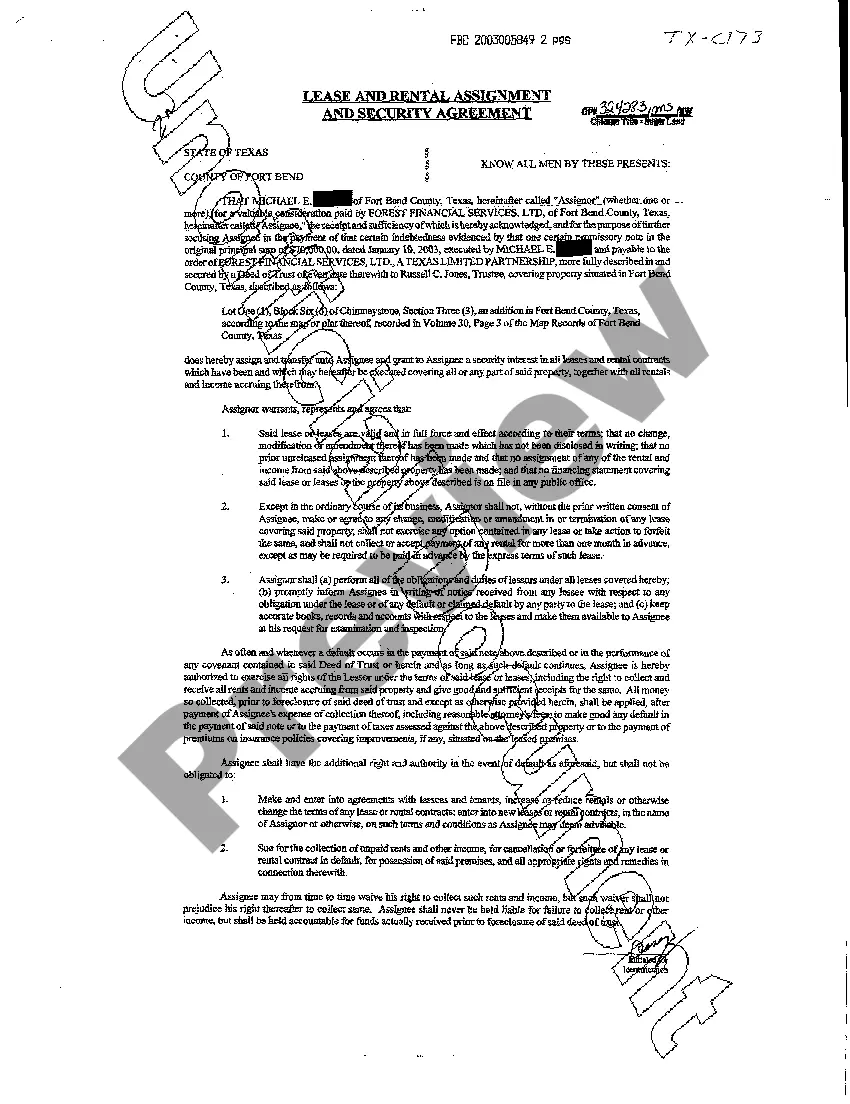

Plano Texas Lease and Rental Assignment as Security for Loan is a legal agreement widely used in the real estate industry, specifically in the Plano area of Texas, to provide collateral for a loan. It involves assigning the lease and rental income from a property to secure a loan, offering assurance to lenders that they will have a means of repayment if the borrower defaults. The Plano Texas Lease and Rental Assignment as Security for Loan is primarily utilized when property owners or investors seek funding for various purposes such as property improvements, business expansion, debt consolidation, or personal needs. By including the lease and rental income as security, borrowers can potentially access larger loan amounts, obtain more favorable loan terms, and even lower interest rates compared to unsecured loans. The process of Plano Texas Lease and Rental Assignment as Security for Loan involves a comprehensive evaluation of the property's market value, potential rental income, and the terms and conditions of the existing lease agreement. Lenders often assess the creditworthiness of the borrower, the property's location, condition, and economic potential before approving the loan application. There are several types of Plano Texas Lease and Rental Assignment as Security for Loan, including: 1. Residential Property Assignment: This type of assignment involves using a residential property, such as a single-family home, condominium, or apartment, as security for the loan. The rental income generated from leasing out the property contributes to the repayment of the loan. 2. Commercial Property Assignment: In this case, commercial properties like office buildings, retail spaces, or warehouses are assigned as security for loans. The lease agreements with tenants are crucial in ensuring a steady rental income stream to cover loan obligations. 3. Multi-family Property Assignment: Multi-family properties, such as apartment complexes or townhouses, can also serve as collateral for loans. The income generated from multiple tenants contributes to the repayment of the loan and provides an added layer of security. 4. Mixed-Use Property Assignment: Mixed-use properties combine residential and commercial spaces. This type of assignment involves using both the residential and commercial lease income to secure the loan, providing higher collateral and additional cash flow potential. It is important to note that the terms and conditions of Plano Texas Lease and Rental Assignment as Security for Loan agreements may vary among lenders and are subject to negotiation. Borrowers should consult legal and financial professionals to assess their specific requirements and determine the most suitable option for their financing needs. In summary, Plano Texas Lease and Rental Assignment as Security for Loan is a mechanism that allows property owners in Plano, Texas, to leverage their lease and rental income to secure loans. It provides financial institutions with assurance while granting borrowers access to greater loan amounts and better loan terms. By understanding the various types of assignments available, borrowers can choose the most appropriate option to meet their specific needs.

Plano Texas Lease and Rental Assignment as Security for Loan

Description

How to fill out Plano Texas Lease And Rental Assignment As Security For Loan?

If you are looking for a relevant form template, it’s difficult to find a better place than the US Legal Forms website – one of the most extensive libraries on the internet. With this library, you can find thousands of templates for company and individual purposes by categories and regions, or keywords. With the high-quality search feature, discovering the most up-to-date Plano Texas Lease and Rental Assignment as Security for Loan is as easy as 1-2-3. Moreover, the relevance of each document is confirmed by a group of professional lawyers that regularly review the templates on our website and revise them according to the newest state and county laws.

If you already know about our platform and have an account, all you should do to get the Plano Texas Lease and Rental Assignment as Security for Loan is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have discovered the sample you require. Look at its information and utilize the Preview option (if available) to see its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to find the appropriate file.

- Affirm your selection. Choose the Buy now option. After that, choose the preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Get the template. Pick the format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the received Plano Texas Lease and Rental Assignment as Security for Loan.

Every single template you save in your account has no expiry date and is yours permanently. You can easily access them using the My Forms menu, so if you want to receive an extra version for modifying or creating a hard copy, you can come back and save it again at any moment.

Take advantage of the US Legal Forms extensive catalogue to get access to the Plano Texas Lease and Rental Assignment as Security for Loan you were looking for and thousands of other professional and state-specific samples on a single website!