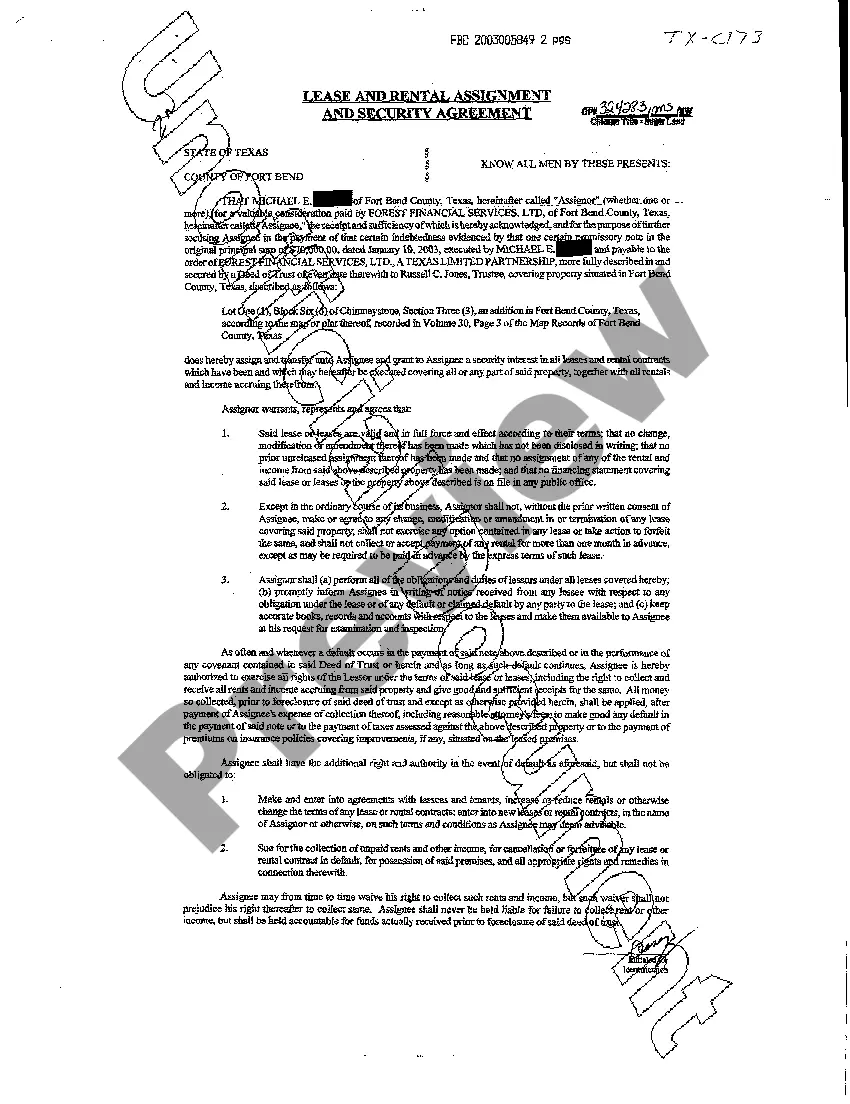

Houston Texas Lease and Rental Assignment as Security for Loan is a legal and financial agreement where a borrower assigns their lease or rental agreement as collateral for a loan. This arrangement enables individuals or businesses in Houston, Texas, to use their existing lease or rental income to secure a loan, providing lenders with an additional layer of security. The concept of Houston Texas Lease and Rental Assignment as Security for Loan is particularly relevant in the real estate industry, where the borrower owns a property and has a lease agreement with tenants. By assigning the lease or rental income to a lender, the borrower can access additional funds based on the projected rental income from the property. There are different types of Houston Texas Lease and Rental Assignment as Security for Loan, which primarily depend on the specific terms and conditions established between the borrower and the lender. Some common types include: 1. Residential Rental Assignment: This type is applicable when the borrower owns residential property, such as a house, apartment, or townhouse, and assigns the lease agreement with tenants as security for the loan. 2. Commercial Lease Assignment: In this case, the borrower assigns the lease agreement of commercial property, such as retail spaces, office buildings, or industrial warehouses, to secure the loan. 3. Single Property Assignment: This type involves assigning the lease or rental income from a single property, regardless of whether it is residential or commercial. 4. Portfolio Assignment: Portfolio assignment occurs when a borrower has multiple properties and assigns the combined rental income from these properties as security for a loan. This provides lenders with a broader base of income sources to mitigate risk. Houston Texas Lease and Rental Assignment as Security for Loan offers several advantages for both borrowers and lenders. Borrowers can access additional funds based on their existing lease or rental income without selling the property. It allows them to leverage their real estate assets to obtain financing for various purposes, such as renovations, debt consolidation, or investment opportunities. For lenders, this type of arrangement provides a secure investment by having a steady source of income as collateral. If the borrower defaults on the loan, the lender can take over the lease or rental agreement to recover their investment by collecting the rental income. Overall, Houston Texas Lease and Rental Assignment as Security for Loan is a beneficial financial mechanism that allows borrowers to unlock the value of their lease or rental income, providing them with liquidity, while giving lenders the confidence of a guaranteed income stream.

Houston Texas Lease and Rental Assignment as Security for Loan

State:

Texas

City:

Houston

Control #:

TX-C173

Format:

PDF

Instant download

This form is available by subscription

Description

Lease and Rental Assignment as Security for Loan

