Travis Texas Lease and Rental Assignment as Security for Loan is a legal agreement between a borrower and lender in Travis County, Texas, where the borrower assigns their lease or rental income as collateral for a loan. This arrangement provides security to the lender in case the borrower fails to repay the loan. By assigning their lease or rental income, the borrower acknowledges that the lender has the right to receive those funds directly until the loan is repaid in full. This type of loan arrangement is commonly used in real estate transactions when a property owner needs access to immediate funds. It allows the borrower to leverage the income generated from leasing or renting their property as a means of securing financing. The lender, in turn, benefits from having a tangible asset that can be used to recover their investment in case the borrower defaults on their loan obligations. There are various types of Travis Texas Lease and Rental Assignment as Security for Loan, such as residential rental assignment as security, commercial lease assignment as security, and land lease assignment as security. Each type caters to specific scenarios and properties, ensuring that different types of borrowers can access the necessary funds based on their unique needs. In a residential rental assignment as security, an individual or family assigns their monthly rental income to a lender in exchange for a loan. This type of arrangement is commonly used by homeowners who need financial assistance but do not qualify for traditional loans due to poor credit or other factors. Alternatively, a commercial lease assignment as security is more relevant for businesses. In this case, a commercial property owner assigns their lease income to a lender to secure financing for business expansion or operations. This type of arrangement provides businesses with the necessary capital to invest in equipment, inventory, or other strategic initiatives. Lastly, land lease assignment as security is applicable when an individual or entity owns land that is leased to third parties, such as for farming or development purposes. Borrowers in this situation can assign their land lease income as security for a loan, enabling them to access funds while keeping the property in use. Overall, Travis Texas Lease and Rental Assignment as Security for Loan is a viable option for borrowers in need of immediate funds, allowing them to leverage the income generated from their lease or rental agreements. With various types tailored to different scenarios, individuals, families, and businesses can access necessary financing while providing sufficient security to lenders.

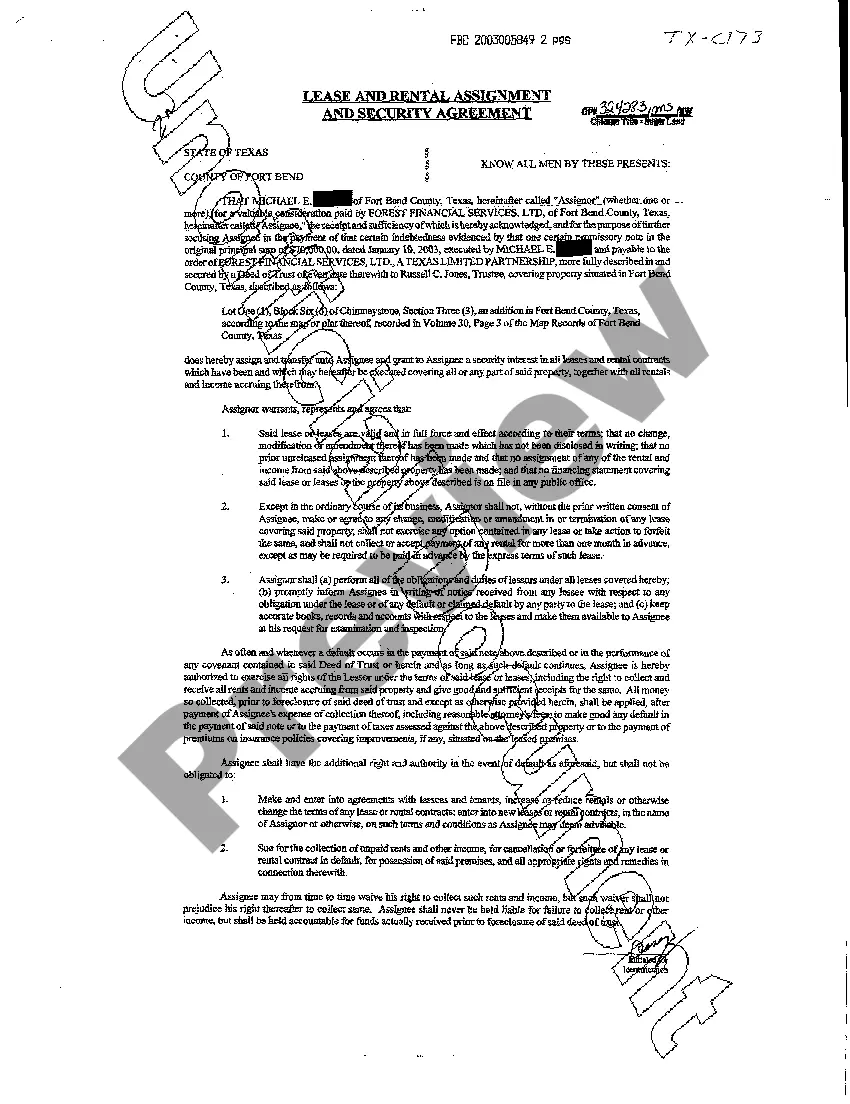

Travis Texas Lease and Rental Assignment as Security for Loan

State:

Texas

County:

Travis

Control #:

TX-C173

Format:

PDF

Instant download

This form is available by subscription

Description

Lease and Rental Assignment as Security for Loan

Travis Texas Lease and Rental Assignment as Security for Loan is a legal agreement between a borrower and lender in Travis County, Texas, where the borrower assigns their lease or rental income as collateral for a loan. This arrangement provides security to the lender in case the borrower fails to repay the loan. By assigning their lease or rental income, the borrower acknowledges that the lender has the right to receive those funds directly until the loan is repaid in full. This type of loan arrangement is commonly used in real estate transactions when a property owner needs access to immediate funds. It allows the borrower to leverage the income generated from leasing or renting their property as a means of securing financing. The lender, in turn, benefits from having a tangible asset that can be used to recover their investment in case the borrower defaults on their loan obligations. There are various types of Travis Texas Lease and Rental Assignment as Security for Loan, such as residential rental assignment as security, commercial lease assignment as security, and land lease assignment as security. Each type caters to specific scenarios and properties, ensuring that different types of borrowers can access the necessary funds based on their unique needs. In a residential rental assignment as security, an individual or family assigns their monthly rental income to a lender in exchange for a loan. This type of arrangement is commonly used by homeowners who need financial assistance but do not qualify for traditional loans due to poor credit or other factors. Alternatively, a commercial lease assignment as security is more relevant for businesses. In this case, a commercial property owner assigns their lease income to a lender to secure financing for business expansion or operations. This type of arrangement provides businesses with the necessary capital to invest in equipment, inventory, or other strategic initiatives. Lastly, land lease assignment as security is applicable when an individual or entity owns land that is leased to third parties, such as for farming or development purposes. Borrowers in this situation can assign their land lease income as security for a loan, enabling them to access funds while keeping the property in use. Overall, Travis Texas Lease and Rental Assignment as Security for Loan is a viable option for borrowers in need of immediate funds, allowing them to leverage the income generated from their lease or rental agreements. With various types tailored to different scenarios, individuals, families, and businesses can access necessary financing while providing sufficient security to lenders.

How to fill out Travis Texas Lease And Rental Assignment As Security For Loan?

If you’ve already utilized our service before, log in to your account and save the Travis Texas Lease and Rental Assignment as Security for Loan on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Travis Texas Lease and Rental Assignment as Security for Loan. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!