Irving Texas Lease and Rental Assignment as Security for Loan is a legal agreement that allows tenants in Irving, Texas to use their lease or rental agreement as collateral for obtaining a loan. This arrangement ensures that the lender has a security interest in the leased property, thereby protecting their investment in case of default. By leveraging their lease or rental agreement, individuals or businesses can secure loans and satisfy their financial needs without relying solely on traditional collateral options. The lender gains assurance that if the borrower defaults on the loan, they can assume control over the leased property and recover their investment by either leasing it to another tenant or selling it. There are different types of Irving Texas Lease and Rental Assignment as Security for Loan, and they can vary based on specific criteria such as duration, property type, and loan amount. Some common variations include: 1. Residential Lease Assignment: This type of assignment involves residential properties such as houses, apartments, or condominiums being used as collateral. Tenants can obtain loans for personal or business purposes, secured against their residential lease agreement. 2. Commercial Lease Assignment: Commercial properties, such as office spaces, retail stores, or industrial units, can also be assigned as security for loans. This option allows business owners to access funds for expansion, renovations, or other working capital needs. 3. Long-term Lease Assignment: Some tenants might have long-term lease agreements, extending beyond the usual one to three years. In such cases, lenders may be more willing to offer larger loan amounts, considering the extended commitment and stability of the lease. 4. Short-term Lease Assignment: Short-term lease agreements, typically spanning a few months or less, can still be utilized to secure loans, albeit with some limitations. Lenders may require additional collateral or impose stricter terms due to the decreased stability of short-term leases. 5. Multiple Lease Assignment: If a borrower holds multiple lease agreements for different properties, they can assign all of them collectively as collateral. This can result in higher loan amounts and increased borrowing capacity. Irving Texas Lease and Rental Assignment as Security for Loan provides an alternative financing option for individuals and businesses who lack sufficient traditional collateral, such as real estate or vehicles. By leveraging their lease or rental agreement, borrowers can access funds for various purposes while lenders mitigate their risk through securing the loan against tangible assets.

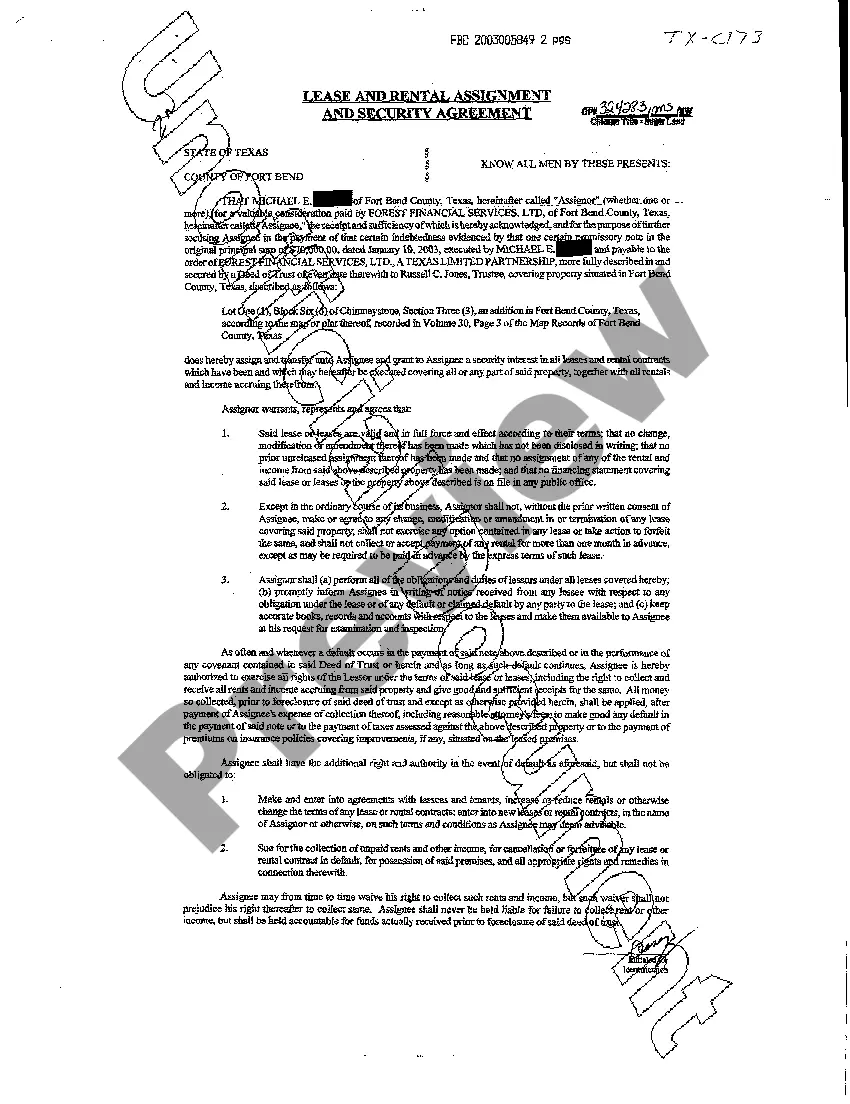

Irving Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Irving Texas Lease And Rental Assignment As Security For Loan?

If you are looking for a relevant form, it’s extremely hard to find a better service than the US Legal Forms website – one of the most considerable libraries on the web. With this library, you can get thousands of templates for organization and personal purposes by categories and regions, or key phrases. Using our high-quality search function, getting the latest Irving Texas Lease and Rental Assignment as Security for Loan is as easy as 1-2-3. Additionally, the relevance of every file is confirmed by a team of expert lawyers that on a regular basis review the templates on our platform and revise them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Irving Texas Lease and Rental Assignment as Security for Loan is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you want. Read its information and make use of the Preview function (if available) to see its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the appropriate document.

- Affirm your decision. Click the Buy now option. After that, choose your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the template. Select the format and download it on your device.

- Make changes. Fill out, edit, print, and sign the obtained Irving Texas Lease and Rental Assignment as Security for Loan.

Every single template you add to your account has no expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to have an additional copy for enhancing or printing, you can come back and save it once more whenever you want.

Make use of the US Legal Forms professional library to get access to the Irving Texas Lease and Rental Assignment as Security for Loan you were looking for and thousands of other professional and state-specific templates on one website!