of the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease include: a. Extension or Renewal Amendment: This type of amendment is used to extend the lease period beyond the original termination date to continue exploring or extracting oil, gas, or mineral resources. b. Area Modification Amendment: This amendment deals with changes in the leased area, either expanding or reducing the land covered by the lease agreement. c. Royalty Adjustment Amendment: This amendment focuses on modifying the royalty payment terms, which might include alterations to the royalty percentage, payment frequency, or accounting practices. d. Financial or Contractual Amendment: This amendment encompasses any revisions related to financial arrangements, billing procedures, accounting methods, or indemnification clauses between the lessor and lessee. e. Environmental Compliance Amendment: This amendment specifically addresses updates or enhancements related to environmental regulations, surface usage, reclamation requirements, or other environmental obligations specified in the lease agreement. In summary, the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease involves modifying and updating the terms and conditions of the original lease agreement to adapt to changing circumstances or financial considerations surrounding the exploration, extraction, and utilization of oil, gas, and mineral resources. By understanding the significance of relevant keywords and outlining various types of amendments, this content provides a detailed description of what the Sugar Land Texas Amendment to Oil, Gas, and Mineral Lease entails.