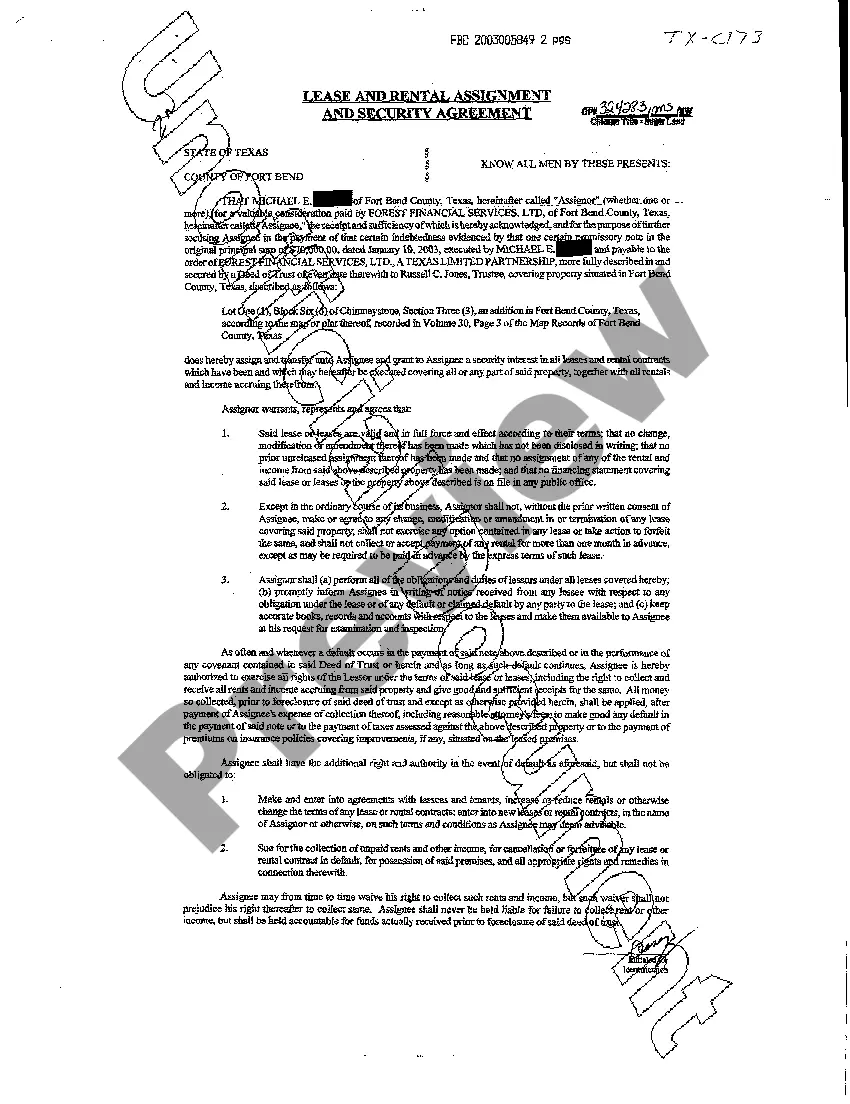

League City Texas Lease and Rental Assignment as Security for Loan is a legal arrangement where a borrower utilizes their lease and rental agreement as collateral to secure a loan. This type of transaction is common in League City, Texas, and offers financial institutions and lenders a guarantee that the borrower will repay the loan amount. In this agreement, the borrower grants the lender the right to collect rental payments directly from their tenants in the event of loan default. By doing so, the lender can recover their funds by assuming control of the rental income generated by the leased property. This provides a sense of security to lenders, as they have a tangible asset to rely on. There are different variations of League City Texas Lease and Rental Assignment as Security for Loan, each catering to specific needs and circumstances. One type involves commercial properties, including office spaces, retail stores, and industrial buildings. This arrangement is suitable for entrepreneurs or business owners seeking funds for business expansion, equipment purchases, or other commercial endeavors. Another type of League City Texas Lease and Rental Assignment as Security for Loan pertains to residential properties, such as apartments, houses, or condominiums. This option is commonly adopted by homeowners who wish to leverage their property's rental income to obtain financing for home repairs, renovations, or debt consolidation. In both cases, the borrower's lease and rental agreement serve as a binding contract that outlines the terms and conditions of the property's lease, including the rental rates, tenancy duration, and specific obligations of the tenant and landlord. The lender will carefully review this agreement to ensure its validity and assess the potential income that can be generated. To initiate this process, borrowers typically need to present their lease and rental agreement, financial statements, credit history, and property appraisal to the lender for evaluation. Once the lender approves the loan, the borrower signs an assignment of lease document, granting the lender the necessary rights to collect rent directly from tenants. League City Texas Lease and Rental Assignment as Security for Loan offers borrowers a viable financing alternative, as it allows them to unlock the value of their property's rental income. Similarly, lenders benefit from a reduced level of risk, knowing they have a secured asset that can cover the loan amount in the event of default. Overall, League City Texas Lease and Rental Assignment as Security for Loan provides a flexible and effective means for borrowers in League City, Texas, to access the capital they need, leveraging their lease and rental agreements as collateral.

League City Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out League City Texas Lease And Rental Assignment As Security For Loan?

If you are searching for a valid form template, it’s extremely hard to choose a better platform than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can get thousands of document samples for organization and individual purposes by types and states, or keywords. With the high-quality search function, getting the most up-to-date League City Texas Lease and Rental Assignment as Security for Loan is as elementary as 1-2-3. Furthermore, the relevance of each record is proved by a group of professional attorneys that on a regular basis check the templates on our platform and revise them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the League City Texas Lease and Rental Assignment as Security for Loan is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have found the sample you want. Look at its description and make use of the Preview function (if available) to explore its content. If it doesn’t meet your needs, utilize the Search option at the top of the screen to find the appropriate record.

- Confirm your decision. Select the Buy now option. After that, pick the preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Receive the form. Select the file format and save it to your system.

- Make changes. Fill out, revise, print, and sign the obtained League City Texas Lease and Rental Assignment as Security for Loan.

Each form you add to your profile has no expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an additional copy for modifying or printing, feel free to come back and download it once again anytime.

Make use of the US Legal Forms professional library to gain access to the League City Texas Lease and Rental Assignment as Security for Loan you were looking for and thousands of other professional and state-specific templates on one website!