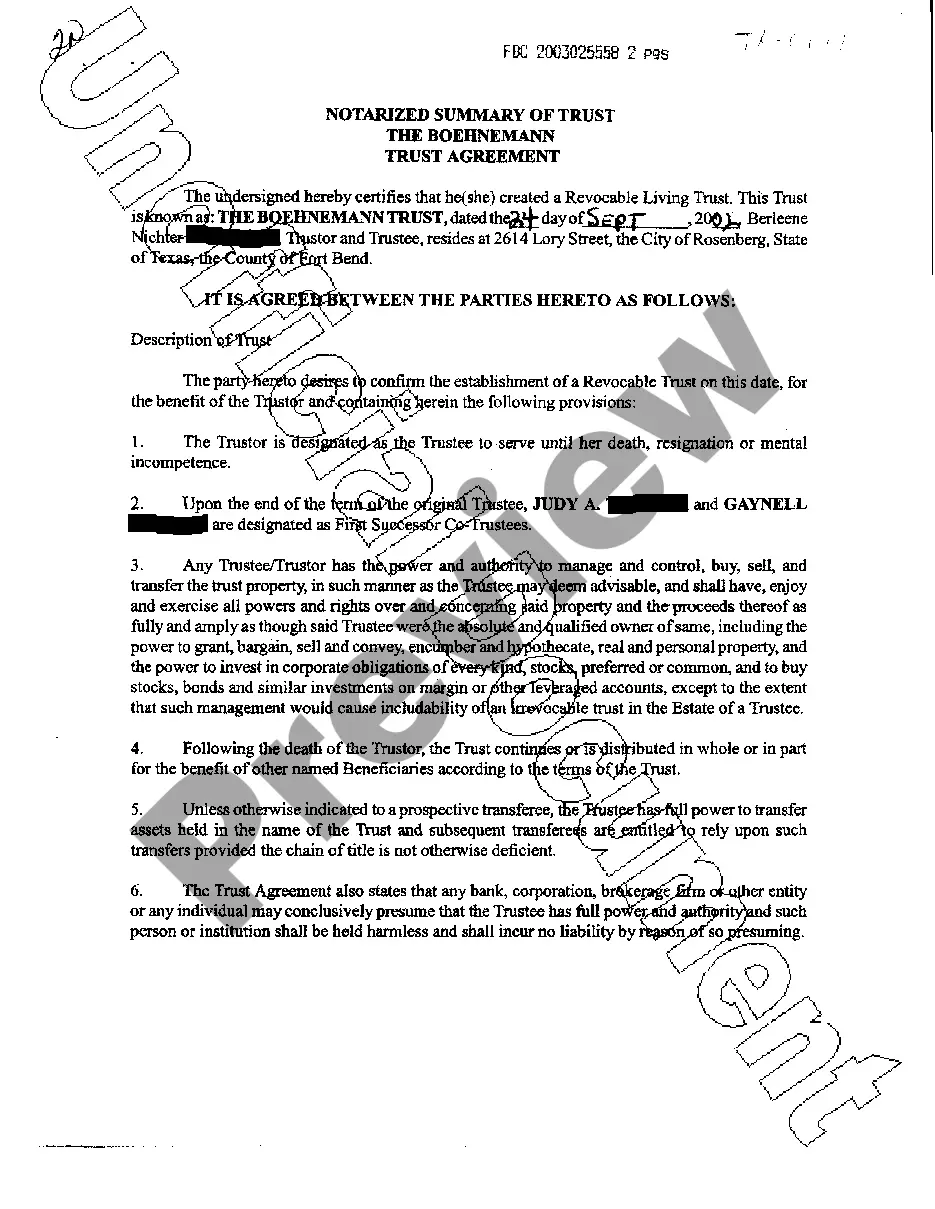

A Frisco Texas Trust Agreement is a legally binding document that outlines the terms and conditions of a trust established in Frisco, Texas. It serves as a crucial tool for estate planning and asset management, ensuring the proper transfer and management of assets for the trust's beneficiaries. The Frisco Texas Trust Agreement encompasses various crucial aspects, including the identification of the granter (the person creating the trust), the trustee (the individual or organization entrusted with managing the assets), and the beneficiaries (those who will benefit from the trust). It also details the specific assets, properties, or funds that will be included in the trust. Furthermore, the agreement thoroughly delineates the duties, powers, and limitations of the trustee, ensuring they act responsibly in accordance with both the trust agreement and state laws. It also outlines the conditions under which the trustee can distribute assets to the beneficiaries, such as age restrictions or specific milestones. This helps protect the assets and ensures they are distributed in a fair and intended manner. Frisco Texas Trust Agreements can be further categorized based on their specific purpose or nature. Some common types include: 1. Revocable Living Trust: This type of trust allows the granter to retain control over the trust assets during their lifetime. They have the flexibility to modify or revoke the trust agreement if circumstances change. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be amended, modified, or revoked without the consent of the beneficiaries. It provides greater asset protection, minimizing tax liabilities and potential creditor claims. 3. Special Needs Trust: This type of trust is designed to provide financial support and care for individuals with special needs or disabilities. It ensures that the beneficiary's eligibility for government benefits is not compromised while enhancing their quality of life. 4. Charitable Trust: A charitable trust allows the granter to donate assets to a charitable organization while simultaneously generating specific tax benefits. It allows individuals to leave a lasting legacy and contribute to causes they care about. 5. Testamentary Trust: This trust is established through a person's will and only comes into effect after their death. It allows the granter to control the distribution of assets to beneficiaries and provide for their long-term financial needs. In conclusion, a Frisco Texas Trust Agreement is an important legal document that plays a crucial role in estate planning and asset management. With various types of trusts available, individuals can choose the one that best suits their specific needs and intentions. Consulting with a legal professional experienced in trust law is highly recommended in order to ensure the trust agreement aligns with state regulations and the granter's wishes.

Frisco Texas Trust Agreement

Description

How to fill out Frisco Texas Trust Agreement?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are very expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Frisco Texas Trust Agreement or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Frisco Texas Trust Agreement complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Frisco Texas Trust Agreement is proper for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!