Sugar Land, Texas, lease and rental assignment as security for a loan is an arrangement wherein a borrower pledges their lease or rental agreement as collateral to secure a loan with a lender. This type of agreement is commonly utilized by individuals or businesses in Sugar Land, Texas, who require immediate funds but may lack sufficient tangible assets to offer as collateral. In a Sugar Land, Texas, lease and rental assignment as security for a loan, the borrower, often referred to as the assignor, transfers their rights, and interests in their existing lease or rental agreement to the lender, known as the assignee. By doing so, the assignee is granted the legal right to collect rental payments directly from the tenant in the event of loan default. This arrangement offers benefits to both parties involved. The borrower gains access to much-needed funds, which can be utilized for various purposes such as expansion, debt consolidation, or even personal financial needs. On the other hand, the lender obtains added security and assurance by having a tangible source of repayment in the form of rental income. There are different types of Sugar Land, Texas, lease and rental assignments as security for a loan available, depending on the specific circumstances and requirements of the borrower: 1. Commercial lease assignment: Businesses seeking financial assistance can assign their commercial lease to a lender as security for a loan. This type of assignment is prevalent in cases where businesses need capital for equipment purchases, inventory restocking, or cash flow management. 2. Residential lease assignment: Individuals who own residential properties, such as houses or apartments, can assign their rental agreements to secure a loan. This type of assignment often appeals to homeowners who require funds for home improvements, debt consolidation, or other personal financial endeavors. 3. Long-term lease assignment: In some cases, borrowers may possess long-term leases with favorable terms. These leases, typically extending over several years, can be assigned to lenders as security for substantial loan amounts. Long-term lease assignments provide borrowers with financial flexibility while ensuring lenders have a valuable collateral source for the duration of the loan term. 4. Short-term lease assignment: For borrowers with short-term leases, such as those commonly used for office spaces or retail shops, lenders may still accept lease assignments as security. These short-term assignments are ideal for businesses needing quick access to capital for immediate operational expenses or short-term growth strategies. In conclusion, a Sugar Land, Texas, lease and rental assignment as security for a loan offers a viable solution for borrowers lacking traditional collateral options. Whether utilizing commercial, residential, long-term, or short-term lease assignments, this arrangement provides an avenue for accessing funds while ensuring lenders have a tangible asset to mitigate their risk.

