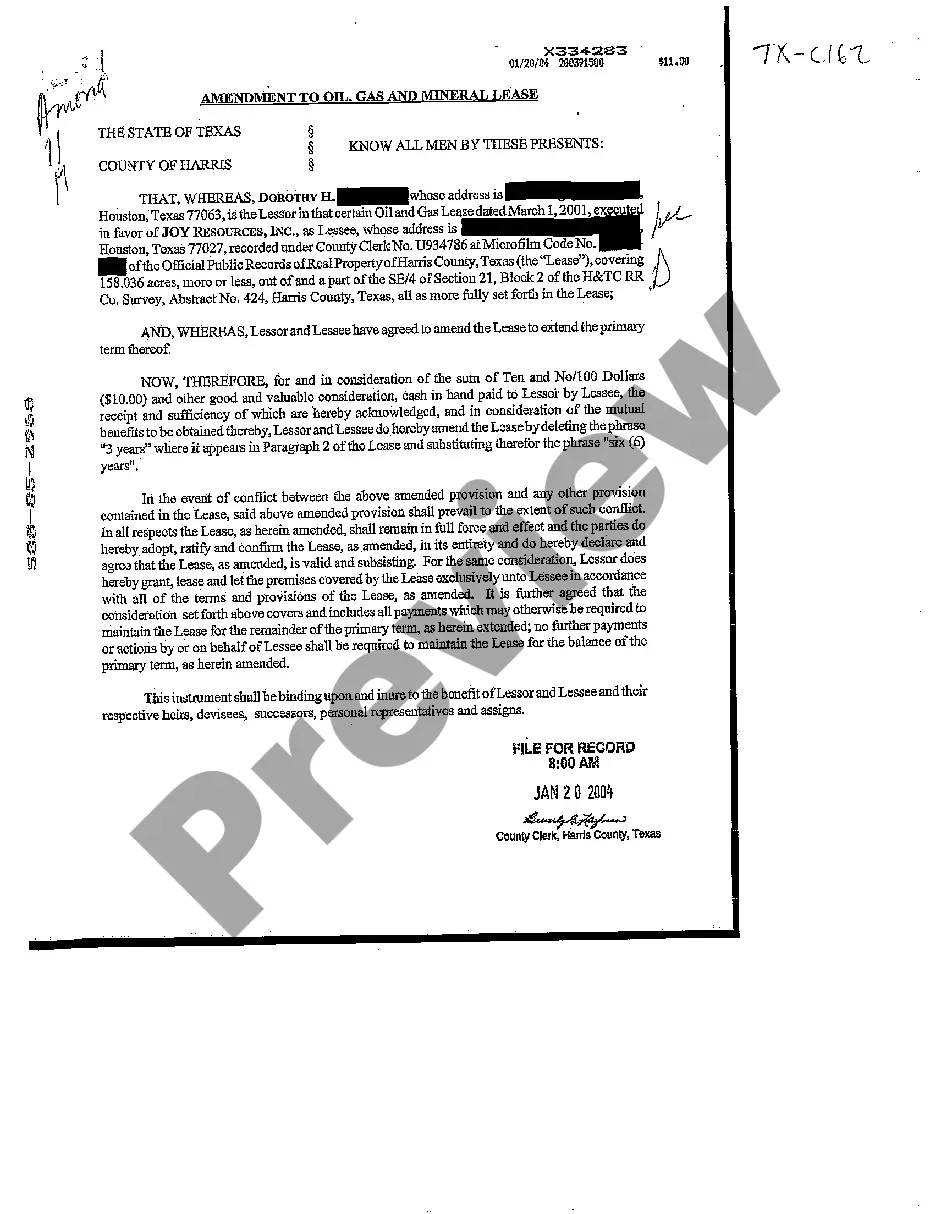

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Tarrant Texas Amendment to Oil, Gas, and Mineral Lease is a legal document that serves as an addendum or modification to an existing lease agreement in the field of natural resources extraction. This amendment is specific to Tarrant County, Texas, and contains provisions specifically tailored to address the unique requirements and regulations governing oil, gas, and mineral rights in the area. Through this amendment, various aspects of the original lease agreement are updated, revised, or expanded upon to better align them with current local laws, industry standards, environmental regulations, and landowner protection. It is crucial to understand that there might be different types of Tarrant Texas Amendments to Oil, Gas, and Mineral Lease, each addressing specific needs related to mineral extraction and leasing in the area. Here are a few possible types: 1. Royalty Adjustment Amendment: This type of amendment may be necessary when there is a need to modify the royalty percentages or calculation methods outlined in the original lease. It ensures that the landowner receives fair compensation based on the market value of extracted resources. 2. Surface Rights Protection Amendment: In situations where landowners want to safeguard their surface rights and protect their properties from potential damages caused by oil, gas, and mineral extraction activities, a surface rights protection amendment could be added. This agreement may detail specific measures, such as restrictions on drilling locations or reclamation requirements after operations cease, aimed at minimizing surface disruption. 3. Environmental Compliance Amendment: Given the increasing concern for environmental sustainability, an environmental compliance amendment might incorporate and strengthen regulations and standards relating to environmental protection, waste management, emission controls, and restoration practices. This type of amendment ensures that operators adhere to the necessary guidelines to mitigate the ecological impact of resource extraction. 4. Lease Extension/Renewal Amendment: If the original lease is nearing its expiration date, a lease extension or renewal amendment can be appended to outline the terms and conditions for extending the lease period. This could involve renegotiating financial terms, adding new clauses, or simply extending the lease term. 5. Assignment and Subleasing Amendment: When a lessee wishes to transfer or assign their lease rights to another party, or if they intend to sublease the property to multiple operators, an assignment and subleasing amendment allows this transaction to take place. It governs the process, terms, and conditions for such transfer or sublease agreements. Each of these types of Tarrant Texas Amendments to Oil, Gas, and Mineral Lease serves a unique purpose and addresses specific concerns tied to mineral extraction and leasing in Tarrant County. As always, it is crucial to consult legal professionals well-versed in the local laws and regulations governing oil, gas, and mineral rights to ensure compliance and protect the interests of all parties involved.