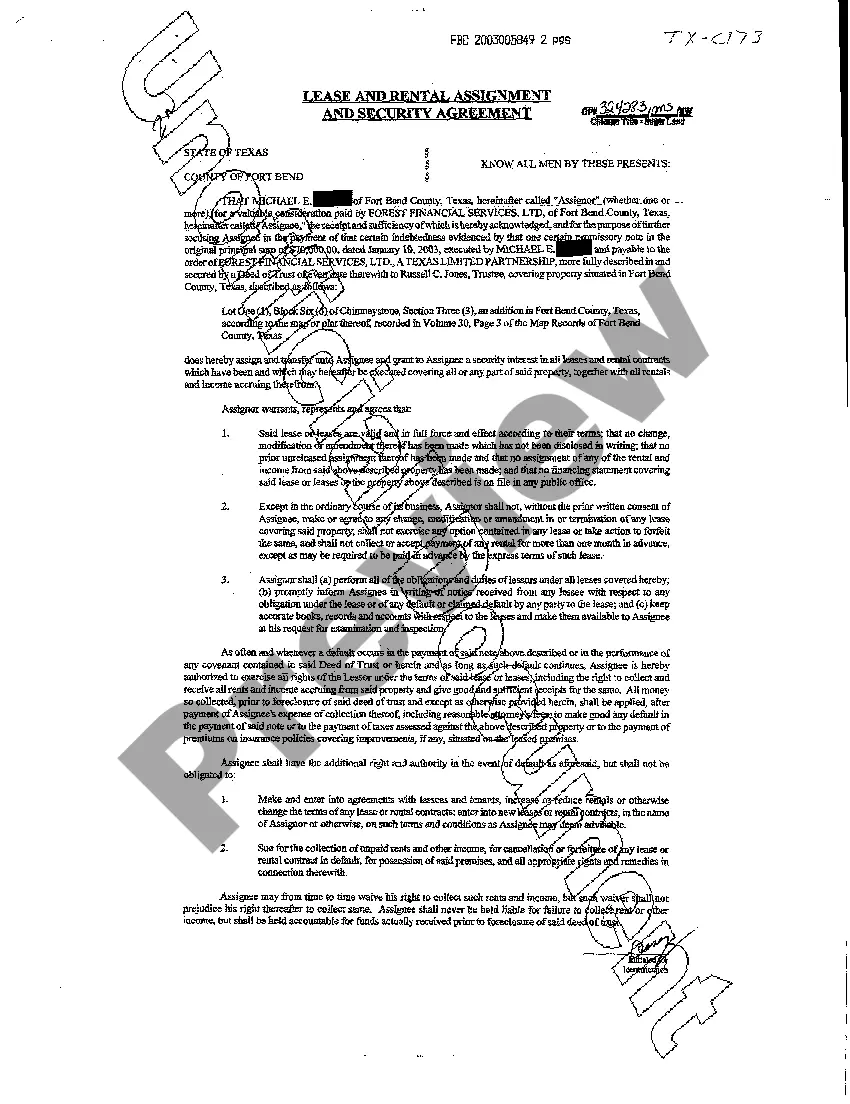

Pasadena Texas Lease and Rental Assignment as Security for Loan is a legal agreement that allows an individual or entity to use their lease or rental agreement as collateral for a loan in Pasadena, Texas. This type of arrangement is common when borrowers need additional financing but lack traditional forms of collateral. The Pasadena Texas Lease and Rental Assignment as Security for Loan agreement involves the borrower granting the lender the right to collect rental income directly from the leasing or renting parties in case of default. By using their lease or rental agreement as security, borrowers can obtain loans with more favorable terms and lower interest rates. There are different types of Pasadena Texas Lease and Rental Assignment as Security for Loan, each catering to various scenarios: 1. Residential Property Assignment: This type of agreement is designed for borrowers who own residential properties such as houses, apartments, or condominiums. The borrower pledges their lease or rental agreement for their residential property as collateral for the loan. 2. Commercial Property Assignment: Borrowers who own commercial properties, including office buildings, retail spaces, or warehouses, can use their lease or rental agreement as security. This type of assignment is tailored to businesses seeking financing for expansion, renovation, or operational purposes. 3. Multi-unit Property Assignment: This type of Pasadena Texas Lease and Rental Assignment as Security for Loan applies to borrowers who own multi-unit properties, such as apartment complexes or duplexes. The agreement allows lenders to seize rental income from multiple tenants in case of default. 4. Long-term Lease Assignment: In some instances, borrowers might have long-term lease agreements in place. These leases generally span an extended period, such as 10 or 20 years. Lenders may accept such leases as collateral, providing borrowers with longer-term loans. By offering their lease or rental agreement as security for a loan in Pasadena, Texas, borrowers can secure financing for various purposes, including debt consolidation, business investment, property improvements, or personal needs. It is essential to carefully review and understand the terms of the agreement before entering into such arrangements, as defaulting on the loan may result in the loss of the leased property.

Pasadena Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Pasadena Texas Lease And Rental Assignment As Security For Loan?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any legal education to create this sort of papers cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service offers a huge collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Pasadena Texas Lease and Rental Assignment as Security for Loan or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Pasadena Texas Lease and Rental Assignment as Security for Loan in minutes using our trustworthy service. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, make sure to follow these steps prior to obtaining the Pasadena Texas Lease and Rental Assignment as Security for Loan:

- Be sure the form you have chosen is specific to your area because the regulations of one state or area do not work for another state or area.

- Review the document and read a brief outline (if provided) of scenarios the document can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Pick the payment method and proceed to download the Pasadena Texas Lease and Rental Assignment as Security for Loan as soon as the payment is completed.

You’re all set! Now you can go on and print out the document or fill it out online. Should you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.