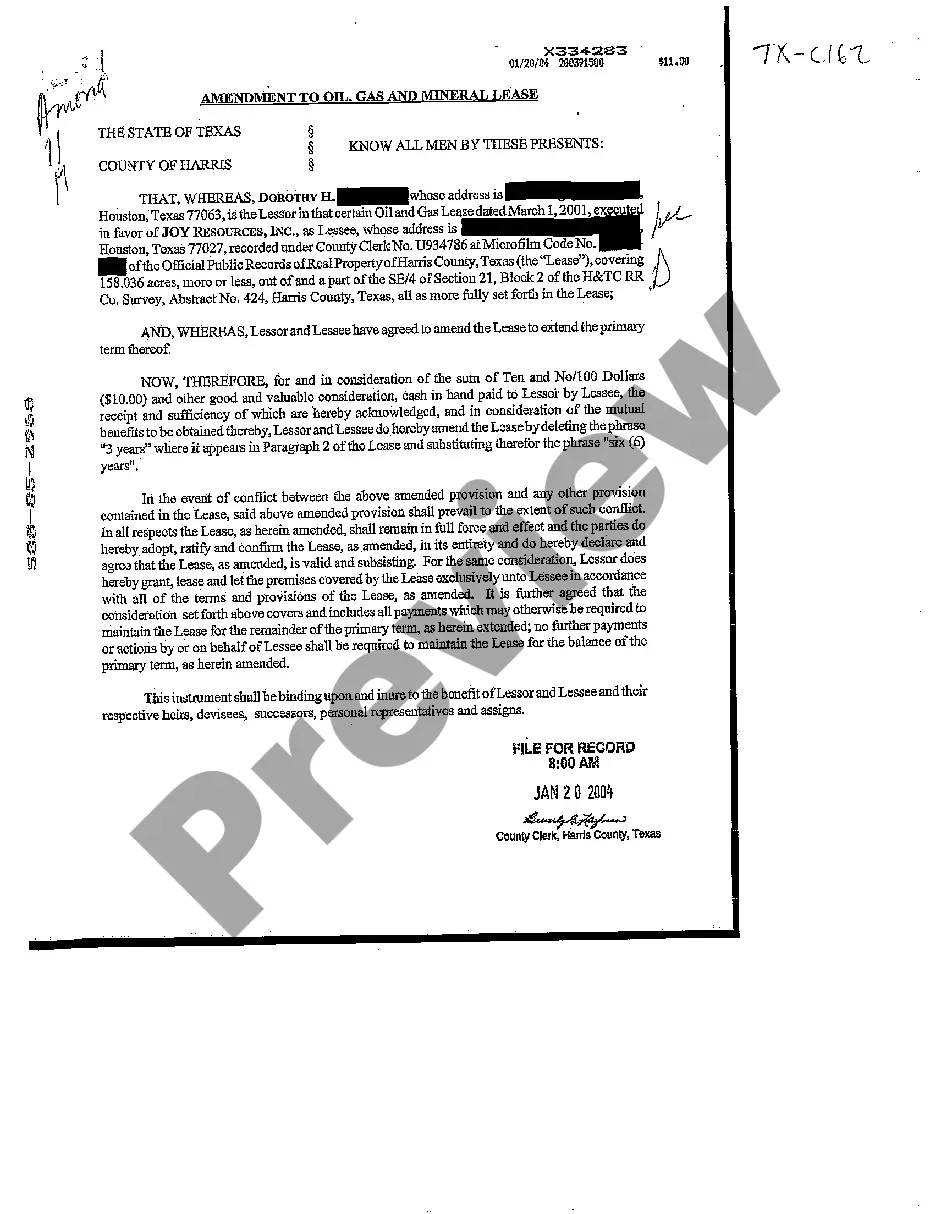

This form is used when the Lessee and the Lessor agree to amend the lease to extend the primary term from three years to six years. The terms and provisions of this amendment of the Lease is binding the the benefit of the Lessor and Lessee and their respecitve heirs, devisees, successors, and personal representatives.

The Wichita Falls Texas Amendment to Oil, Gas, and Mineral Lease refers to a legally binding document that modifies certain provisions and terms of an existing lease agreement pertaining to oil, gas, and mineral rights in the city of Wichita Falls, Texas. This amendment brings about changes or additions to the original lease contract, often addressing new developments, technology advancements, environmental considerations, or market fluctuations within the oil, gas, and mining industries. There are several types of amendments that can be found in the context of the Wichita Falls Texas Amendment to Oil, Gas, and Mineral Lease. Some commonly encountered amendments are: 1. Extension Amendment: This type of amendment extends the term of the original lease agreement beyond its initial expiration date. It typically occurs when the lessee requires more time to fully exploit the mineral resources or in cases of new discoveries on the property. 2. Royalty Rate Amendment: This amendment focuses on altering the royalty rate specified in the original lease. It may be initiated to account for changing market conditions or to ensure fair compensation to the lessor without significantly affecting the lessee's profitability. 3. Surface Rights Amendment: This type of amendment addresses the rights and responsibilities of both parties concerning the use and access to the surface area of the property. It may regulate surface activities such as drilling operations, construction of infrastructure, and reclamation requirements while considering environmental impact and landowner concerns. 4. Production Obligation Amendment: This amendment modifies the production obligations of the lessee, specifying the minimum amount of oil, gas, or minerals that must be extracted within a given timeframe. It can be used to encourage the lessee to meet production goals or to allow flexibility in changing circumstances. 5. Assignment Amendment: This type of amendment deals with the transfer of the lease rights from one party to another. It outlines the conditions and terms under which the lease can be assigned, including consent requirements, financial obligations, and potential liabilities. 6. Pooling and Unitization Amendment: This amendment focuses on consolidating separate lease tracts or mineral rights into a single unit for efficient extraction, commonly known as unitization or pooling. It outlines the method of determining the lessee's share of royalties and the distribution of production among involved parties. These are just a few examples of the various types of amendments that can be associated with the Wichita Falls Texas Amendment to Oil, Gas, and Mineral Lease. It is important to consult legal professionals specializing in oil, gas, and mineral law to understand the specific provisions and implications of any lease amendment.