College Station Texas Lease and Rental Assignment serves as a security for loan transactions in which individuals or businesses use their lease or rental agreements as collateral to obtain loans from financial institutions. This arrangement allows borrowers to access much-needed financing by leveraging the value of their lease or rental contracts. In College Station, Texas, there are several types of Lease and Rental Assignments available as security for loans. These include: 1. Residential Rental Assignment: This type of assignment involves using residential rental agreements as security for loans. Individuals who own or manage rental properties in College Station can pledge their residential leases to financial institutions to secure loans for various purposes, such as property upgrades, debt consolidation, or expanding their real estate investment portfolios. 2. Commercial Lease Assignment: Businesses operating in College Station can leverage their commercial lease agreements to secure loans from lenders. By assigning their commercial leases, business owners can access funding to cover operational costs, invest in business growth, or undertake commercial property renovations. 3. Industrial Property Rental Assignment: Industrial property owners or lessees in College Station can offer their industrial rental agreements as security for loans. This type of assignment enables them to unlock the potential value of their industrial leases and access capital to fund equipment purchases, inventory restocking, or business expansion. 4. Land Lease Assignment: Individuals or businesses owning or leasing land in College Station can opt for land lease assignment as a security for loans. By assigning their land lease agreements, borrowers can obtain financing for agricultural operations, development projects, or land acquisition purposes. Regardless of the specific type of Lease and Rental Assignment as Security for Loan in College Station, Texas, the process typically involves the following steps: 1. Loan Application: Borrowers must apply for a loan with a financial institution that accepts lease and rental assignments as collateral. They provide all necessary documentation, including the lease or rental agreement they intend to assign. 2. Loan Evaluation: Lenders evaluate the assigned lease or rental agreement to determine its value and viability as collateral. Factors such as the duration of the lease, rental income, the creditworthiness of tenants, and the property's location are assessed. 3. Loan Approval: If the assigned lease or rental agreement meets the lender's requirements, the loan is approved, and the borrower receives the funds necessary to fulfill their financial objectives. 4. Assignment Agreement: The borrower and lender enter into an assignment agreement, which legally transfers the rights and obligations of the lease or rental agreement from the borrower to the lender. This action provides the lender with security in case the borrower defaults on the loan. 5. Loan Repayment: Borrowers are responsible for repaying the loan within the agreed-upon terms, typically through monthly installments. Failure to fulfill loan obligations may result in the lender exercising their rights under the assignment agreement. In conclusion, College Station Texas Lease and Rental Assignment as Security for Loan enables individuals and businesses to access capital by using their lease or rental agreements as collateral. This arrangement encompasses various types of assignments, including residential rental, commercial lease, industrial property rental, and land lease assignments. By pledging these agreements, borrowers can secure loans and leverage their property's value to achieve their financial goals.

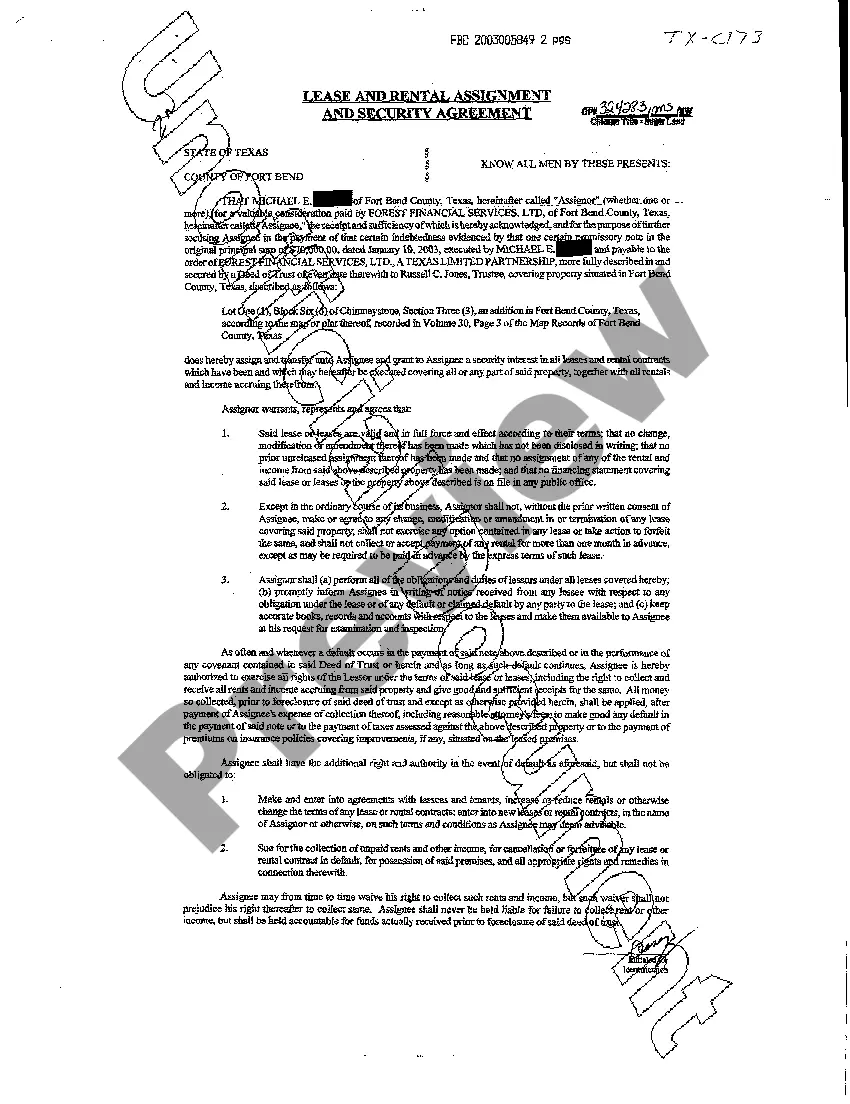

College Station Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out College Station Texas Lease And Rental Assignment As Security For Loan?

Do you need a trustworthy and inexpensive legal forms provider to buy the College Station Texas Lease and Rental Assignment as Security for Loan? US Legal Forms is your go-to option.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the College Station Texas Lease and Rental Assignment as Security for Loan conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is intended for.

- Start the search over if the template isn’t good for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the College Station Texas Lease and Rental Assignment as Security for Loan in any provided file format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online once and for all.