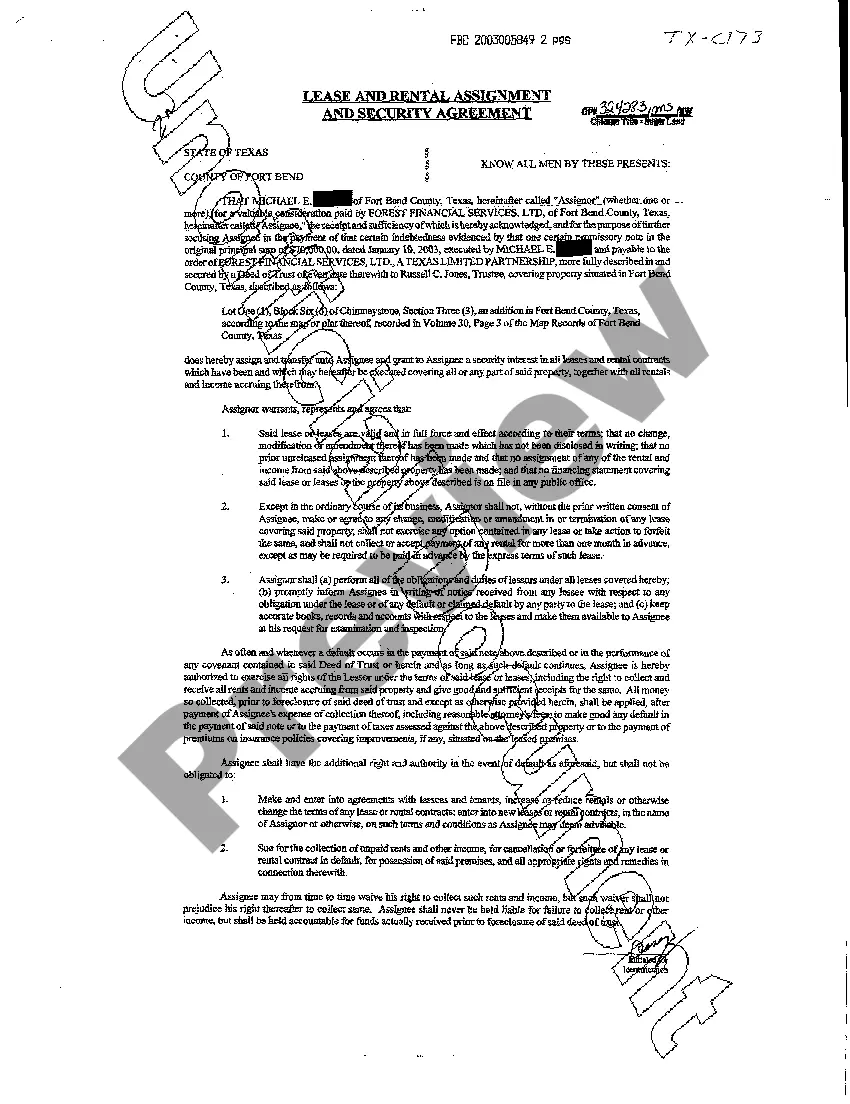

McKinney Texas Lease and Rental Assignment as Security for Loan is a financial arrangement where a tenant assigns their lease agreement and rental income to a lender as collateral for a loan. This type of arrangement is often used by businesses or individuals in McKinney, Texas, who require financing but lack traditional forms of collateral. The McKinney Texas Lease and Rental Assignment as Security for Loan provides the lender with a guarantee of repayment. In case of default on the loan, the lender can step in as the new landlord and collect rent directly from the tenants mentioned in the lease agreement. There are two main types of McKinney Texas Lease and Rental Assignment as Security for Loan: 1. Commercial Lease Assignment: This type of assignment involves assigning a commercial property lease as security for a loan. Businesses in McKinney, Texas, seeking funding for expansion or operational needs can leverage their existing commercial property lease to secure a loan. The lender gains the right to collect rent from the tenants if the borrower fails to repay the loan. 2. Residential Lease Assignment: In this scenario, individuals who own residential properties in McKinney, Texas, assign their lease agreement as security for a loan. Homeowners who need access to funds for personal or investment purposes can use their rental income generated by leasing out their properties as collateral. If the borrower defaults on the loan, the lender can take control of the rental income and potentially become the new landlord. The McKinney Texas Lease and Rental Assignment as Security for Loan is a mutually beneficial arrangement. It allows borrowers to access funds they may not have qualified for otherwise, while providing lenders with a secure form of collateral. This type of loan structure is commonly used in real estate and commercial financing in McKinney, Texas.

McKinney Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out McKinney Texas Lease And Rental Assignment As Security For Loan?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, usually, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the McKinney Texas Lease and Rental Assignment as Security for Loan or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the McKinney Texas Lease and Rental Assignment as Security for Loan adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the McKinney Texas Lease and Rental Assignment as Security for Loan is suitable for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!