Houston Texas Lease and Rental Assignment as Security for Loan is a legal and financial agreement where a borrower assigns their lease or rental agreement as collateral for a loan. This arrangement enables individuals or businesses in Houston, Texas, to use their existing lease or rental income to secure a loan, providing lenders with an additional layer of security. The concept of Houston Texas Lease and Rental Assignment as Security for Loan is particularly relevant in the real estate industry, where the borrower owns a property and has a lease agreement with tenants. By assigning the lease or rental income to a lender, the borrower can access additional funds based on the projected rental income from the property. There are different types of Houston Texas Lease and Rental Assignment as Security for Loan, which primarily depend on the specific terms and conditions established between the borrower and the lender. Some common types include: 1. Residential Rental Assignment: This type is applicable when the borrower owns residential property, such as a house, apartment, or townhouse, and assigns the lease agreement with tenants as security for the loan. 2. Commercial Lease Assignment: In this case, the borrower assigns the lease agreement of commercial property, such as retail spaces, office buildings, or industrial warehouses, to secure the loan. 3. Single Property Assignment: This type involves assigning the lease or rental income from a single property, regardless of whether it is residential or commercial. 4. Portfolio Assignment: Portfolio assignment occurs when a borrower has multiple properties and assigns the combined rental income from these properties as security for a loan. This provides lenders with a broader base of income sources to mitigate risk. Houston Texas Lease and Rental Assignment as Security for Loan offers several advantages for both borrowers and lenders. Borrowers can access additional funds based on their existing lease or rental income without selling the property. It allows them to leverage their real estate assets to obtain financing for various purposes, such as renovations, debt consolidation, or investment opportunities. For lenders, this type of arrangement provides a secure investment by having a steady source of income as collateral. If the borrower defaults on the loan, the lender can take over the lease or rental agreement to recover their investment by collecting the rental income. Overall, Houston Texas Lease and Rental Assignment as Security for Loan is a beneficial financial mechanism that allows borrowers to unlock the value of their lease or rental income, providing them with liquidity, while giving lenders the confidence of a guaranteed income stream.

How to fill out Houston Texas Lease And Rental Assignment As Security For Loan?

If you’ve already utilized our service before, log in to your account and save the Houston Texas Lease and Rental Assignment as Security for Loan on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Houston Texas Lease and Rental Assignment as Security for Loan. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!