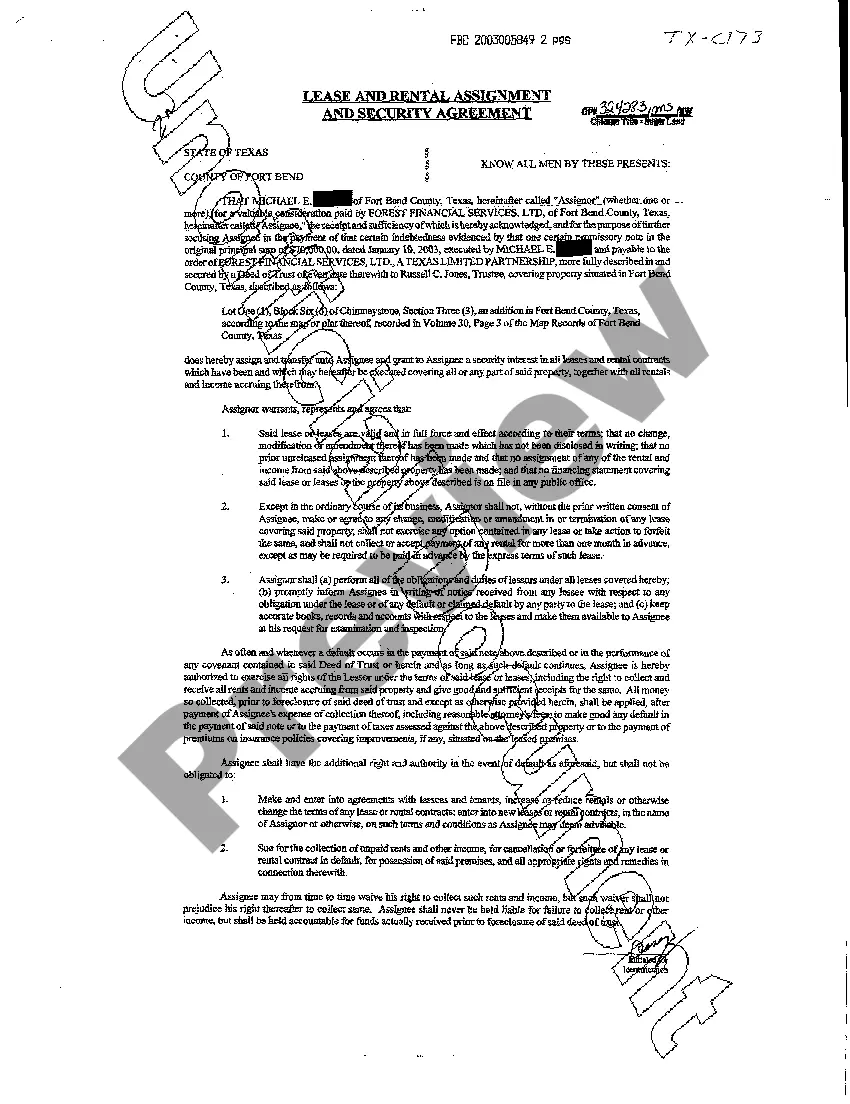

Harris Texas Lease and Rental Assignment as Security for Loan is a legal agreement used to secure a loan by assigning the lease and rental income of a property located in Harris County, Texas. This type of arrangement provides lenders with an additional layer of protection in case the borrower defaults on the loan. When a borrower seeks a loan using a property as collateral, they may need to provide various forms of security to ensure repayment. In Harris County, Texas, one option is to assign the lease and rental income of the property as collateral. This assignment grants the lender the right to receive the rent payments directly from tenants if the borrower fails to make loan payments as agreed. The Harris Texas Lease and Rental Assignment as Security for Loan typically includes specific terms and conditions that both the lender and borrower must abide by. These may include provisions regarding the amount and frequency of rent payments, responsibilities for property maintenance and repairs, and procedures for handling default or breach of the loan agreement. There are different types of Harris Texas Lease and Rental Assignment as Security for Loan, including: 1. Commercial Property Assignment: This type of assignment applies to commercial properties such as office buildings, retail spaces, or warehouses. The borrower assigns the lease and rental income generated by tenants in these properties as security for the loan. 2. Residential Property Assignment: In the case of residential properties, such as single-family homes, apartments, or condominiums, the borrower assigns the lease and rental income from tenants to secure the loan. This type of assignment is commonly used by real estate investors or individuals seeking financing for rental properties. 3. Mixed-Use Property Assignment: Some properties in Harris County may have a mix of residential and commercial units. In such cases, a mixed-use property assignment allows the borrower to assign both residential and commercial lease and rental income as security for the loan. By utilizing Harris Texas Lease and Rental Assignment as Security for Loan, lenders can reduce their risk and gain confidence in extending credit to borrowers. It provides an additional layer of protection by granting lenders the ability to collect rent directly in the event of default, ensuring a higher chance of recovering the loan amount. However, borrowers should carefully review the terms and implications of such assignments before entering into any agreement to ensure compliance and avoid potential conflicts in the future.

Harris Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Harris Texas Lease And Rental Assignment As Security For Loan?

If you are looking for a valid form, it’s extremely hard to find a more convenient place than the US Legal Forms website – probably the most extensive online libraries. Here you can find thousands of templates for business and individual purposes by categories and regions, or keywords. With the advanced search function, finding the most recent Harris Texas Lease and Rental Assignment as Security for Loan is as elementary as 1-2-3. In addition, the relevance of each record is confirmed by a group of expert lawyers that on a regular basis check the templates on our website and revise them according to the latest state and county laws.

If you already know about our system and have a registered account, all you need to receive the Harris Texas Lease and Rental Assignment as Security for Loan is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have chosen the form you want. Look at its information and make use of the Preview feature (if available) to check its content. If it doesn’t meet your needs, use the Search field near the top of the screen to find the proper file.

- Affirm your decision. Select the Buy now option. Following that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Choose the format and download it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Harris Texas Lease and Rental Assignment as Security for Loan.

Each form you save in your account does not have an expiry date and is yours forever. It is possible to access them using the My Forms menu, so if you want to have an additional version for editing or creating a hard copy, you may return and export it once more whenever you want.

Make use of the US Legal Forms professional catalogue to get access to the Harris Texas Lease and Rental Assignment as Security for Loan you were seeking and thousands of other professional and state-specific templates on a single platform!