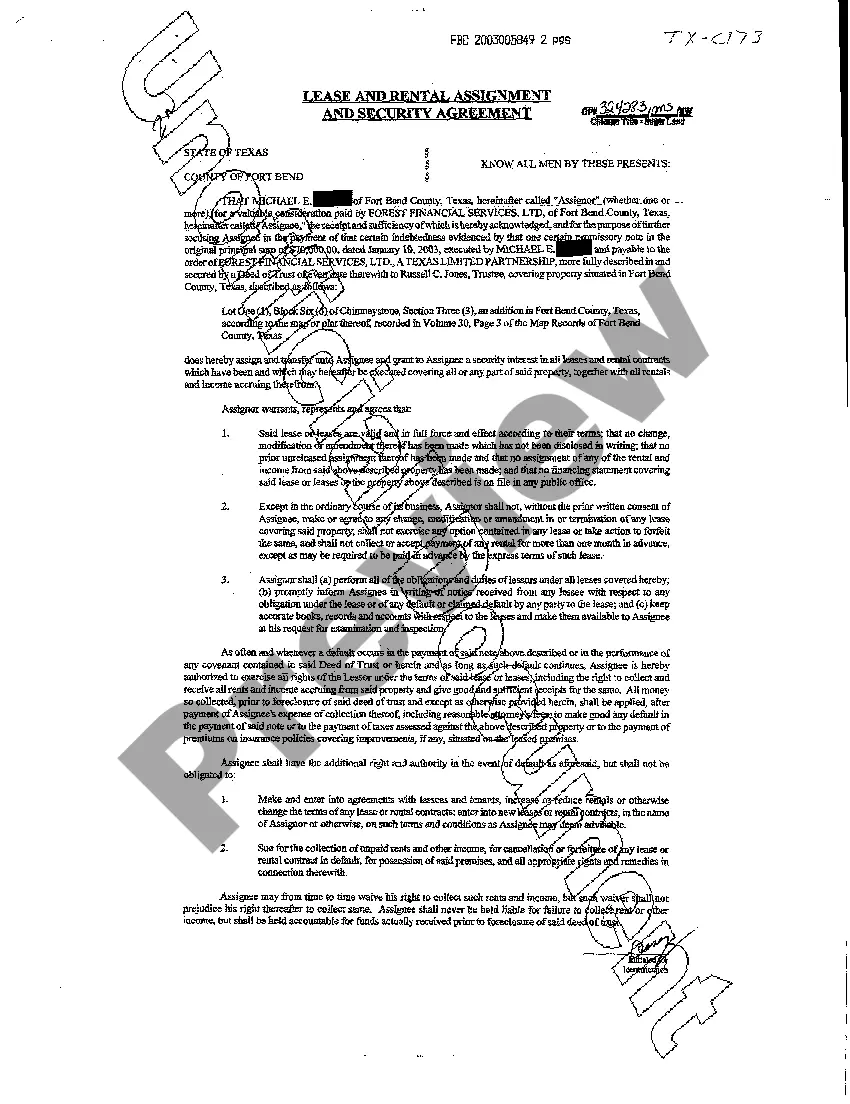

Arlington Texas Lease and Rental Assignment as Security for Loan: A Comprehensive Overview In Arlington, Texas, lease and rental assignment as security for loan refers to a legally-binding agreement where a borrower, seeking financial assistance, uses their leased or rented property as collateral to secure a loan. This arrangement provides lenders with added security by giving them the right to take possession of the property in case of default. Arlington offers various types of lease and rental assignment as security for loan, designed to cater to different circumstances and borrower needs. Here are some common types: 1. Residential Property Assignment: Many individuals in Arlington rely on this type of arrangement to secure loans. With a residential property lease and rental assignment, borrowers pledge their leased apartments, houses, or condominiums as collateral, providing lenders with assurance of repayment. 2. Commercial Property Assignment: This type of lease and rental assignment for loans involves businesses leveraging their leased or rented commercial properties, such as offices, retail spaces, or warehouses, as security. Lenders consider factors like location, lease duration, and market value while determining the loan amount. 3. Industrial Property Assignment: Companies leasing or renting industrial facilities, such as factories or manufacturing plants, can use this type of loan assignment. The lender assesses the property's operational value, lease terms, and equipment present to evaluate the loan's security. 4. Vacant Land or Plot Assignment: Borrowers intending to develop vacant land can rely on this type of assignment. Lenders ascertain the land's value, zoning restrictions, and potential for future development when providing loans against such properties. Important Considerations: 1. Assignment Agreement: Before finalizing the loan, all parties involved must sign an assignment agreement, specifying terms regarding the property's use as collateral, repayment obligations, and default consequences. 2. Lease or Rental Terms: The terms of the lease or rental agreement play a crucial role in loan assessment. Factors such as lease duration, rental yield, tenant stability, and property maintenance obligations influence the loan amount and interest rates. 3. Property Valuation: Lenders conduct extensive property valuation processes, considering factors like location, condition, market value, and demand trends, to determine the maximum loan amount they can offer. 4. Legal Process: In Arlington, the legal process for lease and rental assignment as security for loan typically involves drafting legal documents, recording the assignment with appropriate authorities, and ensuring compliance with State laws and regulations. 5. Default and Repossession: Should the borrower fail to fulfill loan repayment obligations, the lender has the right to repossess the property, following the legal processes outlined in the assignment agreement and applicable laws. In conclusion, Arlington Texas Lease and Rental Assignment as Security for Loan provides borrowers with an opportunity to leverage their leased or rented properties as collateral to secure loans. From residential to commercial and industrial properties, various types of lease and rental assignments cater to specific borrower needs. The agreement's details, property valuation, and legal aspects are critical considerations for both lenders and borrowers in this type of loan arrangement.

Arlington Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Arlington Texas Lease And Rental Assignment As Security For Loan?