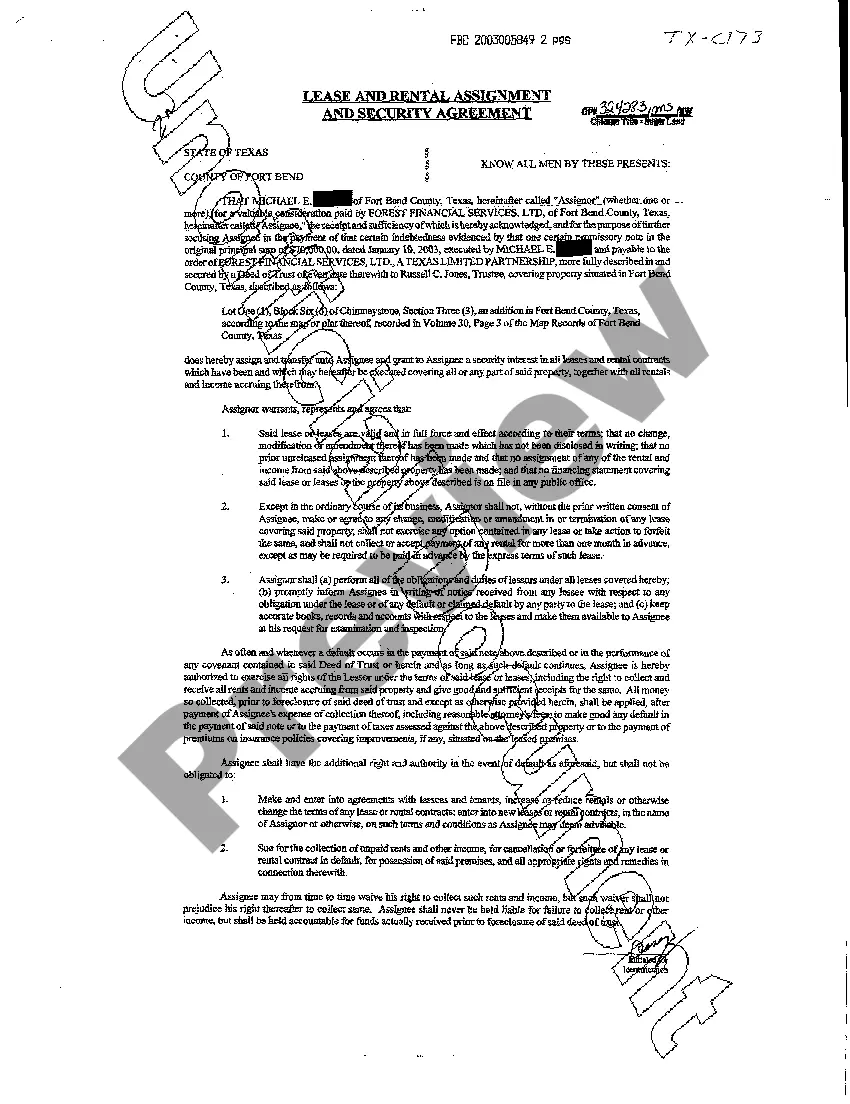

Sugar Land Texas Lease and Rental Assignment as Security for Loan

State:

Texas

City:

Sugar Land

Control #:

TX-C173

Format:

PDF

Instant download

This form is available by subscription

Description

Lease and Rental Assignment as Security for Loan

Sugar Land, Texas, lease and rental assignment as security for a loan is an arrangement wherein a borrower pledges their lease or rental agreement as collateral to secure a loan with a lender. This type of agreement is commonly utilized by individuals or businesses in Sugar Land, Texas, who require immediate funds but may lack sufficient tangible assets to offer as collateral. In a Sugar Land, Texas, lease and rental assignment as security for a loan, the borrower, often referred to as the assignor, transfers their rights, and interests in their existing lease or rental agreement to the lender, known as the assignee. By doing so, the assignee is granted the legal right to collect rental payments directly from the tenant in the event of loan default. This arrangement offers benefits to both parties involved. The borrower gains access to much-needed funds, which can be utilized for various purposes such as expansion, debt consolidation, or even personal financial needs. On the other hand, the lender obtains added security and assurance by having a tangible source of repayment in the form of rental income. There are different types of Sugar Land, Texas, lease and rental assignments as security for a loan available, depending on the specific circumstances and requirements of the borrower: 1. Commercial lease assignment: Businesses seeking financial assistance can assign their commercial lease to a lender as security for a loan. This type of assignment is prevalent in cases where businesses need capital for equipment purchases, inventory restocking, or cash flow management. 2. Residential lease assignment: Individuals who own residential properties, such as houses or apartments, can assign their rental agreements to secure a loan. This type of assignment often appeals to homeowners who require funds for home improvements, debt consolidation, or other personal financial endeavors. 3. Long-term lease assignment: In some cases, borrowers may possess long-term leases with favorable terms. These leases, typically extending over several years, can be assigned to lenders as security for substantial loan amounts. Long-term lease assignments provide borrowers with financial flexibility while ensuring lenders have a valuable collateral source for the duration of the loan term. 4. Short-term lease assignment: For borrowers with short-term leases, such as those commonly used for office spaces or retail shops, lenders may still accept lease assignments as security. These short-term assignments are ideal for businesses needing quick access to capital for immediate operational expenses or short-term growth strategies. In conclusion, a Sugar Land, Texas, lease and rental assignment as security for a loan offers a viable solution for borrowers lacking traditional collateral options. Whether utilizing commercial, residential, long-term, or short-term lease assignments, this arrangement provides an avenue for accessing funds while ensuring lenders have a tangible asset to mitigate their risk.

How to fill out Sugar Land Texas Lease And Rental Assignment As Security For Loan?

If you’ve already used our service before, log in to your account and download the Sugar Land Texas Lease and Rental Assignment as Security for Loan on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Sugar Land Texas Lease and Rental Assignment as Security for Loan. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!