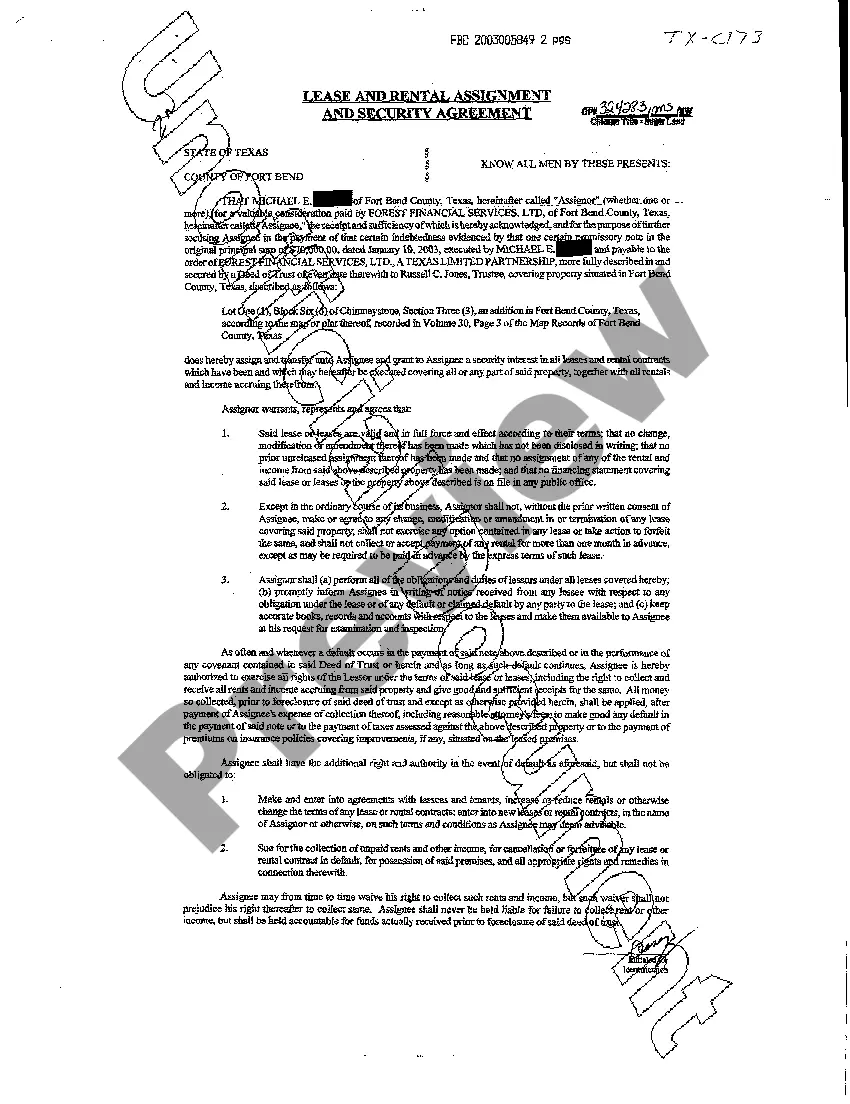

Abilene Texas Lease and Rental Assignment as Security for Loan is a legal agreement wherein a borrower assigns their lease or rental income as collateral for a loan in Abilene, Texas. This type of arrangement is commonly used by individuals or businesses looking to secure financing, leveraging the rental income from their property as assurance for lenders. The Abilene Texas Lease and Rental Assignment as Security for Loan provides the lender with a measure of protection by giving them a claim to the rental income generated by the property in case the borrower defaults on the loan. This type of collateral can be particularly advantageous for borrowers who may not have substantial physical assets to offer as collateral but have a reliable rental income stream. There are two main types of Abilene Texas Lease and Rental Assignment as Security for Loan: 1. Residential Lease Assignment: This type of assignment involves assigning the rental income from a residential property, such as a house, apartment, or condominium, as security for the loan. It is commonly used by homeowners or real estate investors to obtain financing while maintaining their property's usage and ownership. 2. Commercial Lease Assignment: In this case, a borrower assigns the rental income from a commercial property, such as an office building, retail space, or industrial facility, as security for the loan. This type of arrangement is frequently used by businesses to secure capital for expansion, renovations, or operational expenses. It is important to note that the specific terms and conditions of an Abilene Texas Lease and Rental Assignment as Security for Loan may vary depending on the lender and borrower's agreement. These agreements typically outline the duration, monthly rental income amounts, responsibilities, and conditions under which the lender can exercise their claim on the rental income. In conclusion, Abilene Texas Lease and Rental Assignment as Security for Loan is a legal arrangement where a borrower assigns their lease or rental income as collateral for a loan. This arrangement helps borrowers obtain financing by utilizing their rental income as assurance for lenders. The two main types are residential and commercial lease assignments.

Abilene Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Abilene Texas Lease And Rental Assignment As Security For Loan?

If you are looking for a relevant form template, it’s impossible to find a better platform than the US Legal Forms site – probably the most comprehensive libraries on the web. Here you can find a large number of document samples for company and individual purposes by types and states, or key phrases. With our high-quality search function, getting the most recent Abilene Texas Lease and Rental Assignment as Security for Loan is as easy as 1-2-3. Furthermore, the relevance of every document is verified by a group of expert attorneys that on a regular basis check the templates on our website and update them based on the latest state and county requirements.

If you already know about our platform and have a registered account, all you should do to get the Abilene Texas Lease and Rental Assignment as Security for Loan is to log in to your user profile and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the sample you need. Read its explanation and use the Preview function to see its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to find the appropriate document.

- Affirm your choice. Select the Buy now option. Next, pick your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Obtain the template. Pick the format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Abilene Texas Lease and Rental Assignment as Security for Loan.

Each and every template you add to your user profile has no expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you want to get an additional copy for enhancing or creating a hard copy, you can come back and download it once again at any time.

Make use of the US Legal Forms extensive catalogue to gain access to the Abilene Texas Lease and Rental Assignment as Security for Loan you were seeking and a large number of other professional and state-specific samples in one place!