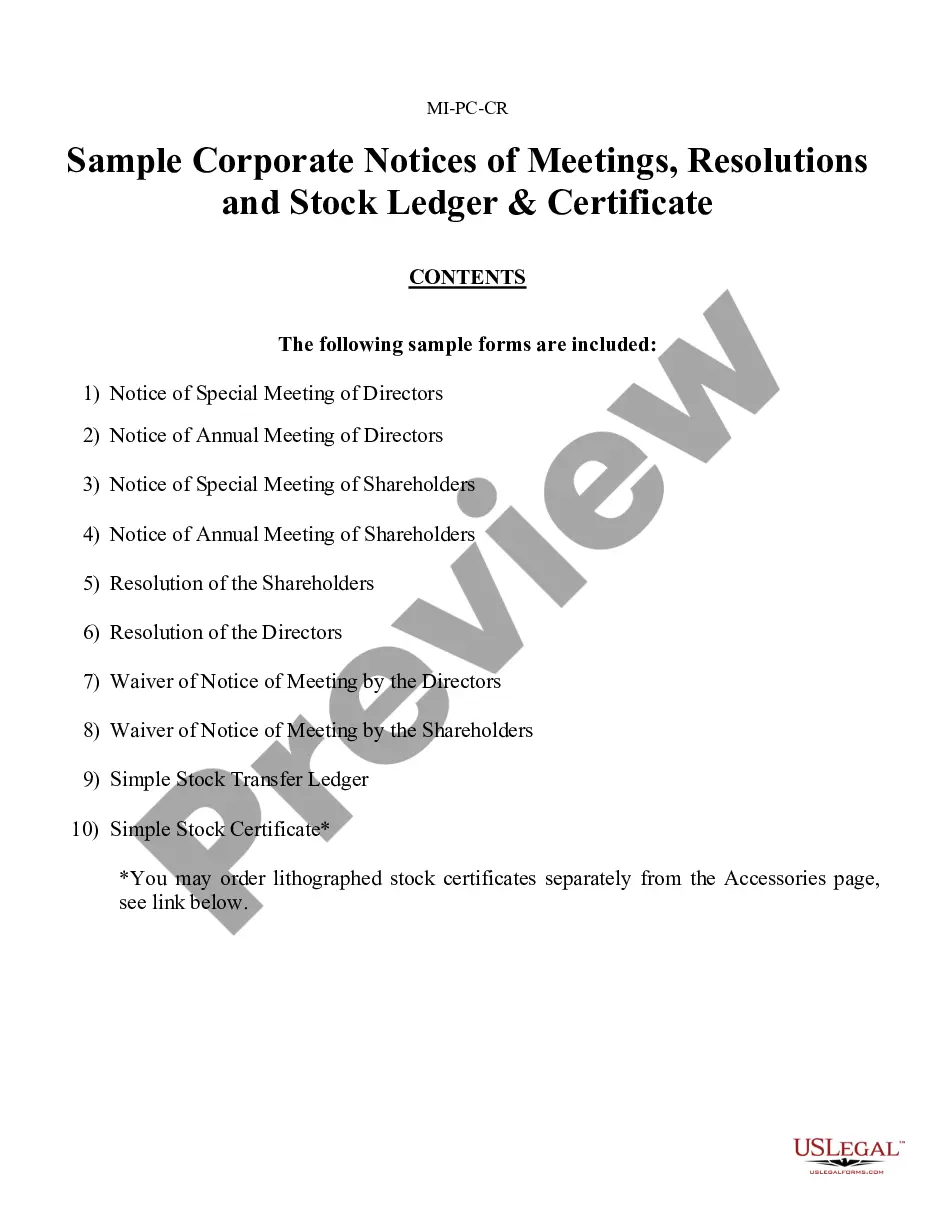

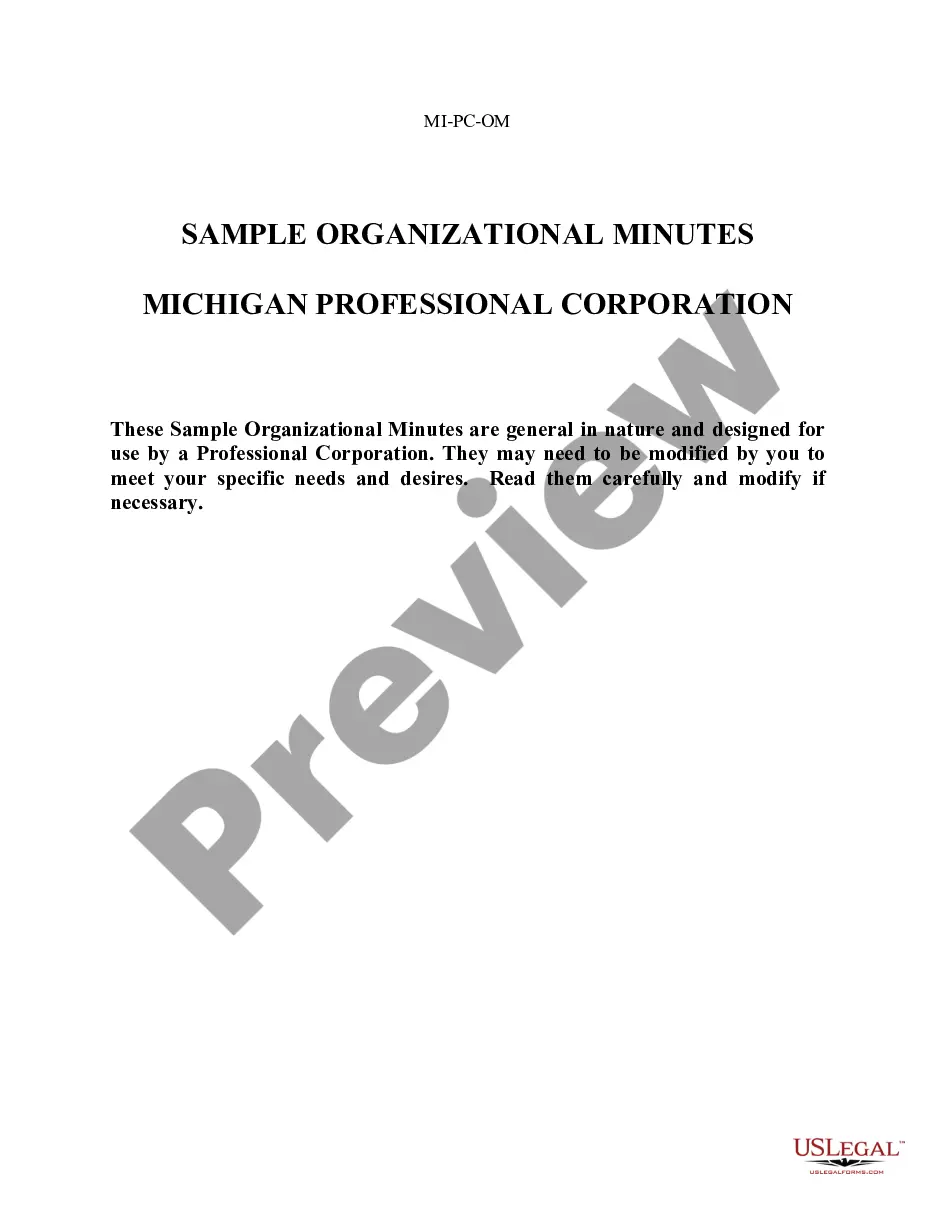

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any law background to create this sort of paperwork from scratch, mostly due to the convoluted jargon and legal nuances they come with. This is where US Legal Forms can save the day. Our service provides a huge library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you require the Arlington Texas Lease and Rental Assignment as Security for Loan or any other document that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Arlington Texas Lease and Rental Assignment as Security for Loan in minutes employing our trusted service. If you are presently an existing customer, you can go on and log in to your account to get the needed form.

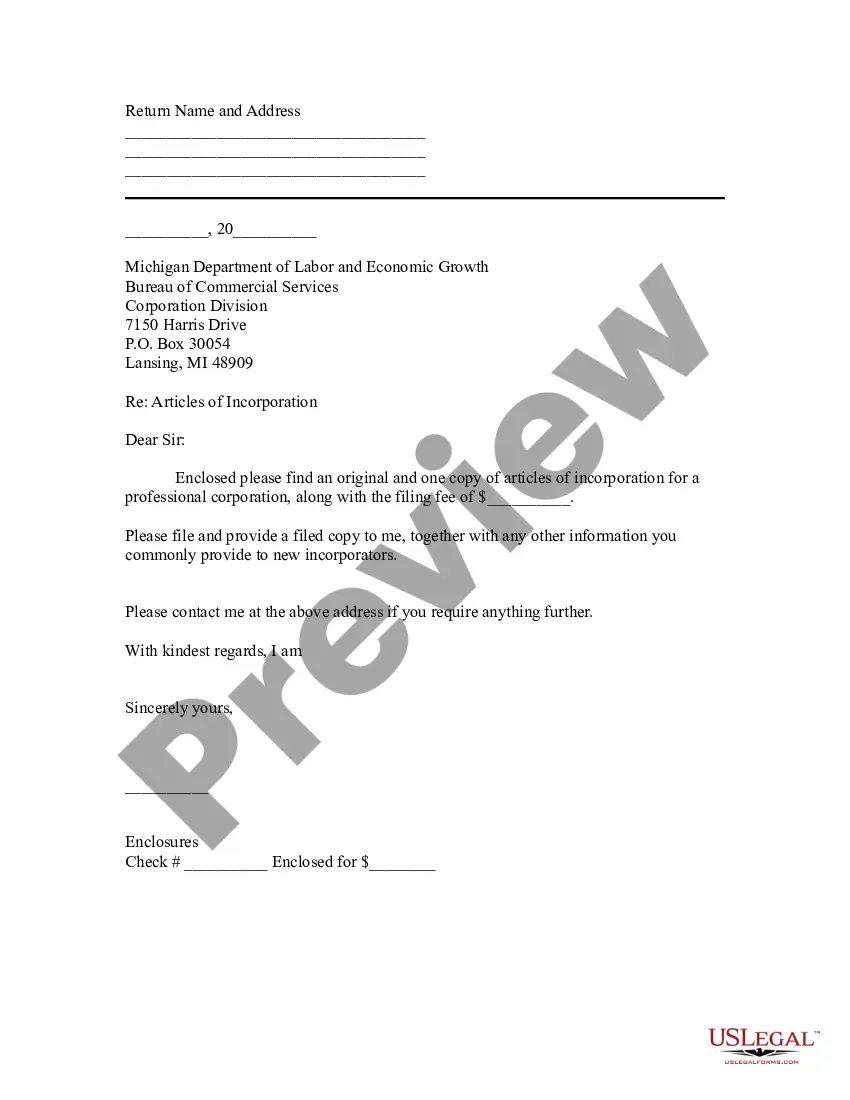

However, if you are a novice to our platform, make sure to follow these steps prior to downloading the Arlington Texas Lease and Rental Assignment as Security for Loan:

- Ensure the template you have chosen is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a brief description (if available) of scenarios the document can be used for.

- In case the one you selected doesn’t suit your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Arlington Texas Lease and Rental Assignment as Security for Loan once the payment is through.

You’re good to go! Now you can go on and print the form or fill it out online. If you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.